VRA Weekly Update 12/22/17: Merry Christmas! 2017 in Review. Big Happenings in Mining Stocks and Bitcoin.

/If you had a chance to listen in last night, you know that Wayne and I covered a lot of territory. 2017 has been nothing short of remarkable…alternate universe kind of stuff. The gurus and pundits, once again, got just about everything wrong:

If Trump wins the market will crash.

If Trump wins, the world will burn (and not just from global warming/global cooling/climate change)

The market is wildly overvalued and cannot keep going higher.

Cryptocurrencies are a scam.

The oversupply of oil will send it crashing back below $40

And my personal favorite; Trump won’t last a year….Russia, Russia, Russia!

But I saw things differently. I even wrote a book about it. The Trump bull market is very real…and its just getting started.

At the end of the first quarter, I first stated in writing that DJ 25,000 was likely. We’re almost there. As you may have heard last night, my 2020 target is being raised to DJ 40,000 (and that may be low).

Of course, no one knows for certain. But I do believe I know this for certain; our current bull market will not end until we have a “blow off phase”. The phase where investor euphoria takes hold and sends stocks screaming higher. We’re simply nowhere near this today.

When everyone starts talking about DJ 40,000….maybe even DJ 50,000…we’ll know that its time to be concerned about a top. Major bull markets do not end until we reach the mania phase. At the soonest, this kind of a top is at least 1 year away…likely 2–3 years away.

Market Internals Solid

My mentors taught me, way back in the mid-late 1980’s, that if you listen to the market, it will tell you what it is about to do. The single best way to do this? Charts, technicals and especially the market internals.

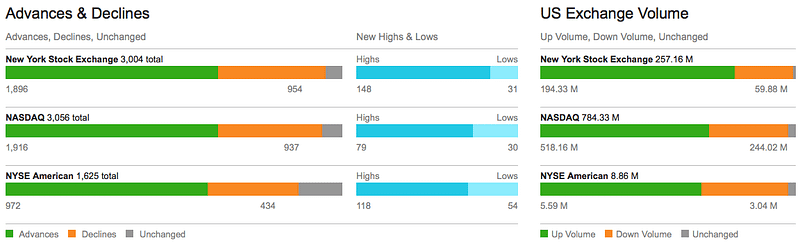

Take a look at yesterdays figures. When we see 2–1 positives across the board, as we saw again yesterday, the markets telling us that it almost certainly wants to go higher still. Once again, we see new highs to new lows at close to a 10–1 ratio. Highly bullish.

2017 — The Trump Bull Market

During the last year we’ve seen more than 75 new all-time highs and a record 5000 point Dow Jones advance (the first in history), as the country is reminded of what a pro-growth, business friendly economy is supposed to look like. We’ve also seen a multitude of highly burdensome regulations slashed…allowing entrepreneurs to do what they do best…grow their businesses.

Remarkable. And yes, who the President is matters a great deal.

But folks, “literally” everything that I see, using the VRA System and my 32 years of experience, tells me that we are nowhere near the end of this rally, certainly not after passage of Trumps massive tax reform bill.

Here are the some of the most important markers that I follow:

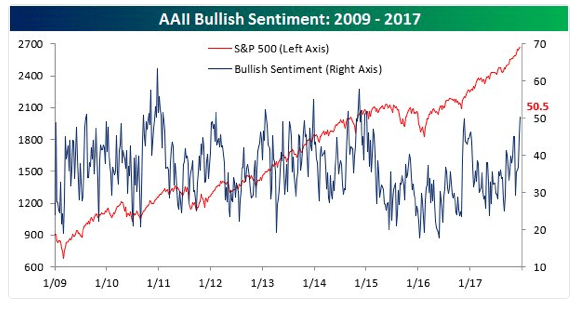

1) Sentiment; yes…investors have become much more bullish (as you’d expect with this kind of a move higher), but the most important sentiment survey that I follow…the same one that I’ve followed since the late 80's…shows bullish percentage still at just 50%. While its beginning to elevate, yours truly will not become concerned about this market reaching dangerously overbought levels until bullish percentage reaches 60%…and for weeks on end. We’re nowhere near this.

Here’s the latest AAII Survey readings from Wednesday, presented in graph form that shows bullish sentiment readings from the market lows of 2009 (exactly when the VRA switched from bearish to bullish….we actually called the stock market bottom within 5 minutes of it occurring).

As you can see, bullish sentiment is finally picking up steam, back to 50%, however we’re still quite a ways from the 60% readings that could begin to signal euphoria. The highest bullish reading over this time frame was 63% (late 2010).

As a contrarian, the odds are slim to none that I will become worried about sentiment becoming too bullish before the end of Q1, 2018 (at the earliest).

2) Seasonality: in what may be the most important statistical investing fact that exists, over the last 50 years more than 90% of all stock market gains have occurred from November to May. Again, 90% folks.

We barely had a single whiff of a sell-off during the historically volatile September/October risk filled months, which told us that we must be positioned aggressively for higher stock prices. My year target of Dow Jones 25,000 is 275 points away. 30,000 in 2018 is not a stretch.

3) My mentors taught me, at the young age of about 24, that you can track markets by the success in the following areas: income tax receipts, health of the housing markets and health of financial stocks. We see all-time highs in all 3 areas today. Highly, highly bullish.

Also, by following the Nasdaq (the best barometer for excitement in the markets), we get a great feel of what the future holds. Remember, since the election, the nasdaq is up a big 30%.

Final point on the markets and the economy: the stock market has always served as a discounting mechanism for the future. It tells us, roughly 6 months in advance, what we can expect economically going forward. Today, I believe the stock market is telling us that both the US and global economy will continue to surge.

In my book “CrashProof Prosperity, Becoming Wealthy in the Age of Trump” I laid out two investing scenarios. In one, I said that “if” we were going to have a bear market and sluggish economy, that it would come early on in Trumps first term (lots of historical precedence for this, during the first year of a new presidency).

That did not happen.

In my second scenario, I laid out the more likely probability that Trump would take the markets to all-time highs, based on economic growth that finally got back to the 4–5% GDP growth of years past. Remember, in not a single year of Obama’s 8 years did US GDP hit 2%. Today, we’re already back to 3% +.

Imagine what Trump might be able to accomplish in years 2–3–4.

I am “all-in”. The DJ is headed to 35,000….possibly even 40,000…over the next 3 years. If that sounds impossible, consider this; a move to 40,000 would mean that the market would need to average a 20% return over the next 3 years. Not impossible at all.

BITCOIN

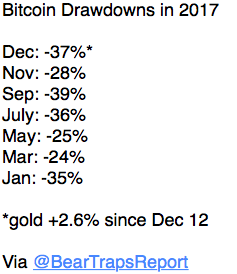

I first bought bitcoin at $600. When it crossed $2000, I began writing publicly about it in these pages, saying “Bitcoin is breaking out…higher prices are on the way”. Bitcoin rose to $20,000….but today its going through another big drawdown (correction).

Here are the big drawdowns for 2017:

For those interested, Bitcoin at $12,000 represents a Fibanacci retracement of 38.2%. If this level does not hold (and its breaking through it as I write), then we can likely expect a move to $9500 (or so). Just some basic technical analysis for those interested.

GOLD and MINERS

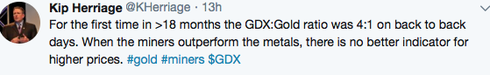

Wayne and I covered this last night as well. Here’s my tweet from the trading action in the miners over the last 2 days. Back to back days of 4:1 ratio, GDX (miner ETF) to gold. First time we’ve seen back to back 4:1 days in more than 18 months.

There is no more bullish sign for the future price of PM’s and the miners than this kind of outperformance. Now, we want to see GDX break though their most important moving averages…and we want to see it take place on heavy trading volumes. This morning, gold, silver and GDX are knocking on the door for this most important breakout. Here are the levels we want to see surpassed:

Gold: $1288/oz ($1273 now)

Silver: $17/oz ($16.29 now)

GDX: $23 (22.70 now)

My target for 2018 remains $2000/oz gold. We will make an absolute killing in the miners (which move 3–5x faster than the underlying metals).

Finally, the markets are quite this morning. I wish you a very Merry Christmas and a great holiday season. The markets are closed on Monday, so I’ll see you back here first thing Tuesday morning.

Thank you for making the decision to join the VRA. Every bone in my body says we are going to absolutely crush the markets in 2018.

Until next time, thanks again for reading…

Kip

To receive two free weeks of the Daily VRA Updates, sign up at VRAinsider.com