VRA Weekly Update: When the Bears Start Growling, Buy Buy Buy. Project Veritas Strikes Again.

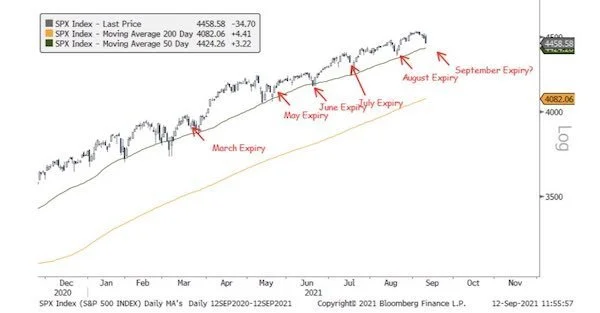

/Good Thursday morning all. Yesterday brought massive intraday reversals higher, with the Dow Jones gaining 560 points off the lows to finish +102. Seeing follow through this AM with Dow futures + 280. Real fear started coming into the market yesterday morning. Music to a contrarians ears.

Read More