VRA Weekly Update: That 1995–2000 Vibe. Collusion in Precious Metals. $1000 Silver During Commodity Supercycle.

/Good Thursday morning all. Earnings continue their solid beats, both on the top and bottom line, as it looks increasingly clear that we are early in the economic and earnings recovery cycle. If we’re right, pullbacks going forward will continue to be shallow and short-lived.

This is not the time to take profits. This feels like 1995–2000. If I had known then what I know now, I would have had my clients using leverage (margin), would have focused on co’s with exposure to tech and to value stocks that were historically undervalued, with the realization that a quality management team matters more than everything else combined. The markets reward leadership.

Of course, back then if your company name had dot.com in it, you were almost assured that your stock price would soar. One of the co’s I helped take public (Edge Petroleum) called me into a board meeting a year after their IPO because certain board members wanted to change the company name to Edge Petroleum Dot Com, an idea that only sounded good for about a half second (my advice was to pass on the idea…which thankfully they did). But that was the level of euphoria about the markets…co’s entertained ideas they otherwise would never had. We’ll get there again…just not there yet. Kind of like Tesla buying Bitcoin. Here. We. Go.

As much as this might feel like a bubble, we’re yet to enter that phase for this bull market. It might be beginning, but with $20 trillion in fresh global liquidity (fiscal and monetary), surging corporate earnings and record amounts of global money supply growth, “crazyville” lies just down the road. More than anything, we think the markets begin to wake up to the “high” probability of the return of inflation. Remember, early inflation is mega bullish. And the Fed has stated early and often that they will let inflation run hot.

And as always, with the return inflation; we want to own gold, silver, copper, miners…and essentially all commodities…with major exposure to oil/nat gas and E&P stocks. Most certainly when real rates remain deeply negative, as they do today.

Market Update

Even as the market was a bit soft yesterday, market Internals remain solid. Near 2:1 positive Nasdaq volume. Flat elsewhere, but check out new 52 week highs/lows; 860 to just 18.

Yes, all of these SPAC’s are causing some havoc in the internals, as SPACS have common stock, units and warrants all being reported…it skews the readings…but we prefer not to rationalize market indicators.

We think the key point here that many are missing with SPAC’s and reporting is that its also a two-way street. On bad days, we should be seeing exaggerated negatives in the internals…and that has simply not happened so far.

Bottom line: these ongoing and consistently positive readings in the internals remain as a bullish indicator, both short and medium term.

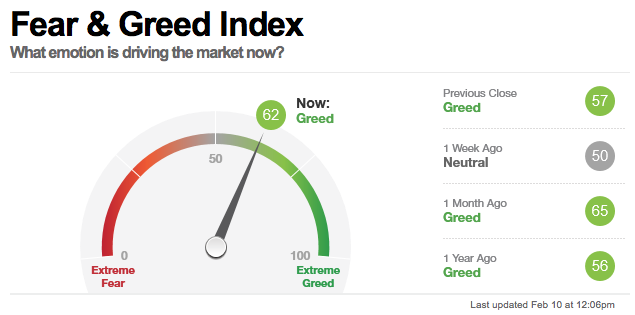

The Fear & Greed Index remains modestly low with a reading of just 62 (greed). Still not seeing readings anywhere near euphoria in our sentiment readings. We find that both interesting and a bit remarkable. Even with this move higher, the public remains skittish on this market. As contrarians, we like that.

Liquidity

Our friends at Evercore (they’ve nailed the economy and markets from the 3/23/20 lows) are pointing out two major themes that we see few others reporting on.

First, money supply is in absolute beast mode, all over the world. In the US, m2 money supply growth is up 26% year over year, with total nominal growth of $20 trillion (just wow). Globally, check out these money growth figures; Eurozone +12% y/y, totaling $17 trillion. China, +10% y/y and a massive $34 trillion in m2 growth. In the UK, 12% y/y m2 growth, totaling $4 trillion.

And here’s a stunning report on consumer net worth (CNW). CNW is on track to be up almost +20% y/y in 1Q. Evercore’s econometric analysis finds that CNW leads GDP growth by a half year. A +20% increase in CNW lifts GDP growth by roughly +3%, all else equal, meaning that for full year, 5%+ GDP growth is now a very real “likelihood”.

In my career, where I’ve followed/recommended gold, silver and the miners, this is the most confident I’ve been for this group. Massive levels of liquidity and currency inflation (debasement) demand our ownership. Similar to the 3 year period of late 2008–2011, this is a market that should reward both equities and precious metals/miners. Just remember that during that 3 yr period, the S&P 500 rose some 43% while GDX (miner ETF) soared 244%.

And what does a stock market that is on fire mean going forward? Are we due for an overbought sell-off in the near future? No…in fact, the move higher should pick up speed.

We think we’re in about inning 4 of this melt-up run. And as much as we like growth stocks, especially VRA Portfolio growth stocks, we are head over heels in love with precious metals and miners. Ok, I love them a bit more than Tyler…he’s all about the purity of growth stocks…but I’m a life-long believer in physical gold, silver and miners. And they’ve yet to have the bull market they’ve deserved to have. Why is that? Because the banking and fiat currency cartel have kept their prices suppressed.

Great piece on this subject from industry veteran Ted Butler. Not only has the price suppression scheme for gold and silver been uncovered, but the short squeeze that awaits silver will be one for the record books. When you hear people talk about $1000/oz silver, the evidence in this piece is why;

https://silverseek.com/article/cats-out-bag

“Decades of price suppression and manipulation have brought us to the sad state where the sellers can’t allow higher prices because of the large size of their silver short positions. This is the only possible explanation for the absolutely bizarre circumstance of the most physical silver ever being bought in the shortest time without any significant impact on price. If anyone can offer another explanation for how so much silver could be bought with little if any price reaction, please fire away.

Remember, we’re talking about the basic law of supply and demand. When demand suddenly exceeds supply, prices must rise sharply. Period. Silver is a market where 2.5 million ounces are produced and consumed each day, 7 days a week, 365 days a year, year after year. For buyers to suddenly buy 110 million ounces in days and for there not to be a violent price surge is impossible. This is the ultimate proof that silver is manipulated in price.”

And this excellent piece this morning from FT this am on a new commodity super cycle thats building;

Investors Set for Commodities Bull Run Spur Talk of a Supercycle

https://www.ft.com/content/27086ad8-bc84-4e2e-9195-91880fa6916f

We see hard evidence that the bull market of bull markets is building today in precious metals and miners.

Across the board, commodities are up 50% + inside of one year. Oil, as usual, leading the way, but silver is surging higher as well, after putting up 54% gains in 2020.

Just yesterday, copper broke out to new 8 year highs.

Until next time, thanks again for reading…

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Also, Find us on Twitter