VRA Investment Update: Blood in the Streets, AKA Investor Panic, is A Buy Signal to Contrarians. WAR, W's Freudian Slip of Freudian Slips.

/Good Thursday morning all. Multiple bases to cover this AM. Yesterdays disastrous trading (on the backs of Target/Walmart/Wall Street waking up to the fact that inflation is at least as high as it was some 40 years ago), had the feeling of a weight so heavy that we couldn’t even have a single mini-rally…we just kept sinking and sinking. The losses in our major indexes (-3.5% to -4.7%) negated much of the positive action from last Friday and this Tuesday and NYSE 92% downside volume of yesterday negated Tuesdays 92% upside volume.

If bear market bottoms are ugly (they are), then yesterdays action absolutely confirms it…assuming we have in fact seen the lows.

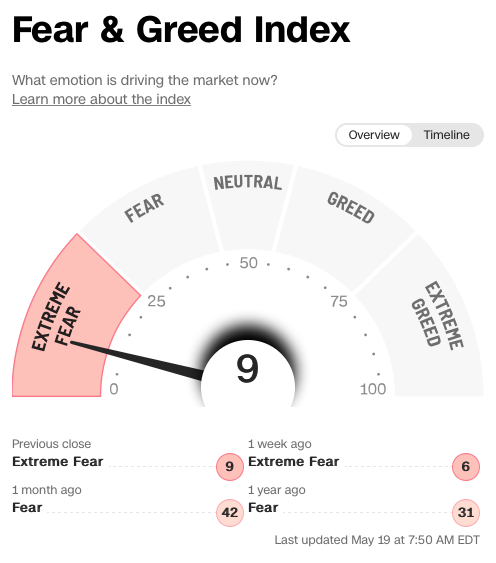

Still, we did hold our lows from last Thursday…when the Fear & Greed Index hit 6 and multiple technical readings took each broad market index to “extreme oversold on steroids”…and in addition the TRIN (Arms Index) hit a reading of 2.86, a clear sign of panic selling, AKA blood in the streets. Again, as contrarians, we like the TRIN at 2.86. Anything above 2 is both rare and panicky.

Note: the levels of doom and gloom are close to as high as I can remember. Saw at least 10 articles that a recession is “certain” and that the move lower in the market “is just getting started”.

Folks, these are the articles that we see at market bottoms…not at market tops…the MSM is rarely if ever right about their doom and gloom calls.

In addition, Ed Hyman, our favorite economist and best on Wall Street for 50 years, is still saying “no recession in the US this year”.

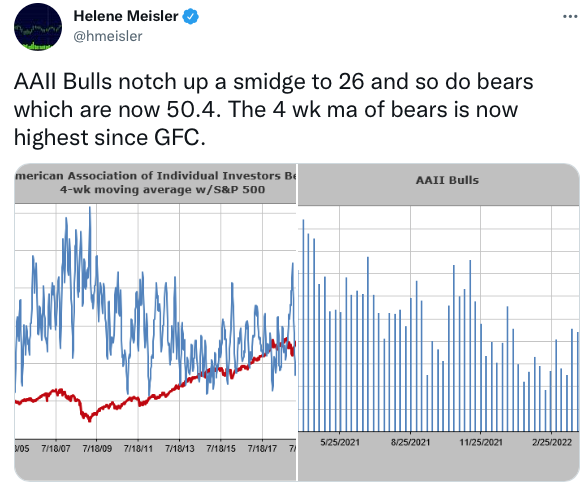

AAII — More Signs of Blood in the Street

Last nights AAII Investor Sentiment Survey came back with bulls at 26 and bears at 50. The 4 week moving average of bears is now at its highest levels since the financial crisis lows. Remember, just 3 weeks ago the AAII hit 15% bulls…a level that is not only one of the worst ever (I’ve voted in this survey since 1990) but typically marks near term lows.

Panicky.

Fear & Greed Index

Last Thursdays reading of 6% bulls in the Fear & Greed Index has hardly improved…now at a reading of 9. Extreme Fear….Panicky

VRA Bottom Line: It’s days like this that are important in determining whether or not the final lows are in place. If the markets can overcome this bad news…and Targets news is a shock to Wall Street analysts (not exactly sure why after Walmart from yesterday)…and still find a way to rally higher, it will send chills down the backs of those short the market and/or heavy in cash. It’s not the news that matters most, it’s the markets reaction to that news.

This is why we own our VRA 10 Baggers. Companies with excellent mgt teams, solid finances and bright futures (in the right sectors) that must be bought during market insanity.

You can find my focus stocks right here.

And, I still think the lows are in….at least for most stocks.

Here’s todays VRA Vid Cast:

https://rumble.com/v15bbod-vra-midday-stock-market-commentary-may-19-2022.html

Wayne Allyn Root

Our great friend WAR has been saying, like us for close to 2 years and the start of the plandemic, that Team Biden (O’Biden, WEF-communists) are practicing “intentional destruction”.

This is WAR’s GETTR post from yesterday….Wayne nails it. When will our R elected officials wake up??

Must watch clip. George W Bush just accidentally ripped his mask off in front of the whole world. Freud would like you all to know this is the greatest example of a Freudian Slip that’s happened in our lifetime. The unconscious is always letting you know what needs the light.

Evil incarnate…that’s who this man is. As you watch the clip, realize that every point he makes is about the US, rather than Russia. Political prisoners (1/6), rigged elections (2020) and the brutal and unjustified invasion of Ukraine (as Bush says correctly, Iraq).

Video:https://twitter.com/sahilkapur/status/1527092111195226114?s=12&t=oX-GTLke9DlYfxDOdIA-SA

Until next time, thanks again for reading….

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast