VRA Weeekly Update: Peak FED? VRA Market Internals Point to Higher Prices. Ed Hyman Looking for Blowout Q3 GDP.

/Good Friday morning all. Markets were less than enthused by what they heard from J Powell and the FED this week. On the one hand they said they would keep rates near zero through 2023…that’s been the case for all of 2 of the last 10 years…but on the other hand Powell struggled to explain why “many” of the FED’s existing programs meant to support the economy during coronavirus insanity have barely been used. And Powell made it very clear, time and again, that unless DC gets their act together and provides targeted economic stimulus, the path forward could be fraught with risk.

Not a good day for the FED or for J Powell. His stammering and hesitation came across like guesswork. Not what the markets wanted to see.

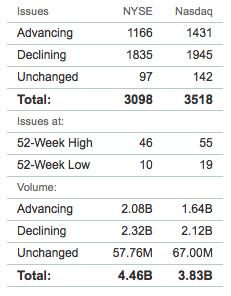

On the heels of this disappointing FED meeting and Powell presser, the markets looked like they wanted to crater at the open yesterday. Even as the Nasdaq finished -1.3% and S&P 500 -.84%, we simply aren’t seeing VRA market internals that point to a steep decline in the making;

Advance/decline, barely 1.5:1 negative. Up/down volume just barely negative with new 52 week high/low coming in a positive 101 to 29.

These readings are more similar to what we were seeing roughly 3 weeks back, when the markets were closing up 1% on the day even as the internals were negative…our advance indicator that market weakness was just ahead. But again, even as we’ve seen weakness over the last couple of days, the internals are not confirming that significant weakness is likely. This is bullish.

This week, we also saw Homebuilder confidence hit 83, a new all-time high. Housing is our single most important leading economic indicator and continues to lead the US economy out of coronavirus inanity. In addition, over the last 48 hours we’ve seen all time highs in the transportation index, the rails and in materials. None of this would be happening unless the economy was powering ahead at a much greater rate than the vast majority of Wall Street economists believe.

We prefer the work of Overcore’s Ed Hyman, who for the last couple of months has made the strong case that the US economy has entered a new economic expansion, and that on average they last 8 years with corresponding gains in the S&P 500 of 250%. $11 trillion in global monetary and fiscal stimulus has to go somewhere…it’s going into risk assets.

In yesterdays update Hyman raised his Q3 GDP estimates even further, looking for a GDP “Blowout” of +35%, which puts Hyman among the most bullish economists in the country. He’s been spot on in ‘20.

Hyman: “The FedEx earnings report for the quarter also makes us realize that S&P 500 Q3 earnings will also be a blowout. The Q3 consensus for S&P 500 earnings is $130. The quarter is more likely to be $145.”

With transportation (trucking, rails) and housing leading the way…with each hitting all-time highs this week…the signs continue to point to a V-shaped recovery. We’re solidly in Ed Hymans corner.

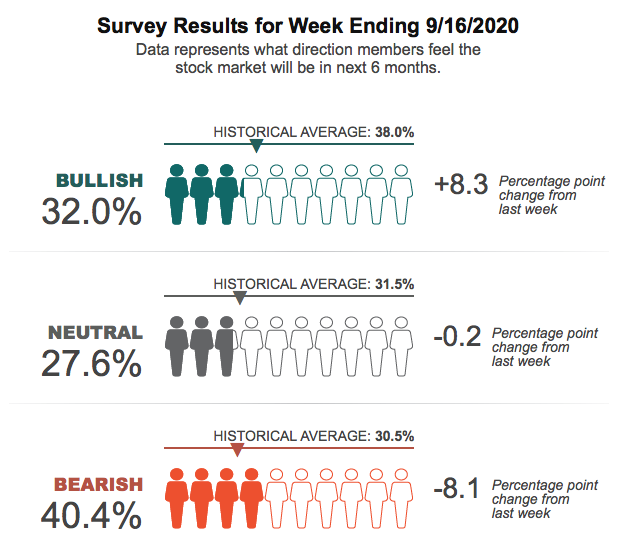

Weekly Sentiment Surveys

AAII out this week with a solid jump in bulls at 32% (+8.3%) while bears fell to 40.4% (-8.1%). Investors continue to be skeptical of our new bull market…exactly what we want to see in our sentiment surveys. Once investor euphoria rolls in…and in every major bull market its the one thing you can count on…we’ll start becoming more defensive. Nowhere close today.

Fear and Greed Index readings are back to 56 (Greed), down from a reading of 76 (extreme greed) last month.

Until next time, thanks again for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/17 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast