VRA Update: Do Not Fight the Tape. VRA System Approach To Crushing the Market. Investing Comes at You Fast.

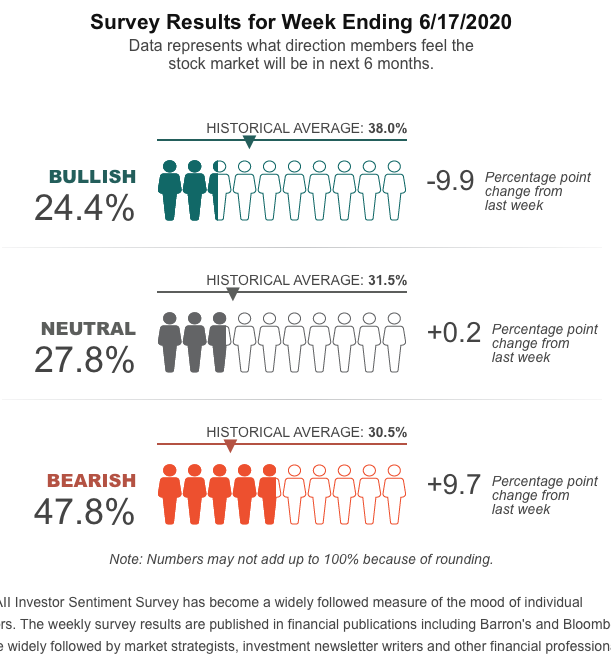

/Good Tuesday morning all. After Monday’s big close I continue to be amazed by the bears that somehow appear blind to whats occurring in the US economy and stock market. Our long time VRA Members know how bullish I am…

Read More