4.1% Second Quarter GDP, Strongest Since 2014. Q2 Earnings Growth Hitting a Massive 27%. Trump Strikes a deal. VRA System Approach

/GDP came in at 4.1%, just a hair below consensus estimates but still the best quarterly GDP growth since 2014. Two things stand out as I read the report quickly; 1) exports added 1.06% to GDP, the highest amount since 2013 and nonresidential business investment grew by a big 7.3%, which should bode well for Q3 GDP.

We’ll take it. I wanted 5%…but the last thing we want to see is Q3 GDP come in weak. If my read on this report is correct, the current 3.1% GDP estimate for Q3 will prove to be too low.

If you were not able to join (the great) Wayne Root and I last night, here’s that interview. Thanks again for having me on Wayne. One of the finest people I’ve ever had the privilege of knowing…absolute salt of the earth guy!

https://soundcloud.com/user-640389393/kip-herriage-with-wayne-allyn-root-on-war-now-july-26-2018

Q2 Earnings Scorecard. What Happened to “Peak Earnings”??

As of last night, 246 of 500 S&P co’s have reported earnings with what can only be called “stunning” results. 86% of co’s reporting have beaten estimates with avg EPS growth of 27.1%. Folks, if you remember all of the perma bears saying “sure, Q1’s earnings were great, but this will represent PEAK earnings”! Well, the perma bears have been proven wrong again. Not only is Q2 shaping up to be fantastic but to date they’re even a full 2% better than even Q1’s results!

Remember, the current P/E multiple on the S&P 500 is 16. If earnings continue to grow at a 20% rate, by the end of Trumps first term some simple math tells us that by the end of Trumps first term (at minimum) we can expect both the S&P 500 and Dow Jones to rise by (at least) 50%, putting the Dow Jones at 38,000 (assuming this low 16 P/E multiple stays in place).

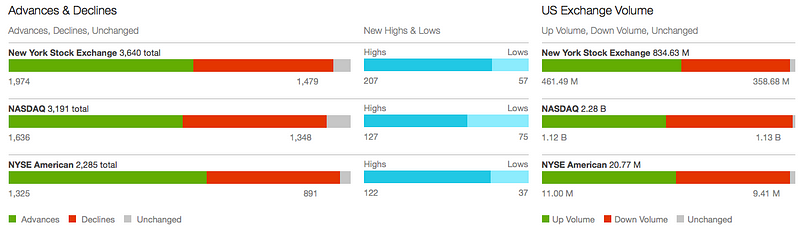

And take a look at yesterdays internals. It’s hard to overstate exactly how positive readings like this are, especially in the Nasdaq. Consider that the Nasdaq closed down a big 80 points (1%), on the back of Facebooks faceplant, but Nasdaq advance/decline was still positive by nearly 300 stocks. I’ve studied the markets internals for 3 decades and there is simply no other way to interpret this action but “bullish”.

Trump Strikes Deal with the EU

If you’ve been with us for any length of time at all, you’ve heard us call “bullish*t” on each and every frenzied attempt by the MSM to scare the hell out of investors over “Trumps Trade Wars”. Yesterday we learned that Trump and the EU have reached an agreement that could ultimately lead to “true free trade” without tariffs or trade barriers of any kind. If you’ve been listening to Trump, this did not surprise you. On MANY occasions he’s said just this; his goal is to be “the ultimate free trade President”.

If you’re confused by any of this, I’ll encourage you again to read “The Art of the Deal”. His negotiating strategy is spelled out in this (remarkable) book, completely. If you watch much MSM, you know that few (if any) have bothered to read it. But we have…it’s been our play book on how Trump would govern and strike deals. I also remember how the economy/markets performed after Reagans tax reform…it’s why we’ve consistently said “dips must be bought” and that “the Dow Jones is headed to 40,000 by the end of Trumps first term”.

VRA System Approach

We used the VRA System to book more than 150% in net profits from last September to January/February of this year, and when the 1/29 top was firmly in place we had already taken profits and were sitting in cash (on our leveraged ETF positions). Once the lows were clearly in place, and the VRA System said “buy”, we began to jump back in. We’ve been long the markets since then.

The VRA System was built to remove emotion from my investing. It was built to have us out of the markets in times of turmoil (or short) and in the market when the bull wants to run. Again, we used the VRA system to book 150%+ in net gains from last September through January/February of this year, when we were stopped out. We avoided much of the pain from the 12–13% correction, as we went to cash on our broad market positions.

But all of that changed at the end of March. The VRA system compelled us to go long, once again.

The VRA system combines fundamentals, technicals and investor sentiment…the 3 most important elements of investing (in any/all asset classes). We use broad market positions with leveraged ETF’s combined with vra system recommended positions and of course, our small to mid-cap “story stocks” for the opportunity of several hundred percent in gains to more than 1000% profits.

The VRA system employs “trend following” methodology. The game plan with trend following is to capture 80% of the move, in our investments of choice. It’s not about calling market tops and bottoms (although the VRA has caught significant market turning points over the years). Instead, we want to capture that middle 80% of the move…thats our sweet spot…thats where the most reliable and predictable profits reside. This makes the 200 day moving average most important…its the major predictor as to whether a stock/sector/market is in a bull or bear market. It’s been my primary trend go-to for 30+ years.

Until Next time, thanks for reading…

Kip

To receive access to our full VRA Membership and daily updates(including our VRA Portfolio with buy and sell recommendations, featuring 2400% net gains since 2014), sign up to receive two free weeks from the VRA atwww.vrainsider.com/14day