VRA Investment Update: Textbook Bull Market Meets Overbought. Buy the Rumor, Sell the News?

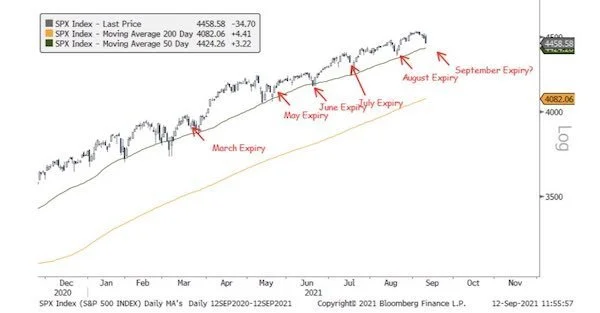

/It hasn’t been straight up from the 10/13 bear market lows but in (most) ways this has been a textbook bull market move higher. From the overwhelming level of fear from 3 bear markets in 4 years to last years August — October waterfall mini-meltdown that culminated in the 10/13 bear market capitulation, from those lows the move higher has checked all of the “new bull market” boxes.

Read More