VRA Update: Stock Traders Almanac - The Legendary Yale Hirsch. Santa Claus Rally and More.

/Good Thursday morning and a Merry Christmas eve. Note; today is a half day of trading…we’ll see you back here Monday morning (and there will be no VRA Podcast this afternoon).

Solid day of trading yesterday until the final few minutes when Trump vetoed the $740 billion (annual) defense bill unless section 230 (protection of big tech/social media co’s from lawsuits over censorship) was removed, followed by threats to also veto “porkulus”, unless congress raises direct payments to $2000 from $600. Any/all of these vetoes could force congress to return to work next week. Futures are slightly higher this AM.

Stock Traders Almanac — The Legendary Yale Hirsch

Many years ago (mid 80's)when I first began working in New York, I was invited to a private dinner at the infamous “Tavern on the Green” and Wall Street legend Yale Hirsch was one of about 8 people at our table. I was 26 years old at the time and had no real understanding or appreciation of Mr. Hirsch and his lifetimes work of changing the way “real” market research was practiced.

Hirsch founded/published “The Stock Traders Almanac”. In short, Hirsch discovered that seasonal market patterns tended to repeat themselves, over and over and over again. You’ve heard us talk (each year) about the “January Barometer”, “Sell in May and Go Away” and the “Santa Claus rally”…each of these came directly from Hirsch’s work.

We spent hours listening to Yale talk about his research. At this time, no one was doing anything like this. Yale was the father of investment data research and a truly extraordinary man. A gentleman in every sense of the word. His son Jeff Hirsch runs the Stock Traders almanac today and still sees his father daily. Still in NYC, obviously.

Yahoo Finance has a good piece out on Yale’s work this morning, specifically on the Santa rally:

“Most long-term oriented investors don’t really need to spend much time obsessing over what may happen in the stock market over extremely short periods of time.

Nevertheless, it can still be fun to look back at history and see what kinds of patterns and averages emerge.

Which brings us to the Santa Claus Rally.

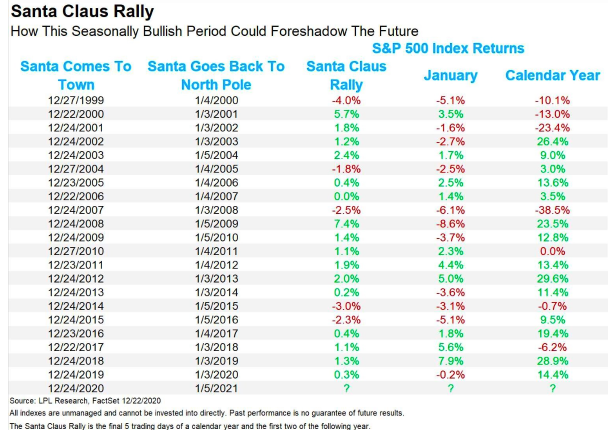

Coined by Yale Hirsch, founder of the Stock Trader’s Almanac, the Santa Claus Rally describes what happens over the last five trading days of the year and the first two of the next.

What makes it so special?

“Well, there isn’t a single seven-day combo out of the full year that is more likely to be higher than the 77.9% of the time higher we’ve seen previously during the Santa Claus Rally,” LPL Financial’s analysts observed after analyzing data going back to 1950. “Additionally, these seven days are up an average of 1.33%, which is the second-best seven-day combo of the year.“

Is there a reason why this happens?

“Whether optimism over a coming new year, holiday spending, traders on vacation, institutions squaring up their books before the holidays — or the holiday spirit — the bottom line is that bulls tend to believe in Santa,” says LPL’s Ryan Detrick.

Also based on the Stock Traders Almanac, here’s what we know about what 2021 and what might have to offer, investment wise…all based on “post election years”

Historically, here’s what has happened in post election years. Hirsch calls it “Post Election Year Fears”:

1) From the Civil War, to WW1, WW2, to Vietnam and 9/11 (2001), each war/event began in post election years.

2) Since 1929, ten major bear markets have begun, in post election years.

3) 8 of the last 11 recessions have begun, in post election years.

Whether Trump or Biden (the next 3 weeks should be very interesting), after Christmas we’ll get into the data of what Yales work shows most typically happens in the first year of new presidency or first year of second term.

Thanks again Mr. Hirsch. You are one of the all-time greats. I’ll reach out to Jeff today and get his dads views on this massive election fraud are (Yale and Trump were NY buddies).

Until next time, thanks again for reading…

Merry Christmas everyone!

Kip, Tyler and everyone at the VRA

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/17 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Also, Find us on Twitter