VRA Weekly Update: Q3 is Here. Welcome to Best Day and Best Two Weeks of the Year.

/Good Thursday morning all. Excellent day in the Dow Jones yesterday (+210…we love both the Dow and R2K charts here) but slow summer-like day elsewhere. ATH’s once again in S&P 500 and we’ve now had back-to-back-to-back days with ATH’s in the semis as SMH put up a bit of a furious rally into the final 15 minutes to close just slightly green (we own SOXL, the 3 x Semi ETF), as semis and tech have continued to lead the way higher. Little is more bullish….semis lead nasdaq/tech, nasdaq leads everything else.

Dow futures +50, nasdaq -10 this AM.

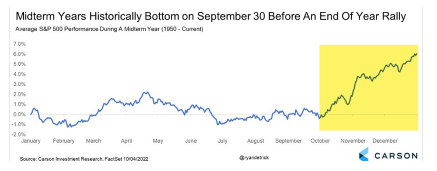

Reminder that we’ve now entered the best 2 weeks of the year for US stocks, as Q2 has come to a close. Significantly, this is the beginning of both a new month and a new quarter. Historically “highly bullish” time frame.

Here come “serious” equity inflows from pensions, 401k’s, retirement funds (again, fresh month and a fresh quarter) along with record levels of share buybacks and the anticipation of Q2 earnings reports (which kick off mid-month).

The path of least resistance for stocks remains higher.

And a reminder that today (the first trading day of July) is THE most bullish day of the year over the last 32 years. From Stock Traders Almanac;

“On the first trading day of July the S&P 500 has advanced 87.5% of the time (up 28 times in 32 years) with an average gain of 0.49%. DJIA has advanced 26 times in the same 32 years (81.3%) and NASDAQ has risen in 24 of those years (75.0%) with an average advance of 0.33% in all years.

No other day of the year exhibits this amount of across-the-board strength which makes a solid case for declaring the first trading day of July the most bullish day of the year over the past 32 years.

VRA Macro Mega Themes: Many continue to miss the most important mega themes of our new bull market. We’ve targeted these key points for most of the last year. They include:

-This IS a new bull market. It will last for years. Dips are to be bought.

-It’s driven by massive liquidity and a surging US and global economy. The Fed continues with $120 billion/month in QE. Even when the Fed begins to taper…whenever that may be…it will only “taper” their purchases. And even when the Fed starts hiking rates (circa mid 2023, if ever), history tells us that the markets continue to rise through “at least” the first 3 rate hikes. And globally we now have $30.5 trillion in fiscal and monetary stimulus. Holy liquidity batman. Don’t fight the tape…Don’t fight the Fed…and never ever, ever, ever fight an unprecedented mountain of global liquidity.

-Millennials (and the investing public) have fallen back in love with investing/stocks/real estate. We have cryptos to thank for this. Millennials are in the process of inheriting $70 trillion and they are plowing it into stocks/real estate/cryptos…and they have diamond hands. Massively underreported and hyper-important short-medium and long term investment theme.

-The Fear and Greed Index still sits in FEAR territory, even as we’re at ATH’s. It’s hard to express our amazement at this action in investor sentiment except to say “this is not how sentiment reacts when we’re anywhere near any kind of market top”.

-This remains a PSYOP. The Big Bribe, meant to make us forget about CV insanity, a rigged and stolen election and the ongoing theft of our constitutional rights. And if Dems want any shot at retaining their across the board power in DC…unless they find a way to rig congressional races all across the country…they require a strong economy and market. And of course, their besties….the Federal Reserve…will do everything in their power to make that happen. AKA “lower rates for longer”.

Fastest Earnings Recovery Ever.

As the graph below makes clear, S&P 500 earnings have demolished both the recent past and most all analyst estimates. Even today, analysts have S&P 500 earnings at just $191.29 by year end.

Like our friends at Evercore (right as rain), we’re looking for “at least” $205/share by years end. And no, Q2 earnings will not mark peak earnings.

And every sell side (retail) analyst on Wall Street has missed the size of the move higher this year. They’ve all been on the low side.

(just not your two guys from Texas…)

Finally for today, The June jobs report is tomorrow. If you’ve been with us long you know that we couldn’t care less about monthly economic data of any sort. We pay attention to trends…that’s what the VRA Investing System keys off of.

But, if I had to make a forecast…it’s just so hard to trust this data month to month, whether in an R or D administration…I’d guesstimate that tomorrows jobs report will be another disappointment (which would make 3 straight reports with a miss to estimates). Here’s why; with so many fresh trillions in stimulus (fiscal and monetary) working its way into the US economy, this fiat money actually serves as competition to a free market economy. That competition serves to rob the normal functioning power of an economy and jobs growth with it. We saw exactly this during Obama’s 8 years (minimum wage job growth was solid, high paying jobs growth not so much) and I expect more of the same during Biden’s time.

What does this mean? I expect slower growth going forward. Not a recession…nothing like that…just an economy that acts like its been manipulated and manufactured…because that’s just what is taking place.

It also means lower rates (for longer, possibly even negative rates in the US by end of 2024) and much more stimulus and QE. #QEInfinity. And yes, all of this fits well with our melt-up theme for US and global stock markets.

Until next time, thanks again for reading…

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Also, Find us on Twitter