The Psychology of Investing. DJ Technical Analysis, Bullish. Investor Sentiment, Extreme Fear. Housing is a Buy.

/Good Friday morning all. What a week. The Fed admits they screwed up and the DJ rallies 1000 points for the week. The 10%+ correction that should never have happened. My mentors (RIP Ted Parsons and Michael Metz) taught me so much about the psychology of investing. The emotions of money…wow.

Ted and Michael also taught me the value of being a contrarian. When everyone is bullish, watch out below. When everyone is bearish, its time to buy. Simple, yes. Difficult, hell yes.

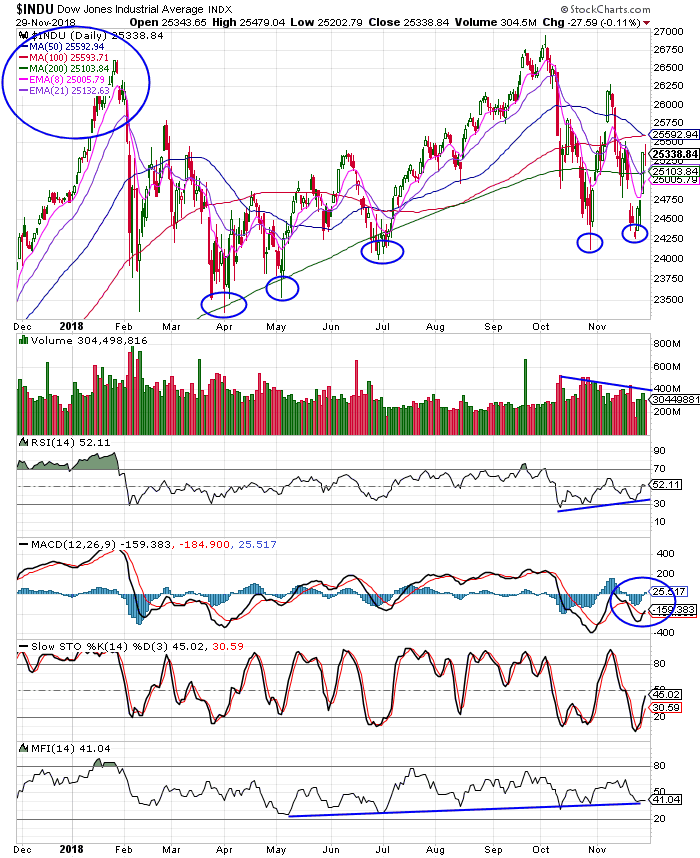

Dow Jones — Technical Analysis

As of today, only the DJ is above its 200 dma (day moving average). The 200 day is the bible for many/most technicians and trend followers. Its a key to the VRA Investing System.

Lets take a quick look at this one year chart of the DJ. Here’s what we see:

1) above the 200 dma (bullish)

2) Series of “higher lows” for the entire year (bullish)

3) RSI (Relative Strength) and MFI (Money Flows) have continued to trend higher, even in the face of the 10% correction. MFI has been trending higher since May. I find that most interesting…the buyers continued to buy.

4) Sell side volume pressure steadily declined into the correction. Again, highly bullish (thanks again Ted and Michael…they were big volume analysis guys).

5) MACD just flashed “bullish” yesterday.

Bottom line; the DJ has led the way higher. The DJ is made up of MANY co’s that would be impacted by a “trade war” (its not) with China. It appears the markets believe the worst is over….certainly the DJ is giving that signal. Now we need the S&P 500, Nasdaq and Russell 2000 to follow the DJ higher. I continue to expect thats just what we will see. China does not want to repeat the mistakes of Japan.

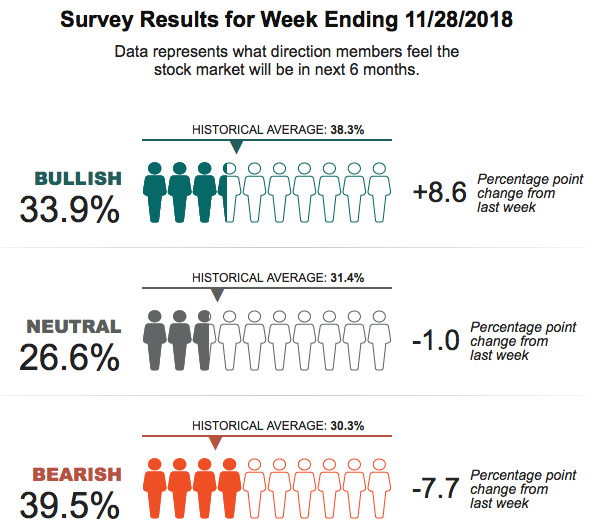

INVESTOR SENTIMENT

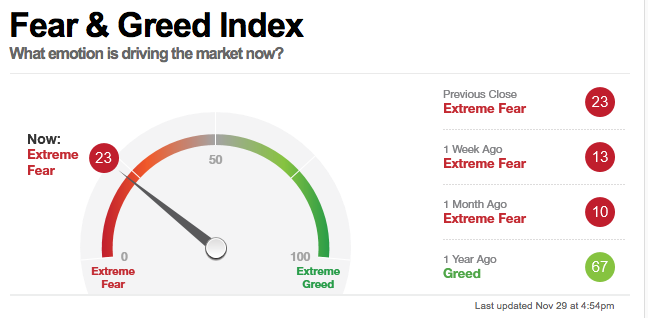

Below are this weeks sentiment surveys from AAII and CNN/Business. Both continue to tell us that investors are still at “extreme fear”, with AAII showing just 33.9% bulls and CNN/Business showing a reading of 23. As contrarians, we know what this means…its impossible to by low when everyone is bullish.

HOUSING IS A BUY!

I encourage you to read this piece about Blackstones views on US housing. Here’s the quote that sums up pretty much exactly my views:

“How do you feel about the residential real estate market in the U.S. right now. I’m still pretty positive on U.S. residential real estate. We like to look at the world in a simple way. So if you look at the data historically you would say we need about a million six homes being built in the United States. And I think to trailing 12 months we’re at a million 250.

That deficit is leading to the upward pressure in home prices. Now some people will say well we’re starting to see a little bit of a slowdown as people adjust to higher mortgage rates. OK. We saw that two or three years ago but ultimately the laws of supply and demand determine the value assets. And there’s a shortage of housing today in the United States. So I would generally be positive.”

MACRO PICTURE

Finally for this morning, a macro thought that I believe is important. One that I’ve heard no one else mention. Over most of this year, global equity markets have been battered. They dropped sharply after the January top…and then just kept falling…even as US markets recovered and moved higher.

I believe this recent correction in US markets was a “global capitulation”. The strongest always falls last. Now it important that US and global markets continue their recovery. Gotta get back over those 200 dma.

Capitulation bottoms are something that I’m very familiar with. My mentors teaching, once again. Here’s the key…the 10/29 lows MUST hold, or it invalidates my capitulation low theory. Just some food for thought.

Make sure and login to your VRA Members site to ensure you are positioned properly. And please sign up for our daily after market podcasts at vrainsider.com/podcasts!

Until next time, thanks again for reading…have a great weekend.

Kip

For our latest updates tune in to our daily VRA Investing Podcast atVRAInsider.com

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 14/15 years.