VRA New Year Update: 2018 is Here! Trump Bull Market. My Forecasts and Predictions. VRA System and Sector Analysis. Extreme Options Program

/Good Tuesday morning all. Happy New Year! Are you ready for an off the charts incredible 2018?

Because….I AM!

I honestly cannot remember being this positive to start a new year. Not in my 33 years in the business. At this time last year we had a new president that got elected because he said BIG things on the campaign trail that resonated with so many across the country (and the world). Those big words/ideas got him elected. But, in January of last year we had no actual proof that Trump would in fact be a man of his word. Most politicians say whatever it takes to win so that they can then line their own pockets with our money. It’s why we loathe the vast majority of elected officials.

Until Trump got into office and started governing, how could we know?

After 11 months in office, we have our answer. There’s not just evidence that Trump is a man of his word…there is 100%, unmistakable rock solid proof that Trump has been a man of his word. A few examples: Border security/immigration enforcement….destruction of business killing hyper-regulation…the largest tax reform/tax cuts package in US history…ISIS destroyed…3%+ GDP/US economic revival…70 new all-time highs in the Dow Jones…unemployment at 17 year lows. Next up, get ready for up to $4 trillion in corporate liquidity to come flowing back into the US economy (repatriation from tax reform legislation), along with a $2 trillion + infrastructure bill. Even the biggest left leaning Dems are ready to agree to a deal on infrastructure.

Just…wow.

The biggest driver for higher stock markets going forward? Massive amounts of retirement/pension/401k are about to come flooding into equities. Frankly, most investors are nowhere near bullish enough, based on my work and the VRA Investing System.

It’s gonna be a busy year folks…I believe a “highly” profitable year for us here at the VRA…now’s the time to get strapped in for the ride.

Lots of bases to cover this morning…I’ll use some tweets from the last couple of days to speed up the writing process:

In 2017, US markets had a banner year. The VRA did better, with a 32% gain (marking 14/15 years this has been the case):

VRA MARKET UPDATE

Based on everything I see, 2018 looks to be one of our best years ever. In 2011, the VRA put up a return of 260%. My best year on record. I repeat…my goal is to beat 260% in 2018.

The VRA System sees no signs of trouble. None. Yes, we’re still ST overbought…but nothing like we were in mid-December. Check out the latest readings from the VRA System (remember, Extreme Overbought readings on VRA System occur when an index/stock is at 90%+ overbought):

S&P 500: 75%

Dow Jones: 84%

Nasdaq: 64%

Russell 2000: 81%

The “pause” over the last week of 2017 brought the overbought readings down….just the kind of “correction” that bull markets love. Now its time for onward and upward. The markets internals continue to point to exactly this. For example, on Friday, when the DJ lost > 100 points, new 52 week highs to lows registered 504 new highs to just 70 new lows. Powerful…and not at all indicative of a market thats ready to reverse course.

VRA Sector Analysis

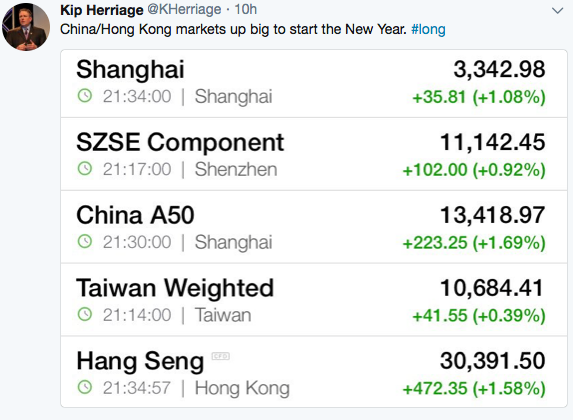

My favorite sectors have not changed: energy, retailers, biotech, PM’s & miners, China and small caps. Check out what China did overnight….Hong Kong +2%….meaning that our holding in YINN (3 x China ETF) will open some 8% higher.

Precious Metals and Miners: Bring on the Rate Hikes! $2000/oz Gold in 2018.

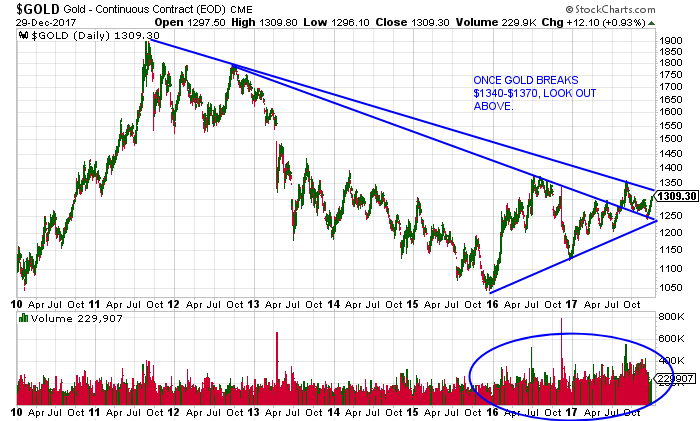

Over the weekend I saw 3 different “gurus” predicting that gold would not do well this year, due to ongoing rate hikes from the FED. Poppycock…!

And heres the chart that matters most….we want to see gold break $1340…then $1370. Then….its liftoff folks.

In this weekends Barron’s, on both the cover and in 2–3 articles, they predicted that commodities/metals/gold would have a banner year and that inflation was on the way back. Nice to see Barron’s join the party on the global reflation trade. The VRA nailed this forecast long ago:

Yes, the VRA System shows PM’s and miners at Extreme Overbought readings. We must be aware of this…just as the US dollar is flashing Extreme Oversold. No need to change course…just important to be aware of a ST pause. However, the shorts are piling into this trade now. If PM’s continue their surge (the best since 2011), the squeeze could send PM’s and miners screaming higher.

Extreme Options Program

The first day of the new year is not the ideal time to laugh a new options program. Look for this email with full details in the next 24–48 hours. If you want in, just send us an email a support@vraletter.com and we’ll make sure your place is reserved (first 100 only). We’ll then launch the next Parabolic Options program within a couple of weeks.

Finally, check out this video (below) of Tyler from yesterday. A wild deer kiss. What a way to start the New Year!

Again, Happy New Year everyone. Looking forward to crushing the markets together in 2018.

Until next time, thanks again for reading….have a great week.

Kip

Sign up to receive two free weeks of Daily updates from the VRA at vrainsider.com