VRA Investment Update: Ugly Trading But Fed Chair Decision is an Opportunity.

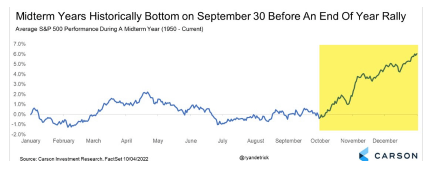

/Good Thursday morning all. Rather ugly day yesterday with a sell-off throughout the smart money hour into the close. And it was the 3rd day in a row with negative A/D for NYSE. It’s been a couple months since we’ve seen that. Weak internals across the board; 2:1 losses in both A/D and volume.

Here’s what we see at the VRA, for the very short term. In addition to coming off of extreme overbought readings, the markets are on edge about the Fed decision. Will we have more J Powell, the money printing rock star or will it be the newbie, Lael Brainard, the MIT financial engineering prodigy?

Know this; that decision has already been made. There is a near zero percent chance it has not. The smart money is of course fully in the loop.

This looks to be setting up as a “sell the rumor, buy the news” event. That’s how we’ll likely be playing it in Parabolic Options. I believe, regardless of the choice, the markets head higher. The question is timing, as they’ve only said that the decision will come in the next few days, according to Biden.

It’s likely, in my mind, that this will be a weekend announcement. They like to make news like this on Sundays.

I give the edge to Powell…but its close. Brainard will be teed up should Powell forget who he answers to (the permanent ruling class). Now that the world has been re-inflated to the tune of $35 trillion in fresh monetary and fiscal stimulus, the fact is that more liquidity is not what the markets need, not at this juncture. That may tip the edge to Powell.

Again, I think the markets rally on the news…depending on VRA Investing System readings we may add a new position headed into the weekend.

As our markets continue to bounce around off of extreme overbought levels, new buying opportunities are beginning to present themselves. We remain aggressively bullish over the medium to long term, as we apply discipline in waiting for our VRA System buy signals to establish new positions. It’s doubtful…with these melt-up levels of liquidity…that any pullback will be more than a blip.

We like energy a lot here.

The chart below is of XLE (the underlying, non-leveraged ETF to ERX. We use the un-leveraged ETF’s for charting purposes)

Here we see XLE is nearing heavily oversold on stochastics with near perfect trend line pullbacks in both RSI and MFI. We also see below what tends to happen when an investment hits extreme overbought…the pauses tend to take some time. XLE also continues to track its 21 ema…another closely watched ST timing signal.

The Biden administration can talk all they want to about their concerns for the American people re inflation. But like everything else this communist admin does, they are not to be trusted.

They care about the American people only to the extent that they can cloak their true intentions; enriching and empowering the elite while enslaving the population.

This is how they really feel about energy prices. They want them MUCH higher. They’re going to get their wish, as oil soon cracks $100. Obama admitted exactly this in 2011.

Finally for today, some excellent news on the CV Insanity front as OSHA has backed completely away from mandating the jab for co’s with more than 100 employees. Bravo!

Until next time, thanks again for reading…

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast