VRA Weekly Update: 36 Million Newly Unemployed. Join Me on the Wayne Root Show Tonight.

/Good Thursday morning all. I’ll be on with the great Wayne Allyn Root tonight at 8:30 EST. Hope you can join us on either USA Radio or 790talknow.com

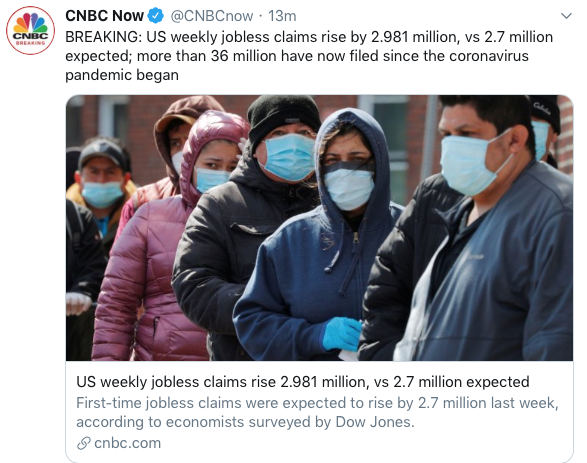

Not how we want to start our day. Another 3 million filed for first time unemployment, taking the CV total to 36 million. Now, the WHO is out with a new report that claims CV will strike for another 5 years, with President Fauci stating before Congress yesterday that states reopening will make wave 2 this winter all that much worse. Remarkably…and this may be a medical miracle…no one appears to be dying from the regular flu (which kills approx 50k in the US and 400k globally each year). Has CV cured the regular flu?

Should Trump lose in November, we see the odds as “HIGH” that we’ll either have a cure or treatment for CV within weeks/months, with (blue) states almost immediately re-opening. We remain doubtful that many/most blue states will reopen prior to the election. This was the original sin of Trumps nationwide lockdowns. Lockdowns now fully weaponized as a political weapon of mass economic destruction.

Maybe central banks are going to bail out the world. Frankly, that’s the only reason to be bullish, as we see it. The question we’ll pose here this morning is “who would global central banks rather have as president? Trump or Biden? A strong nationalist that has slammed the Fed from the day he was sworn in, or globalist Biden?

We think it's an important question to ponder…certainly with the fate of the worlds markets/economies resting in these “masters of the universe”.

We’ll add that Dems have one primary goal…the same goal they’ve had since before Trump was elected; “Get Trump”. With thanks to President Fauci, leading blue states are already announcing that they have no plans to reopen their economies for 3 months. Then, it’ll be wave 2 and continued lockdowns. CV insanity in full display, now being used fully as a political weapon of mass destruction…just as we warned here from day one, when Trump announced a nationwide lockdown. If you saw the House’s $3 trillion bill, you know that there’s a near zero percent chance R’s will pass it…or anything close to it. $1 trillion in federal bailouts to blue states? Not gonna happen.

Now we find ourselves in the fall of 2008. Soon, in our view, the markets will once again start forcing the action. Demanding more from the Fed and Treasury. Much more. This was the 08 playbook….unfortunately, we expect a repeat. And of course the big question that will soon be on everyone’s mind, headed into November; “will Americans re-elect a president with the country in a depression?”

VRA Bottom line; the risks far outweigh the rewards. Should S&P 500 earnings “only” decline by 10% this year, the P/E multiple would rise to 22 (assuming no change in price of (SPX). Over the last 50 years, bear market bottoms have found their footing in the 8–13 P/E multiple range. Consider that should the SPX P/E fall to just 15, SPX would decline by 30% from current levels, taking it from 2870 today to the 2800 area. This is likely our best case scenario.

What we are watching…

Yesterdays trading was ugly (88% down day, NYSE advance/decline) with Tyler’s research on J Powell holding up again (when Powell grabs a mic, the markets plummet 90% of the time). Dow futures were +100 when Powell started speaking only to lose 700 points over the next 6 hours.

However, based on our “VRA Bear Market Rally Playbook” we actually saw some important items that held up.

1) Smart money hour: the market actually rallied in the final hour of trading, with the DJ gaining 150 points off the lows.

2) Nasdaq and Semi’s were down 1/2 as much as the broad markets. Semi’s lead tech, tech leads the market.

3) Oil was only slightly lower and is up more than 2% this am.

This is what we’ll be watching today; oil, tech/semis, internals and the smart money hour.

DJ futures are -250 as I write. European markets -3%.

Note: whenever I see all of these big media names get overtly bearish on the same day…as we saw yesterday with Paul Tudor Jones, David Tepper and Mark Cuban…my BS indicators start going off. It’s entirely common for hedge fund types to say one thing in the media while doing exactly the opposite.

But yes, the bear market rally is in danger. The risk/reward is skewed to the downside with “Don’t fight the Fed” remaining as our biggest reason for optimism.

Finally, for this morning, Matt Taibbi, one of our generation's top financial journalists, is out with another seminal piece on Wall Street and (surprise, surprise) how they’ve rigged CV bailouts almost entirely to their benefit (just as they did in 08/09). Highly recommended.

https://www.rollingstone.com/politics/politics-features/taibbi-covid-19-bailout-wall-street-997342/

Until next time, thanks again for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/17 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast