VRA Investment Update: VRA Quick Hitters. This is Not 2008. Investors at Extreme Fear; Contrarian Buy Signal. The charts Say Buy.

/Good Friday morning all. VRA Quick hitters;

1) Weakness in European shares today as Deutsche Bank is down 15%, taking the European bank index down 5% on the day.

2) Yesterday, Treasury Secretary Janet Yellen had to clean up another unforced error as she corrected her previous days testimony before congress, making it clear that the US will do whatever it takes to protect the banking system and its depositors.

3) Our system of central bank controlled financial engineering works for two primary reasons; a) tight global coordination of central banks and the governments they control b) they’ll do whatever it takes to head off bank runs and contagion. As long as this remains the case, the system remains intact and all-powerful. AKA don’t fight the Fed. It’s not much more complicated than that.

4) The Fed never leads, they only follow. This chart of 10-year yield is stunning; in just 4 months the 10 year has plummeted from 4.33% to this mornings 3.31%, a 24% implosion in yield. What makes it particularly stunning is that the Fed is still hiking rates, even as yields collapse. And look at all of the red candles in this chart (red candles are a sign of further lows to come).

5) For the last 3 months or so I’ve forecast that by year end the 10 year yield would drop below 3%. We’re almost there and it’s only March. Make no mistake about it, the bond market is beginning to price in a recession in the US.

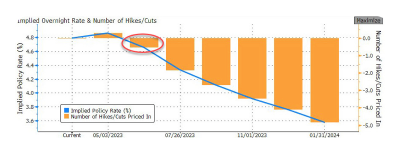

And check this out; as of this morning, Fed funds futures are now pricing in 4.5 rate cuts over the next 10 months. J Powell, no one believes you.

6) Tech continues to lead, as rates collapse. Big buy signal for stocks. Below is relative strength of QQQ to S&P 500.

7) Our biggest buy signal, from the 10/13 capitulation lows; the semis are leading stocks higher. Below is relative strength of Semis to S&P 500. Of note, the semis just broke out this week to new 9 month highs.

8) For the last two weeks, the miners have been leading gold higher. We want that to continue. Big buy signal for the group.

Below we also see that buy-side volume is building in GDX. Setting up for a monster move higher in the miners, in advance of next rate cutting cycle and more QE.

9) the chart of the US dollar looks more and more bearish. With the USD headed lower still, this is bullish for commodities, including oil, gold, silver and copper. And yes, bullish for US stocks too.

10) This is Not 2008

This week we learned that existing home sales soared 14.5% to an annual rate of 4.58 million in February, per the National Association of Realtors. The surge in sales is the largest since July 2020.

As we’ve covered here often, from the 10/13 lows our 3 leading economic indicators and bull market signals (housing, trannies and semis) have led the market higher.

If you think we’re about to have another 2008, you’re likely listening to the wrong people. As we’ve covered often, homeowners credit scores and home equity have never been higher, while defaults are in the bottom 20th percentile. Again, this is nothing like 2008. Add that supply/demand in the housing markets screaming “long term bull market”. As we covered in our new book “The Big Bribe”, housing is one of our 5 Megatrends that will power the US economy into 2030…likely beyond.

11) Sentiment Remains Excessively Bearish

A contrarians delight. Investors are the most bearish they’ve been since Bank of America began their global fund manager survey in 2001.

While it’s hard to make out on this chart, I’ll save you some time; each time we’ve hit this level of “extreme fear” (from the chart above) it’s been a buying opportunity for stocks (within short order).

Also from Bank of America; Fund managers are incredibly bearish: they are long bonds, staples and cash with a US equity weighting at an 18 yr low.

Fund flow sentiment hitting extreme fear as investors sell stocks and move funds into the safety of money mkt funds, cash, ST debt. Readings today have only been more bearish on 2 occasions since 2010; the Fed’s Christmas meltdown of 2018 & rona-insanity.

#ContrarianSignal

12) I was on Charles Payne’s “Making Money” on Fox Business earlier this week where I spelled out a topic that long time VRA Members are accustomed too. The financial system we have is our system. You don’t have to like it. You can in fact detest it and you almost certainly should (especially central banking and the gross devaluation of our money) but the fact is that since Japan started QE in 2002, the US has been turning Japanese.

Here’s the full interview on Fox Business with Charles Payne (and yes, I do know that BTC is not quoted in ounces…no clue what was going on there)

https://rumble.com/v2e1xru-kip-herriage-on-making-money-with-charles-payne.html

Until next time, thanks again for reading.

Kip

Join us for two free weeks at VRAInsider.com

Please join us each day after the market closes for our Daily VRA Investing Podcast! Sign up for email alerts @ vrainsider.com/podcast

Also, Find us on Truth Social and Rumble