VRA Weekly Update: Do Not Sell in May and Go Away. Fearful of Higher Interest Rates? We Should Pray for Higher Rates.

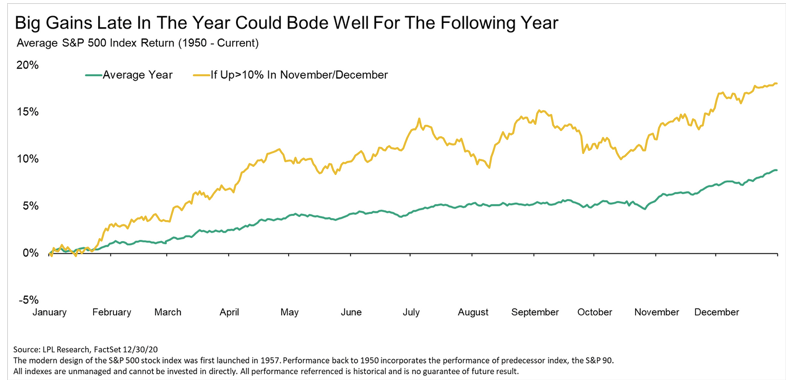

/Good Thursday morning and welcome to the first trading week of May. As we have covered in these pages each year, from 2003 on, May to October are the markets worst 6 months of the year with >90% of all stock market gains occurring from November to April.

Read More