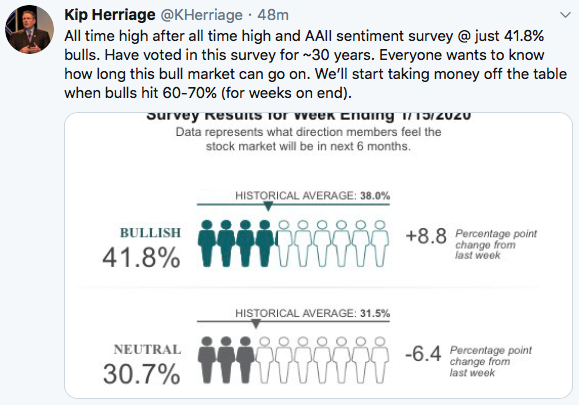

VRA Investment Update: The US Economy is Accelerating (thanks #45). Investor Sentiment is Heavily Bearish…and Why That's Bullish.

/This morning we learned that weekly jobless claims came in at just 190,000, another incredibly low reading which backs up a series of economic data from the last 1–2 months that show the economy is actually accelerating, rather than slowing down.

Read More