VRA Update: VRA Bear Market Rally Blueprint. 33 Million Newly Unemployed. Nasdaq, Tech, Oil Still Leading.

/Good Thursday morning all.

Our bear market rally continues it's backing and filling process. Interesting reversal yesterday, featuring the catalysts we’ve been discussing here.

-oil led the way lower in late February, it’s leading the way higher now. That move higher continues this morning with oil +8.8% at $26/barrel.

-tech followed oil sharply lower in Feb, it's leading the way higher now. Of the major broad market indexes, only the Nasdaq is above its all important 200 dma. In fact, Nasdaq is the ONLY major broad market global index back above its 200 dma. This is a short term positive…but a clear long term negative.

-Smart money hour. The final hour of trading, has been decent, but we are starting to see a pattern of higher opens with weakness into the close. Gone are the 1000 point sell-offs into the close.

-Don’t fight the Fed continues this week, with the Fed on tap to begin buying up to $750 billion in corporate bonds (through ETF’s). The markets have been front running these Fed purchases aggressively (fully telegraphed by the Fed, as usual).

-Buy the rumor (states semi-reopening…Fed corp bond buying)…sell the news. Once the public believes the coast is clear, “sell in May”, in advance of economic reality and the upcoming November elections, will likely kick into gear.

-Until and unless VRA screens flip to at least 6 screens bullish (3 today), we must maintain our defensive posture. We put the odds at 70% that we will have a retest of the 3/23 lows (at minimum).

-Until we see a pattern change in the points above, this bear market rally could (we repeat, “could”) extend to the 61.8% retrace level. That’s DJ 25,000 and S&P 500 2925.

-Here’s what we also believe to be bible; should Trump lose in November, MSM CV mass hysteria will die an almost immediate death.

33 Million Newly Unemployed.

Weekly jobless claims are out with another 3.2 million unemployed, taking the total to 33 million newly unemployed from coronavirus insanity. Tomorrow morning we’ll almost certainly learn that the US unemployment rate reached 18–20% + in April.

We’re also learning that in the worst hit parts of the country (blue states), 50% + of all CV deaths are occurring among the elderly in nursing homes. Nursing homes in NY (and other states) have been financially incentivized/forced to take in the elderly “with” CV. Not a particularly big fan of class action lawsuits, but in this case I’ll be rooting for these families to win and win big.

Nasdaq/tech/QQQ have led the way higher in this bear market rally, as they did again yesterday, but the internals are showing weakness for the 3rd day in a row. We’re also seeing a pattern of higher opens with sell-offs into the smart money hour. This is how markets start to look prior to reversing.

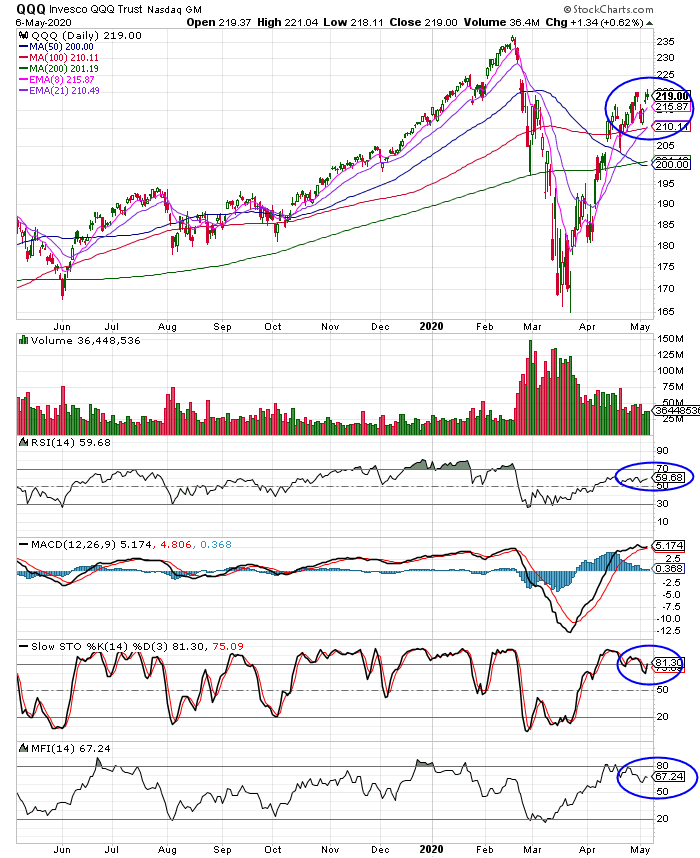

This is likely our most important chart. QQQ (Nasdaq 100 ETF). Tech leads in both directions. With futures up this morning, QQQ should break through to new post-recovery highs (now just 7% below Feb ATH). Above every moving average, with room to run before reaching overbought levels on VRA momentum oscillators. Until/unless tech and oil break down, a sharp move lower in broad markets is unlikely.

Investor Sentiment Heavily Bearish

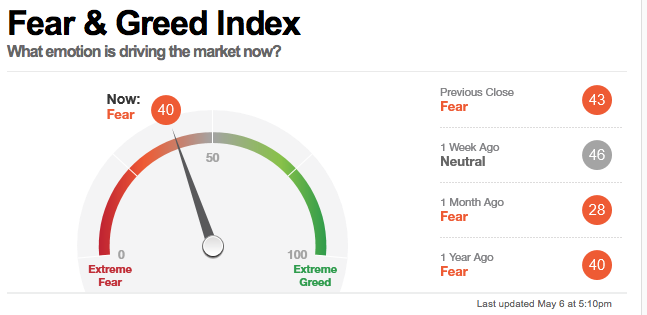

As contrarians, if we only used this one screen in the VRA System (sentiment), we would be getting bullish here.

Fear & Greed Index remains in “fear” territory with a reading of 40. Investors too shell shocked to get back into the 55–60 range, which is ideally where we would want to go aggressively short.

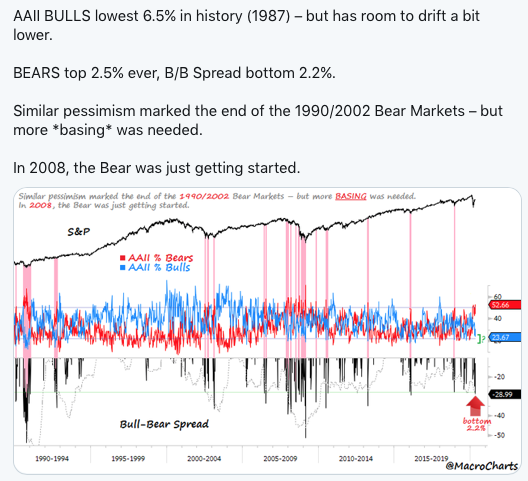

Same with AAII Investor Sentiment Survey, which last night hit a new cycle low of 23% bulls and 52% bears. As this excellent post from Macro Charts points out, based on AAII readings these most often signify bottoms than tops (unless, as we expect, this period is more similar to 2008, which was nowhere near the final 3/09 lows).

Until next Tuesday, thanks again for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/17 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast