VRA Investment Update: Strategy Update. Pattern Changes, Fed 'Flexibility". The Anatomy of Bull & Bear Markets

/Good Thursday morning all. Right at 3 months ago we began our planning for the Biden bear market and issuing our VRA Strategy Updates. We sold our VRA leveraged ETF holdings that focused on tech by selling TQQQ (3 x Nasdaq 100 ETF) and selling SOXL (3 x Semi ETF). We sold TQQQ at $45.94 (it fell to $25) and we sold SOXL at $34.85 (it fell to $18). We’ve also taken 112% in profits over the last 7 months (3 trades) in ERX (2 x Energy ETF).

VRA Strategy Update; that was then and this is now.

Our primary view is that; a) most stocks have bottomed, b) investor sentiment is so bearish that we must be bullish and c) we are buyers.

As we cover here often, most stocks have been in bear market for over a year. But today, if there’s a single piece of analytics that investors should be aware of, I believe this is it.

After the first 100 days of 2022 this is the 4th worst start to a year for the S&P 500 in history. That’s the bad news. Here’s the good news. When we look at the previous worst starts ever for the S&P 500 we see that the rest of the year the market was higher 100% of the time with an average gain of 19.1%.

Got that? Based on history, going back to 1932, the worst starts to the year are then followed by markets that rise 100% of the time into year end and do so with rock solid profits.

AKA, bull markets follow bear markets…a theme you’ll see repeated throughout this VRA Strategy Update.

Pattern Changes and Fed Flexibility.

As we’ve been covering over the last week or so, pattern changes appear to be emerging. From 3 straight days with a 600 point move higher in the Dow Jones, to continued improvement in the internals, to excellent smart money hours, this bear market is taking on a new personality. It may only be the set-up for a strong bear market rally, with still lower lows in our future, but I continue to believe that…for most stocks…the lows have already been seen. We are buyers.

And another potentially massive pattern change…the Fed just committed to “flexibility”, the single word from the Fed’s FOMC minutes yesterday that turned stocks sharply higher on a dime.

Tylers podcast from Tuesday set this week teed up the Fed’s FOMC minutes of yesterday…a sneak preview of what looks to be taking place today.

There is a new line of thinking beginning to emerge that the US economy is so clearly slowing (housing, trannies, retail and tech/social media/advertising is getting smashed) that the Fed will soon

signal that their aggressive rate hike scheme may not actually be quite so aggressive after all. Again, this matches our thinking. The Fed has been actively jawboning the markets lower,

doing their best to slow/reverse inflationary concerns. But most of it is just that…talk.

We just got a bit of confirmation from overseas as well as the ECB is now telegraphing a change to their runoff schedule for QE. Remember, the ECB is still actively involved in QE and is not set to stop buying govt debt until July.

The ECB is essentially acknowledging what we’ve been reporting in the VRA for the last few months. Their economy, post shutting down their banking business with Russian oligarchs and the insanity of attempting to block Russian oil/gas from European markets, has the European economy headed into a recession.

Late Tuesday, ECB head Christine Lagarde said on Bloomberg “we’re not ready to say that the economy could be headed into a recession but we are watching closely, as always”.

That’s central bank talk for “yeah…a recession is just around the corner”.

We certainly see the US bond market taking note, as the 10 year yield has plummeted from 3.17% (5/9) to 2.74% (chart below).

From a yield of just 2.3% in late March to a high of 3.16% on 5/9, this sharp ramp higher in rates resulted in the last wave of selling pressure in US stocks.

Now, with the 10 yr yield reversing course, if the markets are beginning to discount aggressive Fed rate hikes…certainly with everyone already bearish and out of the market…a significant rally could be dead ahead.

As deeply oversold as the markets are, along with the extreme fear readings of numerous investor sentiment surveys, the markets are ready for a relief rally (at minimum).

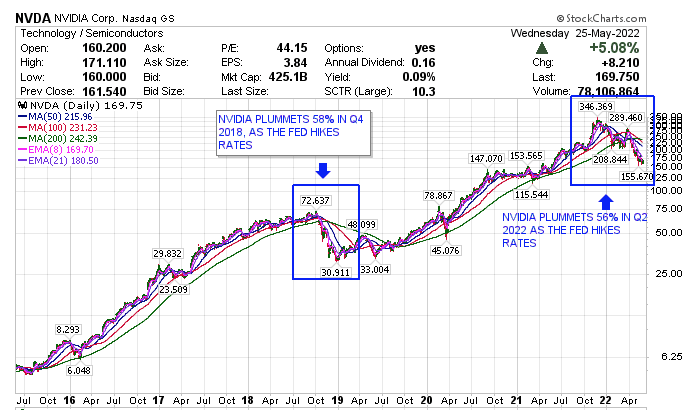

NVIDIA (NVDA): The Anatomy of Bull and Bear Markets

Bear markets make even the greatest of co’s look like the ugliest of car crashes. This is especially true in tech stocks.

It’s even more so in the semiconductors, which lead the markets in both directions. This is why you hear Tyler and I harp on and on about the semis.

There is no single group that matters more, when determining market direction and market personality. “Are we in a bull market or bear market?” can be determined most by watching this one group.

Yesterday after the close, NVIDIA announced earningsand the stock got slammed as much as 9% after hours on a warning over chips and the lockdown in China.

But that’s not the story I find most relevant. It’s the anatomy of a bear market that makes the NVDA meltdown relevant right now, in late May of 2022.

In the chart below, we see the very definition of an amazing stock. From nowhere, in 2016…just $6/share…a little company called NVIDIA began

to catch fire, as gaming and crypto currencies got red hot. No company did it better.

From that 2016 starting point until November 2021, NVDA soared 5600%, turning a $10,000 investment into $560,000 in just 5 years.

This is where the relevance to today begins. When we drill down to Q4 2018 we see that NVDA had its first 50% + meltdown (in short order), dropping from $72/share to $30/share in roughly 4 months.

From there it began its rocket ship move higher to $364/share, which it hit this past November. Buying into that 50% collapse made investors fortunes. But, it was a brutal Q4 bear market.

Sound familiar?

Now, check out what’s just happened, again. In less than 6 months NVDA has…once again…imploded more than 50% (just as it did in Q4 2018).

And once again, this implosion is due (almost exclusively) to Fed rate hikes. China smyna…the land of semis/tech has been shellacked by central bank “awfulness”.

BTW, on my podcast yesterday I called my shot…predicting that NVDA just hit their bear market lows of $152/share, down a stunning 56% from Novembers highs. VRA Portfolio Note: we own SOXL (3 x Semi ETF)

** The question that I believe smart money investors are asking themselves today is “at what point do great companies and sectors once again become a screaming buy?”

And this is when we must also take another look at Cathie Woods Innovation ETF (ARKK). Here’s that theme again…greatness, neutered by the brutality of a Fed engineered bear market.

From March 2016 to February 2021, ARKK soared from $13/share to $158/share, an 1100% move higher. No, its not the insane move higher that NVDA had, but we’re also talking about an ETF…rather than an individual stock…and $10,000 invested into the ARKK ETF turned into $110,000, in just 5 years.

And now, look what’s just happened in 15 short months. ARKK just imploded 77%.

** And once again, the question that I believe smart money investors are asking themselves today is “at what point do great companies and sectors/ETF’s once again become a screaming buy?”

I’m not recommending either NVDA or ARKK here today (we own SOXL and our own portfolio of 10-baggers). I’m making the larger point that bear markets brutalize even the best investment stories. And I’m also making the point that bear markets end…and give way to even greater bull markets.

Many believe we are at the precipice today, staring into the abyss, with fears of a systemic meltdown, World Economic Forum (Team Biden) style, featuring depopulation and a world war that might just end us all.

It’s essentially impossible to find anyone that’s bullish on US stocks. Again, that was pretty much me 3 months ago…but at my core I’m too much of an optimist on America and Americans to throw in the towel.

Its the singular thing I’ve respected most about Warren Buffett and the great Peter Lynch; they always want to invest in America…because no country is better than America…and America always makes a comeback. Betting against America has been a losing proposition 100% of the time.

And Buffett and Lynch also know that bear markets give way to new, and far more powerful, bull markets.

From the S&P 500 to Nasdaq to Russell 2000 to the semiconductors these leaders just plummeted 20–50% + and did so in short order.

Many stocks are down 50–60–70%, (again, including Cathie Woods ARKK and its 77%, 15 month meltdown). BTW, Cathie Wood has never been more bullish.

Woods and her team of investing rain men/women just put out a research paper stating “advancements in AI will soon produce annual GDP growth of up to 50%/year”.

As you can imagine, the pushback against Wood on this “out there” claim has been fierce. But man oh man, is Woods ever smart. No way am I betting against Cathie Wood, just as I wouldn’t bet against Elon Musk. Woods largest and most successful holding for years has been Tesla (although I did buy it cheaper than Wood).

Here’s the bottom line truth; today, there are so many bears that a true contrarian must be bullish. It’s not much more complicated than that.

Again, I’m not calling a bottom. But I am saying that investment opportunities abound and that yes, most stocks have already bottomed.

This wall of worry is about to be climbed.

VRA Bottom Line: I believe we will look back and see this bear market for what it is…a reset in both the economy and the markets…and that the best of America (and a newly red-pilled world), lay directly in front of us.

Until next time, thanks again for reading….

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast