VRA Weekly Update: Our New Normal. With Central Bank Domination, Does Anything Else Even Matter? VRA Market, System Update

/Good Friday morning all,

The VRA System has been upgraded to 4/12 screens bullish (from 3/12). Not a significant change but the action in market leadership, internals and the tape are improving. Still, we see this as a bear market rally that will result in some form of a retest…after this wall of worry move higher ends.

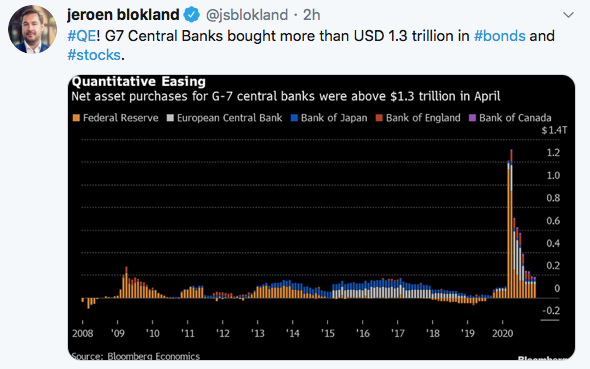

Candidly, our markets are surreal. Almost not investable, if you are a student of fundamental investing. But the markets are also not the economy. Case in point, over the last 12 weeks global central banks have added $4.5 trillion to their balance sheets (QE), a total that it took 4 years (‘08-’12) to reach following the financial crisis. Stunning.

Of course, this total of $4.5 trillion does not include the more than $6 trillion in global fiscal stimulus, nor the leverage that central banks and governments are employing (up to 7:1 leverage, through SPV’s via conduits in sovereign wealth funds and central banks that openly admit they purchase equities; China, Japan).

Through this lens, it’s almost impossible for global equities and debt not to rise in price. This is our Frankenstein economy. This has been our new normal for some time. Fighting the Fed is an almost impossible battle to win…so we continue to participate…other than owning physical gold/silver, miners and bitcoin, what other option do we have?

My big question…maybe my biggest…is whether or not central banks prefer a Trump second term. Because if they prefer Biden, all that central banks would need to do is slow down/reverse liquidity. Of this I am certain; if the powers that be want Biden to win, a crashing stock market/economy headed into the November elections is all that it would take. As bad a candidate as Biden might be, a win for Trump ain’t gonna come easy (ballot harvesting, etc).

Yesterday's trading was interesting…along with last night's action in Hong Kong’s Hang Seng index following China’s moves to tighten their grip on Hong Kong. The Hang Seng fell 5.5% overnight, sending Dow futures -200 overnight. One would reasonably think that this morning's open could have been ugly. One would of course be wrong…Dow futures were positive this morning before turning lower into the open.

The semis led the way lower with losses of 2.7%. Nasdaq was close behind. Oil is off 3% this AM. Our bear market rally playbook key signal indicators flashing warning signs. Watching closely today but with investor sentiment still overwhelmingly bearish (after a 35% move higher, no less) and with fund managers positioned bearishly, our wall of worry move higher still looks like the ST play. Two steps forward, one step back.

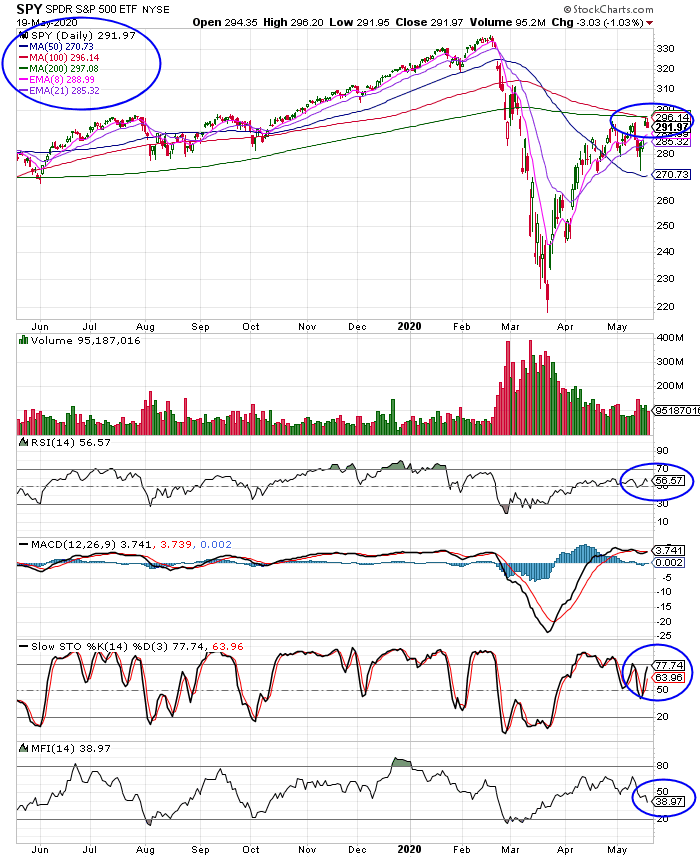

We’ve been focused on leadership in oil and tech/semis for this bear market rally and its time to look at another chart. SPY (S&P 500 ETF, including dividends), which has climbed all the way back to its 200 dma. Should this move continue, the Dow and S&P 500 (SPX), will be right behind it. What’s interesting about this chart (and many others) is that the two steps forward, one step back approach of our markets has prevented the broad markets from reaching overbought levels on the VRA System. We see it below in stochastics (70), RSI (56) and money flows (just 38).

We can look at this move higher, with diverging technicals, in one of two ways; either these momentum oscillators will start playing catch-up, propelling the market even higher, or this will prove to be a non-confirmation, resulting in another sharp leg down. We will continue to watch our bear market playbook indicators; oil, internals, tech/semis and the smart money hour. Yesterdays final hour sell-off was like a hot knife through butter. Watching closely today.

Sentiment Update

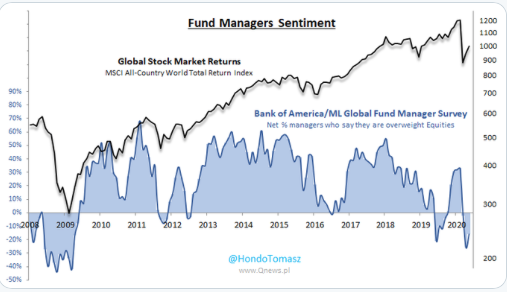

New investor sentiment reports are out; AAII, Fear and Greed Index and the BAML Fund Manager Monthly Survey. Pessimism and caution remain the primary theme.

BAML: Monthly survey from 200 fund managers with more than $600 billion in assets under mgt. This group remains in “extreme fear” territory…lowest percentage overweight the markets since the financial crisis. We also learned from the survey that 68% believe this is a bear market rally with cash levels remaining high at 5.7% of assets.

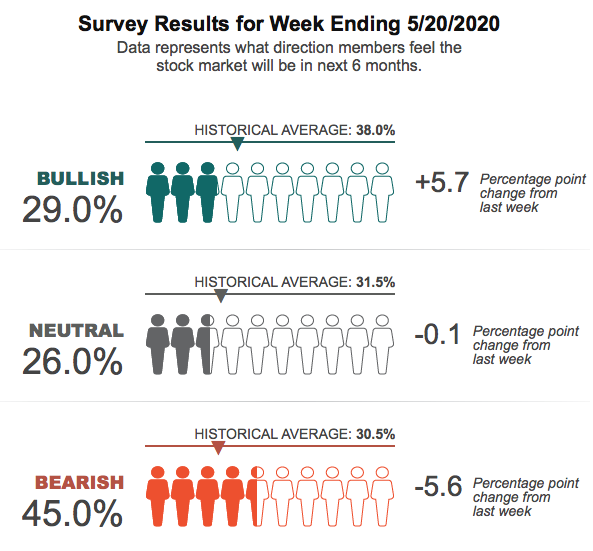

AAII Investor Sentiment Survey

Bullish percent rose 5.7% to 29% with bears down 5.6% and neutral investors flat at 26%. After a 35% move higher from the March 23 lows, AAII survey respondents aren’t buying the move higher. Fear and Greed Index is now at 53 (neutral).

Our bear market rally playbook continues to flash buy signals but looks to be getting long in the tooth. Oil is hitting extreme overbought (down 4% this morning) and tech/semis aren’t far behind it. Our most important signal indicators remain oil, internals, tech/semis and smart money hour. This remains a wall of worry move higher.

Until next time, thanks again for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/17 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast