VRA Investment Update: VRA Portfolio +17.6% in 2022. Russia-Ukraine Bull Market. Hard Truths.

/Good Thursday morning all. As we start trading today the VRA Portfolio is up 17.6% in 2022. That compares to losses of 10-14% in our broad markets. Folks, this feels like on of those years for our stocks. I remember this feeling, similar to the years we’ve put up 100-200% + net gains.

We beat the market again last year, making 16/19 years, with 430% in net profits (on all closed positions), while leaving our core positions and VRA 10 Baggers intact. Now, they’re starting to move.

To check out all of our picks join us for two free weeks at

Russia-Ukraine and VRA Market Update

There’s no need for me to keep belaboring the point. Russia-Ukraine will drag out...Wag The Dogs have a schedule to keep...but Putin has no interest in taking all of Ukraine.

The markets have known this from "first shots fired", which helps to explain the huge move higher from last Thursday.

So, what was Wednesdays big sell off? That was the shake-out that gave insiders the ability to get in (which explains why the internals held up so well).

Think of it this way.

IF I am right, this is like the 2/23/20 lows of CV insanity. Those served as THE lows. We won't breach the lows of last Thursday mornings open…..that was the market bottom.

This means that sell-offs going forward...certainly the lower opens....should be used as buying opportunities. That’s how we’ve been playing it…that’s how we’ll keep playing it, unless something changes (should last Thursdays lows taken out).

Volatility will remain...but the next big move should be back to the 200 dma for our broad market indexes.

As of now, here's where each major index sits below its 200 dma:

S&P 500: 1.5%

DJ: 3%

nasdaq: 6.4%

R2K: 6.5%

This market wants to keep going higher. The 200 dma should now act as a magnet for our broad markets. Once back to those levels, the next set of actions will be MOST important to watch.

We also had solid internals yesterday. 2:1 A/D and 3:1 + on volume. NYSE up-volume volume was 83%, making it the 6th day already in 2022 with 80% up-volume. Should we get another 80% day in NYSE volume it will serve as a rather massive technical buy signal.

And small caps leading the way...again....along with semis, which made a very interesting reversal and closed up a big 3.3%.

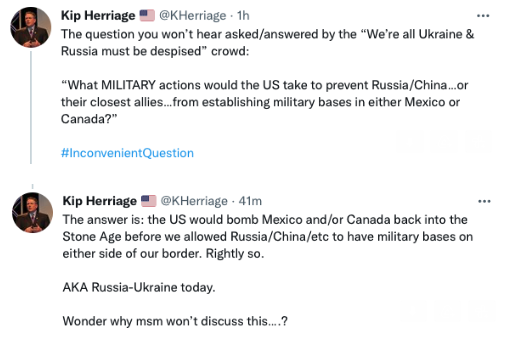

Hard Truths About Dems and Russia-Ukraine. Communists Helping Communists.

An Inconvenient Question For The “We Are All Ukraine Crowd"

Until next time, thanks again for reading…

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast