VRA Weekly Update: Coinbase is Public, Hugely Positive For Crypto's. This is "That" Melt-up Bull Market.

/Good Thursday morning all. Quite the mid-day reversal yesterday, immediately following the Coinbase IPO. Coinbase, which we will own in the VRA Portfolio at some point soon, debuted by popping to $429/share (priced at $250), giving it a first day market cap of $100 billion, before closing at $328. As Tyler covered on our podcast yesterday, there are only 85 co’s in the S&P 500 with a market cap greater than Coinbase on its first day of trading. Impressive.

The list of “really smart people” that have gotten BTC and Coinbase wrong from jump street is a long one. We know enough of these high profile gurus that I can say this with confidence; they get most everything wrong.

My read on the pullback, specifically in Nasdaq, which closed lower by 138 points (-1%)? It had everything to do with Coinbase IPO and the action in crypto-land.

The red-hot IPO/direct listing of COIN marked a (very short term) top in both crypto-land and in nasdaq. This was a classic “buy the rumor, sell the news” event. Happens all the time.

And to borrow from J Powell at the Fed, I expect any weakness, in both stocks and crypto’s, to be “transitory”.

Final (important) note on COIN; this IPO solidified BTC (and crypto’s in general) as “fully legit”. Its hard to overstate the importance of the COIN listing.

Next up, we look for the SEC to (soon) begin approving “multiple” BTC ETF’s, further legitimizing crypto’s. BTC $100,000 remains our target. And the remarkable Cathie Wood began buying COIN yesterday, putting away $250 million in her funds. Wood will only add to her positions going forward. Smart, smart lady.

Even with a sharply lower nasdaq, our VRA market internals were solidly positive, a pattern change from 6/7 days with poor readings. Again, even with nasdaq -138, internals were solid with 489 stocks hitting new 52 week highs to just 56 hitting new lows.

Excellent market tell.

This morning futures are sharply higher across the board, with retail sales crushing estimates with 9.8% growth vs estimates in the 6% range. And you know how much we like small caps here (IWM), which led our markets higher yesterday. We fully look for that to continue.

We wrote the following a couple of months ago. For our newer VRA Members and as a refresher course, yes we really do expect the Dow to hit 75,000 and Nasdaq to hit 30,000 (by 2025 or sooner):

We’re often asked “is the VRA really this bullish? How can that be with Biden as president and with the systemic risks that face our financial system today?

Yes, we are that bullish. Below we count the ways…it’s time to be long and strong US equities.

VRA MARKET MELT-UP FORECAST: REASONS WE ARE HYPER-BULLISH, SHORT, MEDIUM AND LONG TERM

(on our way to Dow Jones 75,000 and Nasdaq 30,000 within 5 years)

1) Don’t fight the Fed…don’t fight an entire planet of Feds. As a reminder, the Fed has an ongoing QE program (QE4) of $130 billion in monthly asset purchases (not including their leveraged programs and not including the shadow banks that mimic the Fed)

2) We’ve just entered a new bull market, from the 3/23/20 lows. Like the birth of the last bull market (March 2009), this bull has years to run…and its being juiced by FAR more fiscal and monetary stimulus ($22 trillion globally and counting).

3) We’ve just had multiple Dow Theory buy signals. These act as leading indicators for both the market and the economy.

4) Every major stock market on the planet now has a rising 200 dma, a primary indicator of new bull markets (rather than the end).

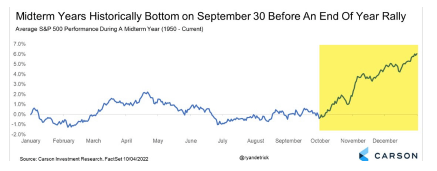

5) March/April are highly bullish, as is the November-May time frame, where more than 90% of gains take place.

6) Housing and transportation (rail, trucking) industries at all time highs, VRA Investing Systems most important leading economic indicators.

7) We expect S&P 500 earnings to hit $205/share by year end, which would place the P/E multiple at just 19, with 15%+ growth in 2022 and 2023.

8) Markets actually perform better under Democrat presidents than under Republicans (15% returns avg per year vs 8%)

9) Q1 and Q2 2021 earnings will replace coronavirus insanity 2020 Q1/Q2, with massive year over year earnings beats

10) Investor sentiment is becoming more optimistic but still nowhere near market tops. Permabears still scatter the landscape…when the last one capitulates we’ll know a top is nearing. When the vast majority of investors believe that stocks “CANNOT” go lower.

11) We see this period as most similar to the 5 year run to Dot-com melt-up when Nasdaq rose 575% with avg gains of 115% per year.

12) Technology coming full circle, from the possibilities of dot-com from 1995–2000 to the realities of the surreal technological/biomedical/medical transformation directly ahead.

13) We’ll know when a market top is nearing when droves of employees across a multitude of industries start quitting their jobs to day trade (like 1995–2000) and when your Uber/Lyft drivers are giving you their hot stock tips.

14) The VRA has outperformed the markets in 15/18 years. The key to our outperformance over the next 5 years will be our VRA 10 Baggers and the use of the VRA Investing System (include 12 VRA System Screens) in order to time short term peaks and valleys, using leveraged ETF’s and tech blue chips.

15) Wild card; this market melt-up is also a PSYOP, a psychological operation to help people forget about the “plandemic” of coronavirus (see Rockefeller Foundations “In Lockstep” from 2010), the stolen and rigged election of 2020 and the effort to push the world closer into globalism/communism.

16) This is “THAT” bull market. A melt-up of all melt-ups. The roaring 20’s. The last major bull market for “decades”

Until next time, thanks again for reading…

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Also, Find us on Twitter