VRA Weekly Update: Q2 Market Melt-Up, Here We Come.

/Good Thursday morning all. Reminder that markets are closed tomorrow for Good Friday.

First quarter 2021 is now in the books. As Tyler covered on our VRA Podcast yesterday, how remarkable that the Nasdaq and Russell 2000 each had “lightning fast” 10% corrections, yet the markets still managed to put up the following “solid” returns for Q1.

Nasdaq up 2.22%

12958 to 13246

SPX up 5.5%

3764 to 3972

Dow up 7.68%

30627 to 32981

RUT up 11.3%

1975 to 2200

This is “that” bull market. Anyone that’s dumb enough to make long term stock market forecasts…I qualify…should typically be ready to be embarrassed. But here’s what annoys me most about todays “gurus”…they’re so concerned about protecting their image that they’re hesitant to tell investors what they actually think is going to occur.

As a simple Texan, I pay little attention to the gurus…that’s why I created the VRA Investing System. And when our system is flashing “strong buy” it means we’re in a major, primary uptrend and our leading economic indicators are screaming “be very, very long”.

Of course thats the case today. Of our more than 15 major reasons to be bullish, heres what continues to be top of that list:

-Housing, transports and industrials hitting ATH after ATH. These are our most important leading economic indicators. This “demands” that we be aggressively long.

-Multiple Dow Theory buy signals.

-Soaring corp earnings.

-Don’t Fight the Tape.

-Don’t Fight the Fed.

-And our ongoing wild card; “The Big Bribe”. The lefts/establishments attempt to numb US and global citizens into submission with free money and soaring stock and real estate markets. What stolen election? What coronavirus insanity?

Hence our forecasts of Dow Jones 75,000+ and Nasdaq 30,000+ by 2025. Now is the time to be long and strong.

This is what we wrote to our Parabolic Options Members yesterday, as the Semis/Nasdaq led the way higher, in what my mentor Michael Metz (RIP Mike), Director of Research at Oppenheimer, called “the early mover day”.

“This is the action we want to see today. Semis leading + 2.7% with Nasdaq +1.8%.

If this the beginning of the next major move higher, as we suspect, it’s this type of early action that often occurs:

Semis/Nasdaq open strong and never look back.

Shorts begin covering, the longs start jumping back in and as Q1 earnings begin to be announced, the ramp higher is in full gear.

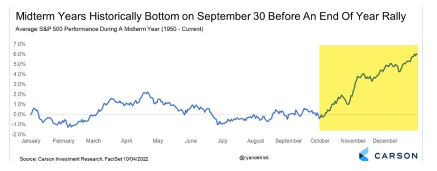

We think the Nasdaq chart below paints this picture well:

Over the past year we’ve had 3 instances where nasdaq fell to its 100 dma. After a decline and bit of basing, just enough to get investors nervous, the 100 dma holds and within short order the focus turns to the next move to ATH in Nasdaq.

Repeating pattern…rinse and repeat.

If today is that early mover day, we’ll know by the close as we’ll have a solid smart money hour. Then we’ll be off to the races into next week.

Solid Nasdaq internals at better than 2:1 across the board. We’d look for NYSE readings, which are ok, to improve into the close.”

As Mike preached to me some 25 years ago, early mover days…we think that was yesterday…typically take place at the beginning of a major move higher. We’re seeing follow-through this AM with nasdaq futures + 140 and the rest of the market following right behind it. And we’re now in the month of April, the best most of the year, with what will be “stellar” earnings reports.

And here’s another bullish outlier that’s making waves this morning. Taiwan Semiconductor (TSM) is investing an additional $100 billion in chip production. Semis lead Nasdaq, nasdaq leads the market.

And tech co’s have never had more cash. Should we get a major acquisition in this group, or a series of M&A deals, tech will get red- hot again. Quick.

A 10 yr yield of 1.72%…or even 2%…is, in my view, essentially inconsequential. Only the velocity of the move higher would concern us.

10 yr rates continue to be negative in Japan and broadly negative throughout Europe. Global buyers want US debt, for the obvious reasons of safety and security, not to mention our MUCH higher yields. That demand should continue to act as gravity for US rates.

We know this puts us in the minority…we like that contrarian position.

We like value stocks…think their move higher will continue…but we’re just 1 year into a new bull market. New bull markets tend to favor tech. Early bouts of inflation are also a market positive.

These signals represent our strongest and best performing bull markets.

Infrastructure Deal

If you watched Biden’s presser on his new $2.2 trillion “infrastructure” deal yesterday, you’ll know it only has a bit to do with infrastructure and much more to do with rewards to the special interest groups that got him elected. And you may remember that when Trump tried to get just $200 billion approved for infrastructure our State sponsored MSM called it “too expensive”. Oh, the sickening hypocrisy…man are they ever fawning over Bidens 10 x plans.

Unfortunately it comes with higher taxes as well. Team Byden wants to kill The Trump Economic Miracle while rewarding his special interest groups at the same time. As bullish as I may be, I also know the significant damage that can be done to our economy with these job killing strategies.

But as it applies to the markets, another major reason to be bullish. This is another significant reason to own Copper and VRA energy stocks . If the global relation trade wasn’t already real…and it was…we’re about to really see the global economy take off now.

And yes, its bringing a rather massive round of inflation with it. The coming move higher in gold and silver will be one for the record books.

Hoping everyone has a great Easter weekend!

Until next time, thanks again for reading…

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Also, Find us on Twitter