VRA Weekly Update: W.A.R and T Herriage. Coinbase IPO. Meme Stock Short Squeeze, Part 2. Early, Rising Inflation and Rates, Hyper Bullish For Stocks.

/Good Thursday morning all. Last night Tyler joined our great friend Wayne Allyn Root on the Wayne Root show, talking bull market of markets, the liquidity/stimulus nearing and why “every” business owner should submit their apps for this new round of PPP. Here’s the link: https://soundcloud.com/user-640389393/tyler-herriage-live-on-war-now-with-wayne-allyn-root-022421

Hitting the wire this morning that the Amazon of the crypto-world, Coinbase, will soon file for its IPO (actually a direct listing, like Spotify did). If you’ve been here for a while you’ll know I’ve been eagerly awaiting the opportunity to add Coinbase to the VRA Portfolio. I doubt it will matter where they price the deal and where it starts trading. This is that company. $1000 investment could turn into $1 million inside of 30 years. This is the one you buy and never sell. We’ll alert you in advance of Coinbases direct listing.

BIG move higher in the markets yesterday. Our extreme overbought pause looks to be over, certainly in the sectors/holdings we care most about. Yesterday brought our second Dow Theory buy signal inside of 1 week, as both the Dow Jones Industrials and Dow Transports hit ATH together. Technically, last weeks Dow Theory buy signal is all that matters. The US and global economy is on fire. 8–10% full year GDP growth is in the cards. 8% GDP growth has not occurred in the US since 1944. This market is headed much, much higher. We are in that 2010 time frame, just a year after the market bottomed during the financial crisis, but this time we have a macro set-up thats set to propel both the economy and markets into the stratosphere. Listen to the permabears at your own peril. Granted, these long term bears may sound smart, but its only an illusion. Permabears are not investors. They are list building clickbait artists that prey on the emotions of investors. That is their business model.

The short squeeze meme stocks are flying again. GameStop and AMC are soaring again. AMC hitting $11 this AM. GME,really hot, hitting $160 this AM. Both have major short positions, most of it via illegal short sells. Were it not for the Biden Admin, with Janet Yellen acting as point person, with scum firms like Robinhood and their hedge fund brethren, AMC would have likely hit $100/share on the previous squeeze. I have no real thoughts on GME but I know that with 70% of the float sold short, as it is today, anything is possible. We’ll alert on when to sell positions in AMC. With approx 1/3 of the float sold short, like GME, anything can happen here. But we will be selling AMC on this go round. Next up, a short squeeze in silver. It’s coming…can’t you feel it?

Market Update

We are seeing a bit of a rotation is occurring in the markets as travel related stocks are joining the existing move higher in the commodity/energy space. The market cap for energy stocks is equal to that of Bitcoin. Energy stocks are still incredibly cheap here. AMC Theatre (AMC) is catching a decently solid bid as well, as NY Governor Andrew “killer” Cuomo announced yesterday that theaters will reopen at 25% capacity on 3/5. 20% of AMC’s float is sold short. Coronavirus insanity ended, as far as reality and the markets were concerned, in the 2nd quarter of 2020. The question now becomes…and its a question smart money investors are asking themselves right now….is this a “buy the rumor and sell news” market event? Should we be selling stocks now that it’s beyond clear that the worst of cv insanity is behind us.

We see the answer as crystal clear…US and global stock markets are headed much higher. This is a structural move higher, driven by insane levels of global liquidity…with up to $7.9 trillion more in US fiscal stimulus if the Biden admin gets their way (who exactly is going to stop them) and an economic and earnings recovery the likes we’ve not seen in our lifetimes. Full year GDP growth could top 8–10% this year. The last time GDP rose 8%? 1944 and WW2. S&P 500 earnings could top $210/share, which would reduce the current p/e multiple for the planets largest and most important equity index from 30 (year end ’20) to approx 19. Not cheap, necessarily, but certainly on the cheap side with what looks to be up to $30 trillion in fresh global stimulus by year end. Two primary factors move the markets; liquidity and corporate earnings. Everything about this combo points to a melt-up environment.

At some point there will be a price to pay for these insane levels of stimulus but as Tyler pointed out in yesterdays VRA Podcast in the lead up to Weimar, Germanys hyperinflationary implosion the shock to the economy was largely unfelt for “years”. The melt-down, featuring annual inflation of 10 million percent, occurred in the final year. We continue to believe that now is the time to be aggressively positioned. A solid strategy is to reinvest half of your profits back into new positions while taking the other half and purchasing physical gold and silver. At the end of the Weimar Republic, a single ounce of gold was enough to purchase prime downtown real estate. We’ll cover this strategy more going forward. We cannot recommend this enough; the monthly purchase of physical gold and silver.

The biggest current concern, certainly of this new wave of bears, is the impact on the markets from higher interest rates and inflation. At some point, we’ll no doubt share in their concerns…but that time has not yet arrived. Early rounds of higher rates and inflation aren’t just bullish for stocks, they are in the wildly bullish cap.

Rising Treasury yields might have investors concerned about highflying tech-related stocks but history shows that when yields are rising “for the right reasons,” tech shares and cyclically sensitive stocks tend to thrive, according to Raymond James.

The right reasons are “improving economic growth and a ‘healthy’ rise in inflation,” said Larry Adam, chief investment officer for the private client group at Raymond James. And those reasons have driven the yield on the 10-year Treasury note to just shy of 1.4%, or about their highest in a year. Yields also are coming off their largest weekly rise in six weeks.

“Since 1990, during rising rate environments, the more cyclical sectors have outperformed,” Adam noted. “The average annualized outperformance relative to the S&P 500 is largest for the tech, consumer discretionary and industrials sectors — three of our preferred sectors,” while higher dividend-yielding sectors like utilities, real estate and consumer staples tend to underperform.

Adams also argues that inflation not only is unlikely to “short circuit” the rally, it may be a welcome development for stock-market bulls.

“When analyzing how the S&P 500 performed under varying levels of core inflation, equities performed above-average in an environment where core inflation was between 1–4%. Inflation at those levels is generally considered healthy when it coincides with improving economic activity. The reason is because companies have pricing power, allowing them to lift prices, while also reaping the benefits from productivity gains, which helps to boost earnings growth.”

When core inflation runs between 1% and 3%, the average performance relative to the S&P 500 on a year-over-year basis has been strongest for the technology (+6.8%), healthcare (+2.3%) and consumer discretionary sectors (+2%).

VRA Bottom line; as long as VRA Investing System readings hold up as solidly as they have during this extreme overbought pause, we will remain aggressive buyers on pullbacks.

What would get us concerned? Negative volume readings of 8:1. SMH (Semis) losing 5% on a single day. Until and unless these readings occur, extreme overbought pullbacks are healthy.

Until next time, thanks again for reading…

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

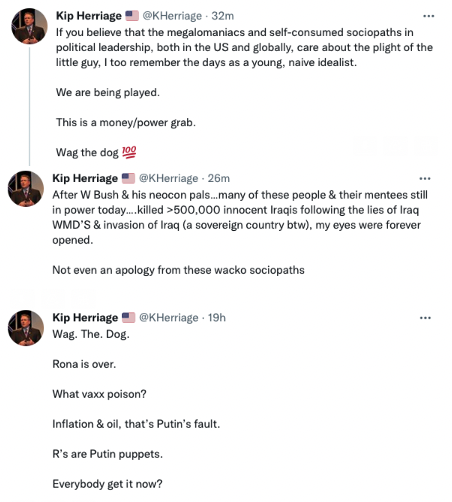

Also, Find us on Twitter