VRA Weekly Update: Multiple, Important Bases to Cover. Wall Of Worry, Bull Market Move Higher Directly Ahead.

/Good Thursday morning all. Multiple important bases to cover this AM.

1) Yesterdays sell-off took place on 90% downside volume in NYSE. Old school market watchers look for these as a signal of selling capitulation. We will need to see a corresponding upside day in order to validate.

2) Our building wall of worry is clear to anyone paying even 1/2 attention. One of these bricks is the lack of further economic stimulus…but that could quickly change, starting tomorrow, with a House vote to free up $134 billion in PPP stimulus money. Should this pass…and it’s a rebuke to Nancy Pelosi as its being led by Dems…not only will it be a serious blow to Pelosi’s leadership but could quickly lead to passage of our next major round of economic stimulus. Big and bullish.

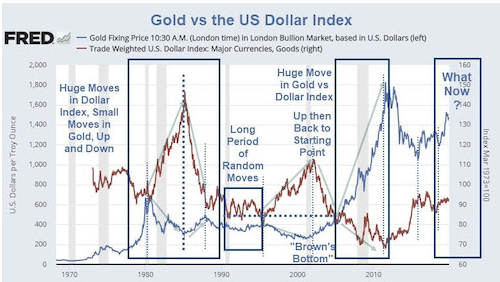

3) The pop higher in the US dollar caught many by surprise. Yesterdays volume in UUP (Dollar ETF) was the 2nd highest in a decade, indicating massive short covering. While we wouldn’t be surprised to see the dollar move higher in the short term, it’s this 10 year chart of USD (below) that we believe matters most. That blue trend line served as “support” for the dollar for the entirety of the last decade. Once the dollar broke this trend line (May), you likely remember the throng of dollar bears screaming “that’s it…the USD is about to lose its global currency reserve status! The dollar is dead!!”.

You may remember that we mocked dollar permabears at the time…it’s highly doubtful that the dollar will lose its reserve status, in our lifetimes. Now, many are scrambling to cover their dollar shorts. If we traded currencies, we would not. We would look to add to USD shorts. Because now, that supporting trend line has turned into what should be significant resistance. It’s essentially the basis of technical analysis (once a major trend line is broken, the strength flips in the opposite direction).

VRA Bottom line on the USD: in the short term its move higher should continue. But once USD hits the trend line (approx 96), heavy selling pressure should send it lower once again.

4) USD strength has hit US dollar based commodities (gold, silver, oil, etc). As it pertains to gold, this move lower is in part due to the wrong-headed notion that USD and gold are tightly correlated….but that’s (mostly) a myth, as seen in the chart below (going back to 1970). Yes, in the short term, major moves in USD impact the price of gold, but the longer term correlation is less than 60%. We look for the next pivot in gold to take place in the $1844/oz range. At this point, gold and the miners will also be hitting extreme oversold on the VRA System. We’re getting very close now. I can tell you in the near future, in Parabolic Options, we will be buying calls in the miners.

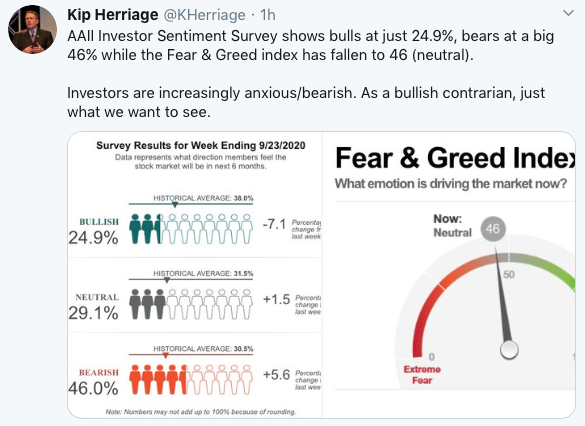

5) Investor Sentiment Getting (More) Bearish

Last nights AAII shows bears at a big 46%, with bulls sinking to 24.9%. Fear and Greed Index down to 46. As bulls (that’s us), investor sentiment is setting up another “strong” buying opportunity, just as the VRA System shows readings nearing near-perfect buying opps on our broad market indices.

6) Speaking of gold, did you see yesterdays news that JP Morgan…the all powerful and criminal banking cartel…has agreed to a $1 billion settlement to end their metals rigging investigation. As usual, JP Morgan gets off light. It’s been our hope, since Trump was elected, that the decades long criminal manipulation of gold and silver prices would come to light. If you and I did this we would be locked up like Madoff. Nothing, in todays global landscape of cabals, is more powerful than the banking/fiat currency cabal. A pox on humanity in our view.

— -

Stay frosty….we are looking to add position(s) in the VRA Portfolio.

Until next time, thanks again for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/17 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast