But even with this beat (to both CPI and PPI), the odds have increased that we have a “negative credit impulse” building with rising odds of a recession, certainly after the implosions of SVB and Signature Bank NY. The latest inflation reports did not capture these banking failures and potential credit crunch as it’s inherently backward looking. The CPI report is always a “fade” and I think this report is especially the case. A Fed pause and pivot should now be here. I’ll be surprised if the fed hikes again on 5/3, but we have 3 more weeks of data plus of course earnings reports of Q1.

My forecast (of the last 4 months) remains unchanged; the Fed will start cutting rates in the 4th quarter and by years end the 10 year yield will fall below 3%.

Financial markets and the Fed are reading from two different playbooks but as history has taught us well, the Fed never leads, they only follow.

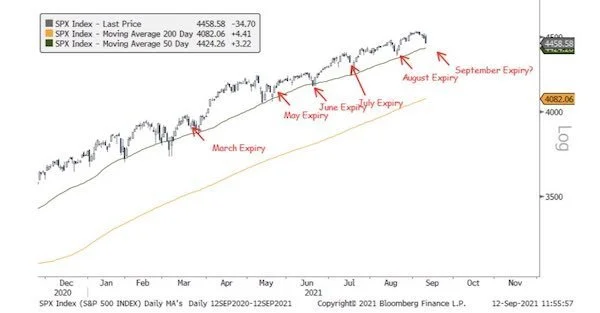

Chart Review S&P 500

The largest and most important equity index in the world continues to flash “buy me”. From the 10/13 bear market lows…just classic capitulation…SPX has a clear series of higher highs and higher lows as it remains well above its 200 dma and has worked off its overbought levels over the last week. I expect a breakout to take place in the next 1–2 weeks which would lead to a rally to 4300 + (5% + from here).