VRA Weekly Update: VRA Investing System, 36 Years in Development. Why We Use the VRA System to Time the Markets. 1995–2000 Case Study.

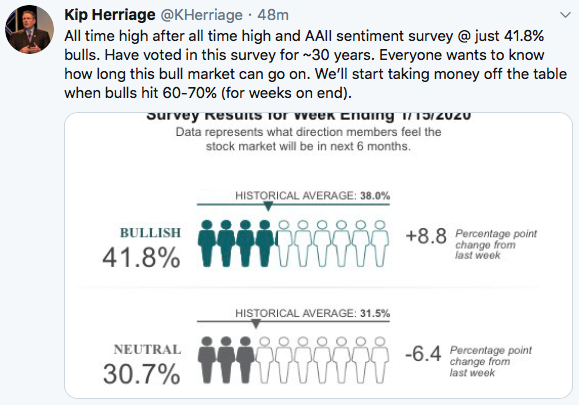

/Good Thursday morning all. As we welcome new VRA Members it’s important that we’re all on the same page. That means understanding the VRA Investing System, ensuring that we are positioned to crush Mr. Market. As we begin trading today, the VRA System sits at 9/12 Screens Bullish.

Read More