VRA Investment Update: CPI at 40 Year High. Thanks Again Biden. Textbook Bottom and Bear Trap. Gold and Miners Love Rising Rate Cycles

/Good Thursday morning all. The much awaited CPI data is out and its a hot number, with inflation hitting a 40 year high as the CPI posts a 7.5% annual gain in January. Honestly, don’t most of us look at this number and say “what do you mean it only rose 7.5% year over year…based on what I’m paying for stuff it feels much more like annual inflation of 20% +.”

Lets see, what’s changed over the last year? Thats right, we got a new president…the basement dweller with “81 million votes”. Not sure about you but I cannot find a single person that will admit to voting for Biden.

The markets were flat in advance of the CPI data but immediately went south, with DJ now -225 and Nasdaq down a bigger 260 (-1.8%).

In the bigger picture, this market has been on an absolute bull run, following what looks to this market watcher to have been a perfectly set “bear trap”, as I explained in our VRA Podcast yesterday.

The 1/24 market bottom and the corresponding move higher has been “textbook”, so far.

First, we had the 1/24 capitulation…classically completed on a sharply lower Monday open, just as the average Nasdaq stock had already collapsed by more than 50%.

Second, tech…led by the semis…have led the way higher. Nvidia (NVDA), which we highlighted in yesterdays VRA Update, has been a nonstop freight train higher…up a big 6.5% yesterday…and +22% from those 1/24 capitulation lows.

Third, our VRA Investing System continues to pick up “significant pattern changes”, both in market internals and key leadership action, as the smart money hours are flipping back to bullish as well. Yesterdays internals were the best readings of 2022, with 80–85% up volume (NYSE, Nasdaq)…6:1 for Nasdaq…and another big day for advance declines. Back to back, fantastic days.

VRA Bottom Line: The markets have zoomed higher from the 1/24 lows. In just 2 weeks, a 2300 point move higher in the DJ (+7.5%) and a near 1400 point move higher in Nasdaq (+10.6%) and a BIG 16% move higher in the Semis (SMH)…and we remain buyers of dips, in our VRA Portfolio Positions.

We’re still in the most seasonally bullish time of the year, equity inflows and share buybacks are piling in and the biggie; we’re still just entering year 3 of a new bull market, driven by (still) solid corporate earnings and record amounts of global liquidity. As we’ve said now for 18 months plus, this is a structural bull market, with the Trump Economic Miracle (still) serving as its springboard and corporate financial engineering emerging as a dark horse element for sharply higher prices.

Plus one of mine and Tyler’s favorites; we told you several months ago that Biden was already a lame duck president…that’s now being recognized as fact…and the markets love DC gridlock as much as just about anything. They also love (early) rate hikes…but that looks like a stat that many market watchers have (oddly) yet to figure out. I think they’ll get there…”

Gold and the Miners LOVE Rate Hike Cycles

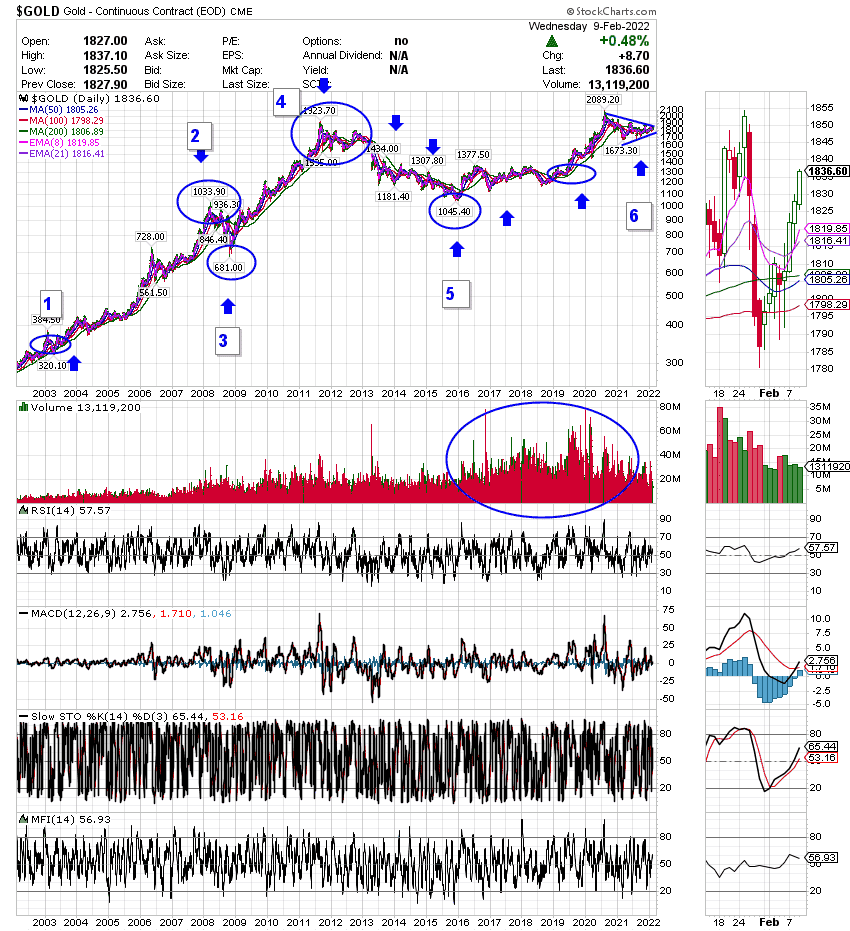

Check out this 20 year chart of gold below, marked by points 1–6.

Point 1 is where I first recommended gold and silver, in my 2nd ever VRA Update in 2003. Gold was $375/oz….silver was $4.75/oz.

What followed was the rising rate cycle of 2004–2006 (17 straight rate hikes) when gold that more than doubled in price.

Point 5 was the next rate hike cycle (2016) as the Fed jacked rates higher 8 times in Trumps first 2 years. Again, gold doubled in price.

They REALLY love rising rate cycles.

Finally, here’s golds 1 year chart, featuring a pennant formation (even the flagpole is in place). I believe a big breakout is nearing.

Until next time, thanks again for reading…

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast