Locked and Loaded. Massive, Multi-Year Breakout Nearing. We Must Be Long and Strong.

/Good Thursday morning all,

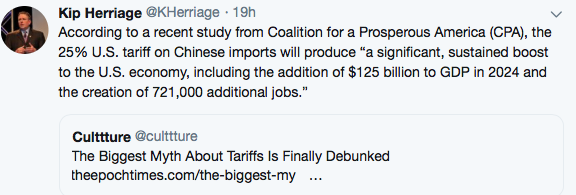

The move higher in stocks continues on the heels of the best week in ’19 and news of Mexico immigration/trade deal. Next up, G20 and Trump-Xi meeting, June 28–29. Does a US-China trade deal even matter? Not according to this new study…

But let's be honest…US-China trade deal is not really about trade. Never was. We’ve covered this 100’s of times since the “trade war” kicked off in January 2018. This has always been about Trump calling out China as the worlds biggest economic cheater. Not a close second. And you bet your butt it matters…here’s how we know, with certainty.

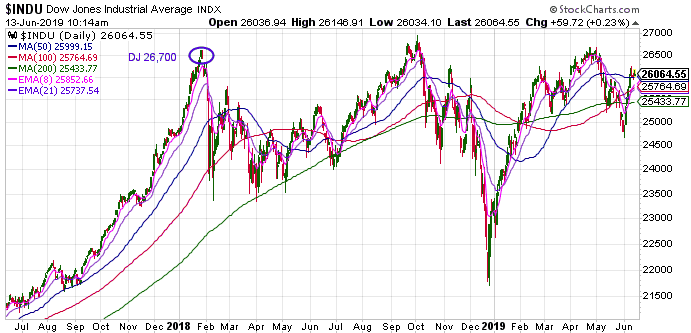

The Dow was coming off of 26,700….all time highs…when Trump first announced tariffs. Today, the DJ sits at 26,000. 700 points lower than 18 months ago. We’ve been in a massive trading range ever since, which has cost us the gains in our VRA Portfolio that we would have otherwise had. Because…and I believe this with every fiber of my being…had Trump simply looked the other way (like every president before him) the DJ would be in the 35,000 ballpark today.

But Trump isn’t like our previous presidents. Trumps in this for the long run. Trump will not stop until US GDP is back to the 5% range. Laugh if you will…bet against this man, if you will…but I am 1000% in Trumps corner…and I am an unapologetic trade hawk. Now is the time to force change in China.

In the event that you are new to the VRA, know this; the Trump Economic Miracle is only now beginning to kick in. We are perfectly positioned to crush Mr. Market, as the DJ hits 35,000 by end of 2020 and 50,000+ by end of 2024.

Let’s review the VRA’s major macro reasons to be ULTRA bullish.

ONE: Trump and the Trump Economic Miracle. Like Reagan before him, Trump knows…at the DNA level…that free market capitalism is the only way to build an economy. Cut taxes and regulations, empower the entrepreneur, then get the hell out of the way as job growth explodes, taking GDP with it. Capitalism, as the ultimate socialism destroyer. The US economy is on fire…just getting started.

TWO: The world is kicking globalism to the curb. Hard. Populism/nationalism is returning with a vengeance. Die hard, globalism. Yippee ki-yay, mofo. The world was awash in the epic failure of globalism for 3 decades. But then it all began to change; Hungary, Poland, Brexit, Trump, Brazil, Italy, Australia. The trend is clear. Elite control of open border, low wage, low GDP government is being replaced everywhere we look by the free market capitalism of populism/nationalism. True competition. Make _____ Great Again. Let the best country win. The end result? A global bull market on steroids…for possibly decades on end.

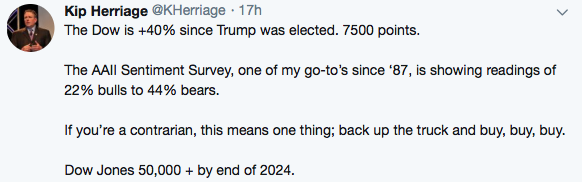

THREE: Structural abnormalities compel us to be ALL IN. The DJ is +40% from Trumps election…so how is it that everyone is bearish?? In my career, this is among the most bizarre readings I’ve ever seen. It’s also HUGELY bullish. And know this; the bulls will return. AAII bullish percentage will get back to 50–60–70% bulls. But at this rate, the DJ might hit 35–40K first. These readings make me salivate at the upside potential. Folks, this is why we have remained aggressively long….along with 9/12 VRA Investing System Screens remaining bullish.

And this structural abnormality….as we’ve talked about for more than two years, buybacks and M&A continue to rip free trading shares from the market. Supply and demand. Economics 101. Stocks MUST go higher.

VRA Market & System Update

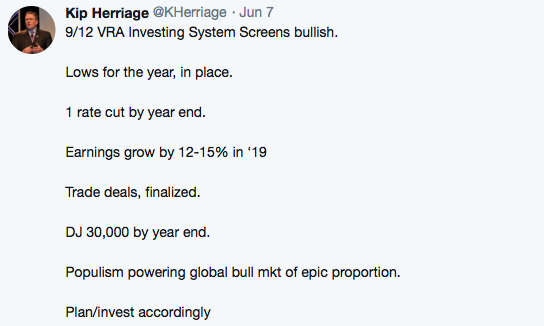

We aggressively added to VRA Portfolio positions last week…the same day we told you that the lows were in place for the year. They are. The melt-up is on. Tech just had their best 5 day stretch in 7.5 years. This morning, the move higher continues. Asian markets soared this week…the upcoming G20 and possibility of US-China trade deal…its “buy the rumor” time.

Australian markets hit 11.5 year highs overnight. Electing a pro-growth, capitalist/populist leader, kicking far left globalism to the curb…what’s not to like? And trust me on this folks, Australian markets would not be soaring if China’s economy was falling off a cliff. No way in H.E. Double L. As much as I’ve lambasted China for their economic cheating, it doesn't mean there isn’t great value there. There is. It’s why we own and continue to add to positions. Once China bends the knee to Trump, look out above. The fact that through all of this “trade war” (its not, never has been) drama, how interesting that the Chinese market (Shanghai Stock Exchange) has remained above its 200 day moving average, in confirmed bull market territory. As much as I like the US markets, a parabolic move higher awaits for Chinese stocks.

And what would a bull market be without a wall of worry to climb? This week the news services are running this story, pretty much everywhere. Be afraid…be very afraid! A recession could drop the market 30%!

Reality check; the unemployment rate is 3.6%, there are 1 million more jobs available than people to fill them and GDP has grown 3.1% over the last 12 months. Negative news clickbait….gotta love it. But again, bull markets love climbing a wall of worry. We want to see as many of these articles as possible…along with “Trumps going to crash the economy” and “Chinese tariffs will send consumer prices soaring”. The more of these permabear, Trump-US hating stories, the higher the market will soar.

Remember last weeks AAII Sentiment Survey reading of 22% bulls and 44% bears? And the Fear & Greed Index reading of 37 (fear)? It’s “recession” articles and fear mongering, like the one today, that keeps investors afraid and out of the markets. Just remember, the AAII survey WILL get back to 50–60–70% bulls. The DJ may hit 35,000 first…but it will happen.

Until next time, thanks again for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/16 years.

Sign up to Join us daily for our VRA Investing System podcast

Learn more at VRAInsider.com