VRA Investment Update: Nvidia Earnings Call Surprise; "AI Inflection Point". My Fox Business Interview with Charles Payne.

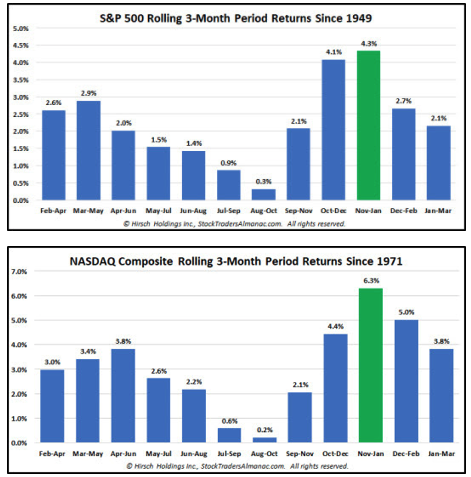

/As our markets complete their overbought “pause”, we believe seasonality is playing a major role as the second half of February is historically weak. It’s actually one of the worst two weeks periods of the year.

But soon, our overbought sell-off will be behind us. Based on VRA System readings, by weeks end we should be hitting oversold levels that typically mark reversals higher, especially near the birth of new bull markets.