VRA Weekly Update: Stunningly Bullish Investor Sentiment. What Do I Have in Common With Nicki Minaj?

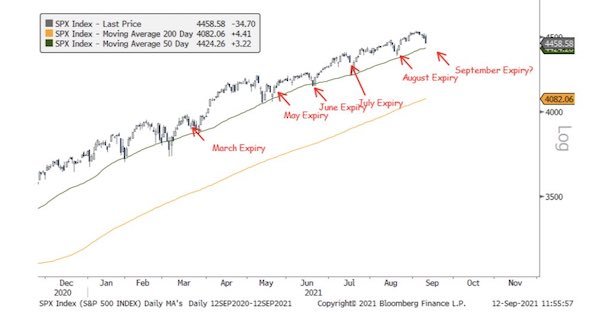

/Good Friday morning all. Some interesting data here; for the last 6 months the markets have sold off into today’s options expiration, with those Friday lows marking THE lows into months end.

And here’s MORE bullishly compelling data from our investor sentiment surveys. In addition to the Fear & Greed Index, which hit 31 on Tuesday (Fear), last nights AAII sentiment readings are “mind blowing”.

Bulls are down to 22.4% (-17%) with bears up to 39.3% (-12%). Stunningly bullish to have retail investors this bearish when we’re mere days away from ATH’s.

New targets: We are looking at 2 potential additions, as it applies to leveraged ETF’s. Each has worked off their overbought readings on the VRA Investing System, these should produce 50%+ profits into year end trading.

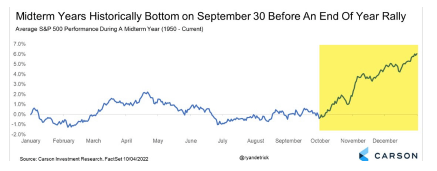

VRA Bottom Line: we’re nearing a highly profitable short term trading bottom. We’ll be taking additional action in the VRA Portfolio soon.

For our newer VRA Members, here are our most important, broad market macro views on the market, bonds, energy, precious metals and cryptos….along with some top buy rec’s for the next year.

BIG PICTURE: We have entered the 3rd term of Obama’s presidency. Get ready for slower growth, lower rates, more QE/stimulus and a melt-up stock market driven by central bank financial engineering.

ONE: Stock market (remember, the stock market is NOT the economy).

We’re in just the second year of a new bull market that will take the Dow Jones to 100,000 +. Three times higher from current prices, in approximately 5 years (by 2027).

This melt up will rival the Dot com melt up and is being driven by two major factors:

a) unprecedented global liquidity of $32 trillion; fiscal (government stimulus) and monetary (central banks)…with much more on the way. TINA (There is no alternative) and FOMO (fear of missing out) will continue to force stock markets higher. Don’t fight the tape, don’t fight the Fed.

b) surging corporate earnings that won’t peak for 5 years (the power of a new economic cycle…they last more than 5 years, on average)

Best ways for a long term, more conservative equity investor to invest: a 50/50 mix of $SPY (S&P 500 ETF, plus dividends) and $IWM (Russell 2000, plus dividends) should produce gains of 30% + per year. More aggressive investors should of course use the VRA Portfolio. And oil/nat gas prices will soar with the insanity of The Great Reset depopulationists climate change.

And remember, cash is trash!

TWO: Bonds

If you’re a true contrarian, you MUST believe that interest rates will continue to plummet. While 99% of PHD economists (most all employed by the Fed) are telling us that rates will rise sharply from here, here’s why they are wrong:

*the majority of PHD economists are NEVER right.

*rates have fallen for 40 years. It’s hard to find a more powerful repeating pattern.

*We are in a new world of financial engineering, run exclusively by central banks. The financial masters of the universe. They cannot stop QE, ever, or the system implodes.

* We believe rates in the US will be negative, likely by 2025, just as they continue to be in Japan and Germany (broadly throughout Europe)

Best way to invest: Use the VRA Portfolio in recognition of TINA. Buy real estate/homes. As rates continue to fall, home values will continue to skyrocket.

THREE: Precious Metals

- We’ve just entered the most bullish seasonal period for gold and silver (now through year end).

- Central banks have resumed buying at record levels

- The publics ownership of gold is right at all time lows (as a percentage of investable assets). As a contrarian, there is no bigger buy signal.

- Record Currency inflation demands that precious metals move higher.

- If/when it all blows up, precious metals will be the only real place to hide.

Best way to invest: physical gold and silver and gold/silver miners

FOUR: Cryptos

Bitcoin is the top play (with Ethereum #2).

Because they will never create more than 21 million BTC, this is a unique “supply and demand 101” story.

Timing wise, BTC is just above its 200 day moving average, a level that needs to hold.

BTC also just had a “golden cross” where the 50 day moving average crosses over the 200 day moving average. Golden crosses are highly bullish, high probability technical events.

Regulation is becoming a larger risk to cryptos. The SEC just started targeting them as “securities”. This is a battle that cryptos have been trying to avoid.

What Do I Have in Common With Nicki Minaj? In Twitter Jail, Again

Yesterday I received notice from Twitter that my account was locked and that I was suspended (again). This makes strike 3 for me. Like most on twitter that have the nerve to ask honest questions and challenge the Pravda propaganda, I’ll be banned from Twitter as well. Just a matter of time.

What was the tweet that got me in hot water this time? I included an article from The Guardian that asked the (important) question “why has the CDC stopped collecting data on breakthrough infections” along with my question as to why its ok for USPS, congress and NBA players to get a pass on forced vaccinations, but the rest of us pawns should just shut up and take it. And seriously, why would the CDC stop tracking data on the fully jabbed that now have CV, are in hospitals and that have died after being injected? One would think this is important info the rest of us would want to know.

As Dr. Brian Tyson, who has had the courage to speak out while most doctors cower in fear, points out; Exactly how is it that one year later we are FAR worse off than we were without the jabs??

Maybe its time for “medical experts” to start asking the obvious question; are the vaccines in fact the virus??

When it takes someone like Nicki Minaj (in Twitter jail too) to start asking the questions that matter most, what does it say about our country?

Bravo Nicki. Bravo.

CV Insanity…Sleepwalking into Fascism of “trusting the science”

Until next time, thanks again for reading…

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Also, Find us on Twitter