VRA Weekly Update: US Markets Hit Extreme Overbought Conditions

/Good Thursday morning all.

Following yesterday's ramp higher US markets (DJ, SPX) are sporting gains of 40% from their 3/23 lows, with internals that continue to point to strength but also with our markets hitting extreme overbought.

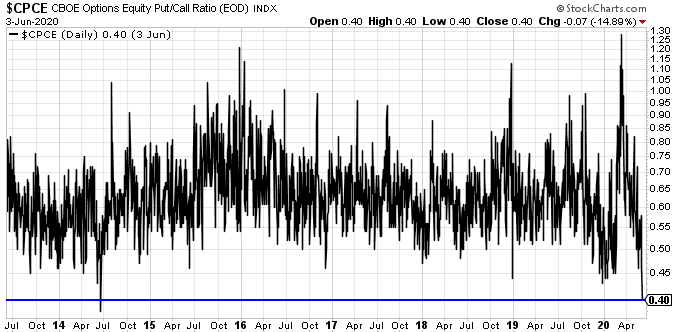

Whether this move represents the birth of a new bull market or not, we do believe that we can recognize froth when we see it. The Fear and Greed Index is back to 63(Greed). The equity put/call ratio hit its lowest levels in 6 years at .40%. On the VRA System, each broad market index is now trading at extreme OB.

And while the S&P 500 just had its best 50 day run in history, with gains of 37.7%, a look under the hood is more than just a little interesting. While the largest 5 stocks (FB, AMZN, AAPL, MSFT, GOOGL) have returned +17% in 2020, the remaining 495 stocks in the S&P 500 are down 8%. Folks, that’s one very thin rally…which has also occurred on light volume. Just when the investing public comes rushing back into the markets, as we’re witnessing in the put/call ratio and sentiment surveys, the potential for a correction increases (chart from FactSet and Goldman).

What Matters Most: Precious Metals and Miners

Regardless of how the broad markets perform, you know our top group; (physical) gold, silver and miners. We believe this is a period almost identical to 2008–2011, as we’ve been making the case for some time.

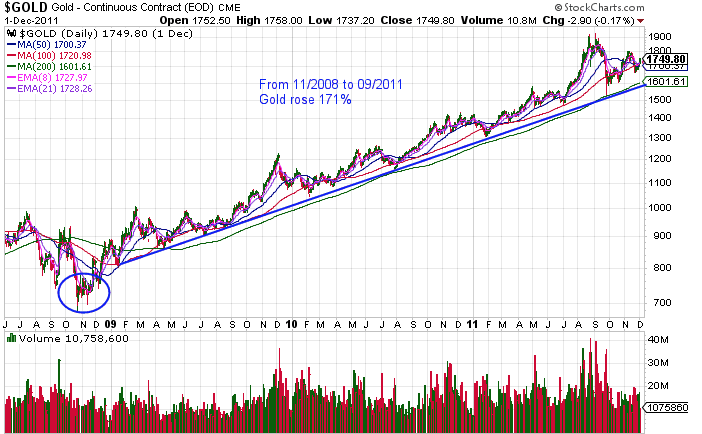

For some perspective, below are 2008–2011 charts of gold, silver, GDX and TRQ (formerly Ivanhoe Mines, which we booked 1300% profits in). Our view is that the current move in precious metals/miners will surpass the moves from 08–11. The bull market of bull markets.

The fundamentals and technicals from 2008–2011 to today line up almost identically. Massive QE/stimulus, with an interesting distinction: after the start of the financial crisis in 2008, it took 4 years to get the amount of QE that we’ve had in just the last 2 months.

GOLD: gold rose 171% from 11/08 to 09/11, following this perfect trend line for 3 years. The VRA went aggressively long this group in 12/2008.

Silver did even better….much better…going parabolic from from 10/08 to 04/11 with 450% in gains. Look at the explosion in buyside volume.

GDX (Miner ETF) rose 313% from 11/08 to 09/11. Volume explosion here as well (NUGT did not become an ETF until 2011).

The leverage hereis in the miners, as much as we like gold and silver.

Until next time, thanks again for reading…have a good week

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/17 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast