Coordinated Momentum, Liquidity Breakouts Continue. VRA Market and System Update.

/All eyes are on the G20 and Presidents Trump/Xi meeting on Saturday. Earlier this week, Treasury Secretary Steve Mnuchin stated that “we’re 90% of the way there”. I wished he had said nothing of the sort.

Our view is unchanged. We’ll be surprised if a trade deal is completed…but we will also be surprised if the meetings are a complete disappointment. Both sides will be heavy with the spin.

Here’s what really matters; the markets likely already have this figured out. We’re going higher…much. New all-time highs will beget more new all-time highs. And, we WILL break higher from this triple top in both the S&P 500 and DJIA.

If you’ve been with us for a while, you know that we’ve expected a full on momentum/liquidity fueled breakout in not only the equity markets (domestic & global) but also in assets like precious/base metals, oil/gas and Bitcoin. We are witnessing coordinated momentum breakouts, fueled by a staggering level of global liquidity. VRA Investing System readings (10/12 Screens bullish), along with rock solid market internals, continue to confirm our beliefs.

To crush Mr. Market, we must: a) be on the right side of major moves in the broad market, b) be in the right markets/sectors/stocks and c) be positioned for maximum leverage and exposure.

Bearish Sentiment Continues to Shock

The fact that this breakout is occurring at the same time that investors (both individual and institutional) are across the board bearish, only helps to cement our bullish, contrarian case. When everyone is going left, we want to go right.

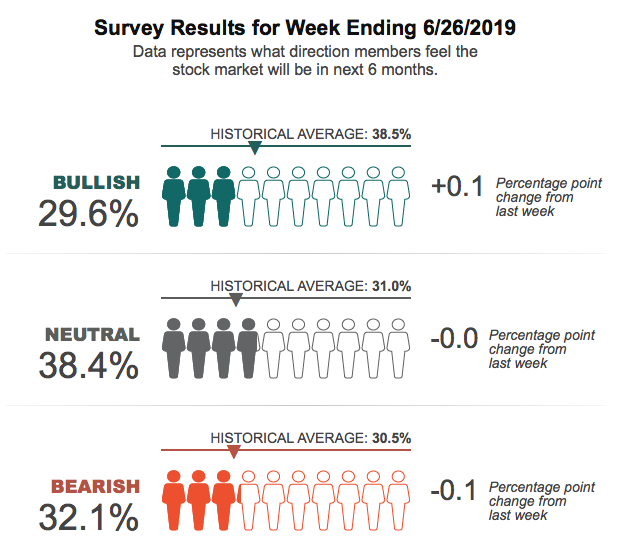

AAII sentiment continues to be bearish. Stunning! 29.6% bulls to 32.1% bears. 7 weeks in a row that bears have outnumbered bulls. Again, highly bullish for our markets. A contrarians delight.

What’s happening now…and we see this as just the early innings…is the beginning of a multi-year move higher that will take the Dow Jones to 50,000+, gold to $3000+ and Bitcoin to ? (who knows…but much higher) by the end of Trumps second term. If Trump were to lose in 2020, the markets will crash lower…and we will quickly flip from bullish to bearish. Not hyperbole…not a political statement…just a reality of the significance of having a president that knows what it takes to grow an economy. The Trump Economic Miracle is playing out right before our eyes.

The free market capitalism/populism/nationalism movement actually started before Trump. First up, Poland and Hungary acted in defiance of the EU (saying no to forced migrant placement)…then they elected strong, country loving, populist presidents. Then Brexit…then Trump…followed by populist leaders that were elected in Italy, Czechoslovakia, Brazil…even Australia is kicking globalism to the curb.

The economic significance of the VRA’s bullish macro case continues to be underestimated. In a world driven by free market capitalism…lower taxes, less regulation and smaller government…the entrepreneurs animal spirits are unleashed. Entrepreneurs create high paying jobs. They replace the power base previously controlled by big government, globalist elites. We see this as a long term, hugely bullish global macroeconomic & geopolitical development that could result in the strongest global economy of our lifetimes.

GOLD & MINERS UPDATE

We continue to be long and strong gold and miners. As seen in both gold and GDX below, they sit at extreme overbought levels, but the breakout is very, very real. Keep buying pullbacks. We’ll add NUGT soon. Over the last month, gold is +13% and GDX is +29%. The leverage is in the miners…and the miners are leading the way higher. Again, exactly what we want to see. Over the same time frame, our top gold pick is +48%. A monster move higher is directly ahead.

Lastly, I’ve received the following story from many of you this week. Merrill Lynch caught criminally manipulating precious metals. Once the manipulation of precious metals comes to an end, parabolic moves higher await.

Until next time, thanks again for reading…have a great weekend.

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/16 years.

Join us for two free weeks at VRAInsider.com

Sign up to Join us daily for our VRA Investing System podcast