VRA Saturday Alert: What. A. Week. VRA Market Update

/Good Saturday morning all. What. A. Week. I’ve run all VRA System Scans and screens this morning and have a number of important points for us to cover. If you’re reading this, you are likely anxious about the markets. If not, you have more ice water in your veins that me…nerve wracking might be an understatement. But if I can be so bold, this is also why you subscribe to the VRA. The VRA System helps us to remove emotion from investing…as much as possible…making clear headed decisions, based on whats worked for me over 3 decades.

We’ll cover the VRA Alerts from this morning next, but first, the question that’s most on your minds; “are the lows in place?” I honestly do not know at this point, but we do have some hard data that points to the likelihood that a deeply oversold bounce should be in the cards come Monday morning and the early part of the week. Consider:

1) Both the put/call ratio and the VIX hit near panic-selling levels this week. On Friday, the put/call ratio averaged 1.4. Anything over 1 tells us that options traders are heavily bearish…almost always a solid contrarian indicator…a reading of 1.4 tells us that (if nothing else), a relief rally should be in the cards.

The VIX (volatility or the “fear index”), spiked to 50 on Tuesday…an 118% 1-day increase (an all-time record) and a 2.5 year high. But, on Wednesday and Fridays sharp declines, the VIX failed to surpass 31, closing at 29 on Friday. This tell us that the declines are becoming more orderly…less fear induced…and that’s a positive.

2) Investor Sentiment has flipped from 60% bulls (AAII Weekly Investor Sentiment Survey) all the way down to 37% bulls. We have to keep in mind that these are the readings from Wednesday, but we also learned on Friday that the USA Today Sentiment reading was down to 8…it had been as high as 80 just 2 weeks prior. Again, as contrarians, we want to act against the majority…most especially during a bull market, when bearish sentiment reaches a fever pitch. We’re getting there now.

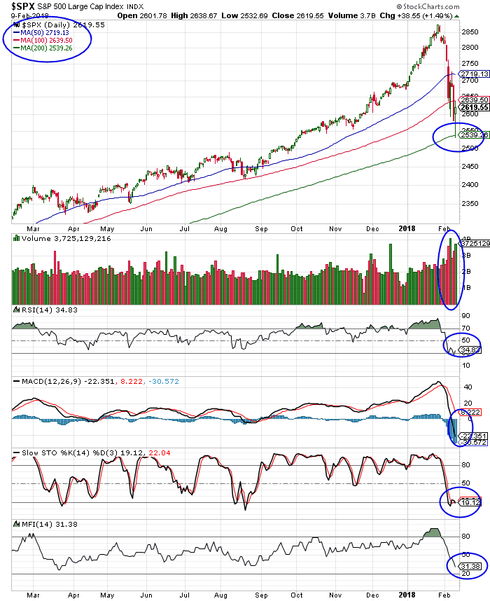

3) Fridays wild day in the DJ (+300, -520, +500…with a close of +330) was just the kind of messy retest of the lows that we’ve been discussing. While the Dj remains some 1300 points above its 200 day moving average (200 dma)…never getting close to the 200 dma…the S&P 500 fell to EXACTLY its 200 dma on Friday. Here’s the SPX chart…this is the one that every smart money market watcher is talking about…its the only chart we will look at this morning.

At its lows, SPX traded down to 2359…again, exactly to the 200 dma (circled below). Investors that invest almost exclusively on fundamental analysis pay close attention to the 200 dma. Here’s why; if a stock or index is above the 200 dma, investors can assume the trend will continue to be “higher”….and will buy/add to positions. Conversely, if a stock/index is below its 200 dma, this is when investors can look to go short, betting against a move higher, looking for lower prices instead. The VRA keys off of the 200 dma for exactly this reason.

We can also see that the momentum oscillators are reaching heavily oversold levels….not yet extreme oversold on the VRA System…but certainly getting close. Should we get an additional test of the 200 dma, dollars to donuts we can bet that extreme oversold levels will be reached. These levels of extreme oversold readings commonly mark a bottom (at least for the short term). We also saw some interesting readings in trading volumes. As you can see below, buy-side volumes were higher on both of the recovery moves higher (Tuesday and Friday) than at any other point during the week, as the market was plunging. This is a positive divergence…and that’s good.

Fridays reversal higher was most important. If we had seen a sharp sell-off headed into the weekend, investors that wait until the weekends to review their portfolios would likely have entered sell orders, for first thing Monday morning. This is how black Mondays occur. This is how a standard market correction can turn into something much worse. The rally into the close could prove far more important than most realize. Again, another positive.

We also saw BIG reversals higher in some of the most important market leading indexes…aka, the same indexes that have led the market higher over the past year. The Housing Index (HGX) finished up .73%. The Semiconductor Index (SOX) finished up a huge 3.05%. The Bank Index, another important market leader, finished up 1.98%. Often, major intraday reversals like this signal important market bottoms.

So…as we can see…there are a number of signs pointing to the likelihood that the markets may be reaching their lows. Add to this that the economy is powering ahead, tax reform is just now kicking in, and we have a president that is committed to MAGA, and the fundamentals look solid. Globally, as well.

Now…the negatives. And yes, this decline “could” be signaling that something bad is headed our way.

For my members, I’ll remind you of my Wednesday podcast. Swamp draining is in high gear. It could also come with a steep price tag. If we really want to get dark, think back to what the markets did prior to 9/11/01. Many have forgotten this, but just prior to the 9/11 attacks, from May of 2001 to the day before 9/11, the Dow had already fallen some 14% during those 4 months. After the attacks, over the next 12 months, the Dow would plunge another 20%. 34% in combined DJ losses.

Was the 14%, 4 month decline in the DJ…just prior to 9/11…signaling trouble on the near horizon?

If you’ve seen the recent news out of Syria, which has already developed into a proxy war between Syria, Iran, Russia, Turkey, Israel and the US (among others), the news is getting steadily worse. In just the last few days, planes, helicopters and attack drones have been shot out of the sky. Are we nearing a much more serious global conflict?

I’ll resist going too far down the rabbit hole, on this already bleak and rainy Sugar Land, Texas morning. And honestly, its most often when paranoia begins to set in, that we’ve reached a market bottom.

Until Monday morning, thanks again for reading…enjoy the rest of your weekend.

Kip

To receive updates like this Daily sign up to receive two free weeks from the VRA at www.vrainsider.com/14day