VRA Investment Update: Repeating Pattern From March. The Best 3 Months of the Year. Trump Media, Own It.

/Good Thursday morning all.

Yesterdays trading…actually the last 2 days of trading…have served as an important reminder that until we break the pattern of market sell-offs/pauses that’s been in place from March (once reaching extreme OB on VRA System momentum oscillators), we must continue to respect this pattern. For the 2nd day in a row we’ve seen weak smart money hours and poor market internals. Yesterday, even when the Nasdaq was +120 (it finished flat) Nasdaq advance/decline was 2:1 negative. Not good. NYSE finished especially weak, with 3:1 negatives in both A/D and volume. Markets finished at their lows of the day.

We’ll be watching the internals plus the final hour of trading for signs of a reversal back higher. In addition, the Fear & Greed Index just hit 71 (Greed)….not far now from extreme greed. Just 1 month ago the reading was 21.

We don’t think it will take long for this pause to play itself out….we are entering the best month of the year and we continue to expect the markets to melt up into year end. Any pullback will likely be short lived.

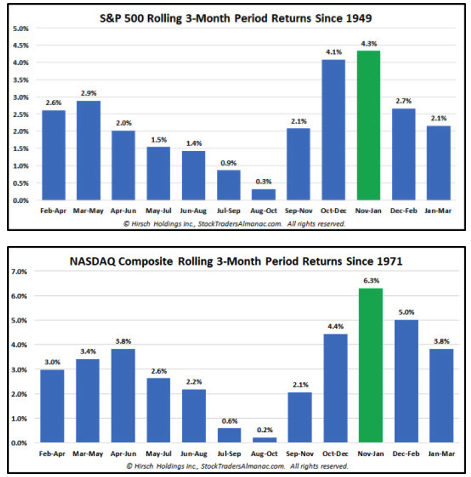

With thanks to Stock Traders Almanac, below we see the hard evidence that we are entering the best month of the year and the best 3-month span of the year, for the Dow, S&P 500 and nasdaq.

November, December and January constitute the year’s seasonally strongest 3-month period for the S&P 500, Dow Jones Industrials and the NASDAQ Composite. This seasonal strength is created by a combination of the annual, semiannual and quarterly operations of institutions and the habitual behavior of retail investors and consumers.

The November-January 3-month span has produced a gain of 4.3% for the S&P 500 & DJIA since 1949. October-December runs a close second at 4.1% for S&P and 3.9% for DJIA. Since 1971 NASDAQ has gained a whopping 6.3% November-January with December-February in second at 5.0% and October-December in third at4.4%.

These charts also highlight the Best and Worst Months of the year with the Best running from October/November to April/May/June and the Worst from May/June/July to September/October. Stocks have been firming up since we issued our Seasonal MACD Buy Signal to subscribers on October 8 and look poised for a solid yearend rally that continues into early 2022.

3rd Quarter GDP Comes in Weak

You know our thoughts…we are in Obama’s 3rd term. This mornings 3rd qtr early read came in with just 2% GDP growth vs the 2.7% estimate. Folks, these numbers will only stagnate further from here. When the government takes over the economy the end result is universally the same; economic growth is stifled. The same scenario is playing out globally. Just remember this all important point; the stock market is not the economy. Our views on a market melt-up are unchanged.

Another major plus is that Biden appears to be a lame duck president (yes, already). Regularly on my podcast I challenge people to name a single major accomplishment of Bidens…not a single taker so far (obviously). Have we ever had a lame duck prez inside of his first 10 months in office?? And this is excellent news for the markets, who like little more than DC gridlock. This will only amplify if R’s demolish in the midterms. Again, gridlock is highly bullish.

It’s Time for Small Caps to Shine

The #1 performing group from now into year end, going back 50+ years, is the small caps. As we see in the chart below IWM (Russell 2000 ETF) is actually the least overbought of our broad market indexes and still the only index yet to hit an ATH.

The 8 month channel you see below has been tested 3–4 times on both the upside and downside and we see HIGH probability that the breakout from this channel will be higher. Of note are the rising trend lines on MFI and RSI. Highly bullish. Momentum is building in small caps for a spectacular melt-up into year end and Q1.

Trump Media (DWAC)

Just giving you a heads up…I’m going to be a dog with a bone on this one. Not going to make the same mistake I made with Tesla. I am pounding the table on DWAC.

It’s a buy and will continue to be a buy for years to come.

Login to any stock chat room (Reddit, Yahoo, etc) and these are the types of comments that you’ll see re DWAC;

Trump Media has the potential to be unlike any stock to ever trade publicly. Period.

Lastly, thank you for your feedback on Tuesday’s podcast. Among several topics, Tyler covered Ayn Rand, author of many great books but likely best known for Atlas Shrugged, a book that Tyler first read in high school and which I can attest made a deep impact on his world views. We are living through the dystopian times that Rand envisioned some 7 decades ago. Here’s the link to Tyler’s cast:

Until next time, thanks again for reading…

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast