VRA Weekly Update: When the Bears Start Growling, Buy Buy Buy. Project Veritas Strikes Again.

/Good Thursday morning all. Yesterday brought massive intraday reversals higher, with the Dow Jones gaining 560 points off the lows to finish +102. Seeing follow through this AM with Dow futures + 280.

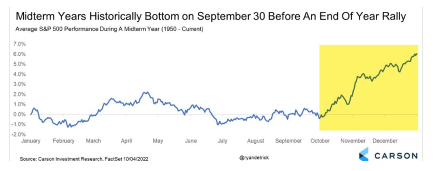

Real fear started coming into the market yesterday morning. Music to a contrarians ears. Combined with seasonality, which is about to turn bullish (for 7 months), we like this setup.

Investor Sentiment Flashing Huge Buy Signals

This is the fear I’m talking about . The “Investors Intelligence” poll just dropped to 40.4% bulls, the most bearish reading since April 2020. You read that right…investment newsletter publishers (that’s who this poll is made up of) are as bearish today as they were right at the very bottom of coronavirus insanity. I do not have a vote in this survey…I vote each week in the AAII Survey and have for more than 30 years (below)…but just think this through for a moment. Here we are, just 6% from ATH and in just the second year of a new bull market that’s driven by more than $32 trillion in fresh global liquidity and surging corporate earnings…a structural bull market that is “forcing” stock prices higher…yet my fellow newsletter writers are hitting the panic button. Hey, I never claimed that we were the sharpest knives in the drawer. As you’ll also see, this survey also has those looking for a “correction” at the highest levels since March 2020…the exact lows of CV insanity. Back up the truck.

And we’re seeing the same kind of readings in Fear & Greed Index., which now sits at 27 (Fear)

And finally, the weekly survey (AAII) that Tyler and I vote in. AAII.

Bulls sit at just 25.5%, bears at a massive 36.8% with neutral investors at a stunning 37.7%.

You read that right sports fans, 74.5% of all investors are neutral/bearish on this market. Even as the Fed and ECB continue monthly QE of $120 billion (each).

VRA Bottom Line: all of the pieces are in place for a rip-roaring move higher into year end. 9/12 VRA Investing System Screens are bullish…once the internals begin to improve we’ll almost certainly be back to 10/12.

And yes, this is contingent on Housing and Trannies…reversing higher from their 200 dma and leading the way higher…which is just what we believe is about to happen.

The VRA Investing System lists Housing and Transports as our two most important leading economic indicators and discounting mechanisms. They lead both the markets and the economy in both directions.

HGX (Housing Index) has just fallen below its 200 dma and needs to reverse course. Dips below the 200 dma are common, just prior to sharp reversals in the bullish direction. That’s what we believe is about to happen here…that’s what needs to happen here.

We see similar action in the trannies. Recent action below its 200 dma has been followed by a move higher over the last 10 days, and now just above its 200 dma.

This is classic trading action, in Housing and Transports, prior to a renewed move higher in the markets. But again, we don’t tell the markets what to do…they tell us. It’s also a stark reminder of the reality that we are in Obama’s 3rd term.

Finally for today, Project Veritas Strikes Again. Pfizer Scientists Telling the Truth to Undercover Journalists About CV Jabs.

2.7 million views in just 11 hours.

“Natural immunity is superior”

“If you haven’t been vaxxed, wait”

“I work for an evil corporation.”

“Our company is run on Covid money:”

“They fire you for saying any of this.”

They’ve built statues to people like George Floyd, but when America gets straightened…that process is underway…we’ll build them for people like Trump, Ron Paul, G Edward Griffin, our boy Wayne Allyn Root and undercover journalists like James O’Keefe. Just amazing admissions from multiple Pfizer scientists. Serious talks about Nuremberg-like trials for CV criminal fascists are beginning.

https://twitter.com/EricSpracklen/status/1445344182365720577

Until next time, thanks again for reading…

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast