VRA Investment Update: Nvidia Earnings Call Surprise; "AI Inflection Point". My Fox Business Interview with Charles Payne.

/Good Thursday morning all. As our markets complete their overbought “pause”, we believe seasonality is playing a major role as the second half of February is historically weak. It’s actually one of the worst two weeks periods of the year.

But soon, our overbought sell-off will be behind us. Based on VRA System readings, by weeks end we should be hitting oversold levels that typically mark reversals higher, especially near the birth of new bull markets.

And we got some welcome news from chip leader Nvidia, which reported earnings after hours and is now up 12% on the news (and up 110% from the 10/13 bear market capitulation lows).

This AI talk could be big. Possibly really big. Here’s what our VRA silicon valley tech insider “Ed” had to say this morning; “I listened to the analysts call. Jensen (CEO) was in full sales mode on ChatGPT and AI. Analysts don’t know how to quantify the opportunity so the bears will have to stand down unless AI Proves false.”

Remember, the semis lead the market in both directions. The semis are THE tell.

Nvidia Soars on Earnings and AI Outlook

During the analyst call, NVDA CEO Jensen Huang said “AI is at an “inflection point,” leading businesses to purchase its chips for machine learning software.

“NVDA’s unique, turn-key model of chips, systems, software coupled with emerging inflection in generative AI/large language models positions NVDA solidly for large/profitable growth,” wrote Bank of America’s Vivek Arya who also hiked his Nvidia price target to $275 per share from $255, implying upside of 32.5%.”

We see this as “typical February consolidation and a buying opportunity”. The second half of February is not a good time frame for the markets (but its also almost over with just 4 trading days left). We continue to believe that we are in a new bull market.

Thanks to Fox Business Charles Payne for having me on his show “Making Money” yesterday. I know we have a large number of Charles Payne fans among our VRA Members.

He’s a consistent “common sense” patriot that sees things the same way that the broad majority of Americans do. Respect the constitution, show love for our country and leave us alone to raise our families and grow our careers as we see fit. And stop warmongering and spending/taxing us into oblivion. It’s not complicated.

Here’s the link: video.foxbusiness.com/v/6320986918112

VRA Quick Hitters

The miners (GDX) remain the single best set-up on the VRA System.

You can see it in the chart of GDX below. GDX is at the 200 dma, is now fully at extreme oversold on steroids and sits at an area of support.

This rubber band is stretched and ready to break. Especially with bond yields and the dollar hitting heavily/extreme overbought. Strong correlations here.

And this is also significant, the two biggies when it comes to trading patterns/price action for precious metals/miners are their correlations with both interest rates and the US dollar. When rates and the dollar are moving higher, as they have been of late, Pm’s and miners tend to get hit. These are high probability correlations.

Now, rates (10 year) are hitting extreme overbought and forming a double top pattern while the dollar is hitting heavily overbought while also hitting an area of strong resistance.

Just a great trading set-up as we’d expect PM’s and miners to bottom and move higher, as the heavily correlated US dollar and interest rates move lower.

Final notes: gold and silver are also hitting extreme oversold levels. There’s never a perfect trade…they all have risk…but in my 37 years of experience this is about as good as it gets.

I look for a “primary, bull market move” higher to begin this week in precious metals and miners.

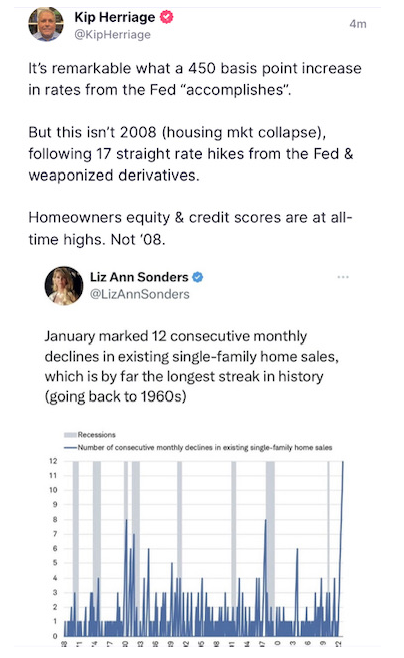

Yes, the Housing Market News Looks Horrible. But…

…it only looks that way. As you may have read in our new book The Big Bribe, housing is in a long term, structural bull market, driven by supply/demand, incredibly (financially) healthy homeowners and yes, millennials.

The Best Analytics of My Career Point to Strong 2023

WW3? I Don’t Think So. More like a “Wag The Dog” Money Laundering Operation

VRA Bottom Line: beginning on 2/2 we began warning that the markets had reached “extreme overbought levels” on the VRA Investing System. This is when we use patience before adding to positions in our our ETF’s while we continue to use monthly dollar cost averaging on our VRA 10-Baggers. We expect any market weakness to be short-lived and now that we’ve come off of our overbought readings we are once again buyers on dips. This has the markings of a big year for the US and global stock markets. 30% + in US.

Until next time, thanks again for reading.

Kip

Join us for two free weeks at VRAInsider.com

Please join us each day after the market closes for our Daily VRA Investing Podcast! Sign up for email alerts @ vrainsider.com/podcast

Also, Find us on Truth Social and Rumble