VRA Weekly Update: Prepare to Act, in Advance of Prolonged Economic Downside

/(From VRA Sunday Update to Clients)

Good Sunday afternoon. As US markets have now hit heavily/extreme overbought on VRA System readings, its time to prepare for what we expect will be a near term move lower.

As you’ll read, it is our view that this bear market rally will soon end, with the possibility of a 40–50% decline from current levels over the next 1–2–3 years.

Our primary goal is to take advantage of the moves in both directions, in both VRA and Parabolic. Importantly, we will hold/continue to buy our VRA 10 baggers…great growth stocks perform well in any environment…along with our physical gold/silver positions and VRA mining stocks.

This is a departure from what we had hoped would be the case, but as you’ll read in this update, the medium/long term changes in consumer behavior, in the US and globally, from the insanity of lockdowns, will almost certainly have a lasting and chilling effect on the global economy and employment. If we avoid a global depression, at this point, it will be a minor miracle. We’re likely in a depression now. When bear market rallies end (and they almost always represent the sharpest moves higher), the move lower is swift. And hell yes, I want to be wrong. Importantly, if VRA System readings do not confirm this breakdown, we will remain long.

Our bear market rally bogey has been 25,000 on the Dow Jones, which now sits 3% higher from here. Our strategy has been “buy the rumor, sell the news” on states reopening, a process that is now (semi) beginning.

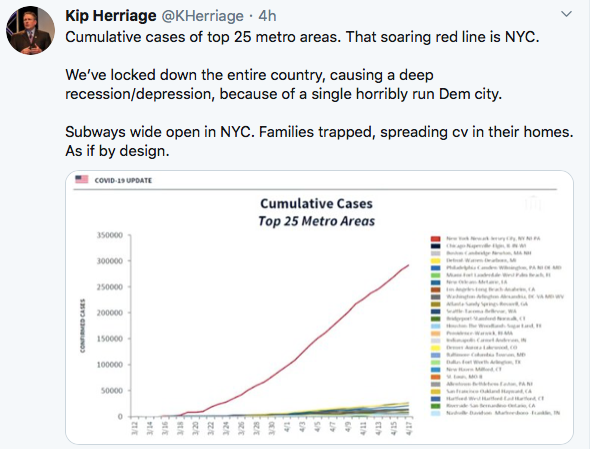

We also know that QE/stimulus/bailouts have provided significant support/juice for our current 30% move higher in 3 weeks. Again, and unfortunately, we have entered a (global) deep and prolonged recession/depression, which will have a multi-year, highly negative impact on corporate earnings.

Whether we take action tomorrow, or at some point this week, this update will prepare you for our coming moves, both in VRA Portfolio and Parabolic Options (VRA Members will participate in our next 2–3 options trades). We are extending Parabolic Options #10 as well. Date for opening of #11 will be announced at a later date (Parabolic Options update from Friday is included below). This looks to be a busy week.

First, It's hard to put into words how disappointed I am in our president. If you’ve been with us in the VRA for a while, you’ll know how difficult this view is for me.

As a lifelong independent, I am beholden to no party and to no man. I expect that describes most of you. After the calamity we’ve been through these past 20 years; 9/11, Iraq WMD’s, 6400 US soldiers lives lost, 140,000 injured, 500,000 innocent Iraqi civilians killed, $7 trillion in treasure, the Great Recession of ’08 to ’12, brought on by the vampire squid Goldman Sachs and wall street/big bank criminals, and now the manufactured crisis of CV and the depression-like economic devastation currently taking place. All as if by design.

How much can we take in two decades? We’re about to find out.

I did not see the three week, 38% move lower in the markets coming. I fully expected that we would fend off CV like most other cases of influenza (which kill 50,000 + in the US each year). I incorrectly assumed that we would take the approaches of Japan, Sweden, Brazil, South Korea, Taiwan, etc. No lockdowns. Mostly business as usual. Protect/isolate the elderly and vulnerable. No intentional economic destruction.

I was completely wrong. More importantly, in my view, our president was wrong. He continues to be wrong. If you’ve watched the investigative journalist (Harry Vox) video that we shared this week, it is more than fair to ask whether or not Trump knew about this Rockefeller Foundation think tank scenario, from 2010. If not, why then are we following that road map to the very T? Why did Trump make the decision to lock down the entire country, when “many” non-Gates medical experts were telling him it would be a colossal mistake…just as it is proven to be. And why has Trump stuck to this horrendous decision, long after he’s had ample time to realize that the Gates funded modelers (Imperial College, President Fauci and Birx) have been nothing but wrong. As in, dead wrong, each and every week of this crisis. Why in God’s name would Trump still be taking their advice? Why are so many other world leaders following in lock step?

For our investment purposes here, maybe it doesn’t matter. Highly doubtful we’ll ever learn the truth. But, we are still stuck in Trump's disastrous decision making. That’s just a hard core fact of the matter. And, like past market crashes and deep recession/depressions, I see little to no chance that the current move higher in US and global markets will continue, unabated. Instead, its highly likely that this move higher is about to be interrupted.

Possibly the most troubling aspects of cv, medium to long term globally, are the changes in consumer behavior that appear to now be a part of our consumer behavior DNA. Complete industries, employment with them, are now fully at risk. This is the end result of 24/7 MSM mass hysteria. This is the end result of the idiocy of global lockdowns. It’s almost impossible for me to believe its just been a horrendous mistake.

Importantly, I am not saying that we must head back to the lows of 3/23, or that we must break to new lows, just that the possibility is increasingly likely. But, unless the Fed and central banks of the world plan on completely commandeering the markets higher, always a possibility in the central bank controlled world that we now live in, a sharp move lower is likely in our near future. Too much economic carnage, globally, has been done. Too much continues to be done.

Deep recessions/depressions are multi-year, deeply painful events. Stock markets, historically, have not made new highs during this process. The bottoming process is messy. Bear market rallies are far more powerful than bull market rallies. Then, they end, and are followed by heavy selling pressure.

I have no interest in being caught up in a sharp decline. I know you don’t.

The markets move higher/lower based on one primary ingredient; corporate earnings. Today, the annual earnings/share of the S&P 500 are $140/share (based on the last full quarter report, December ’19). In a multi year recession/depression that could last 3 + years, we expect earnings could decline by 20–30%. Assuming earnings fall by 20%, SPX earnings/share would fall to $112/share. Using a P/E multiple of 15, this would take the SPX to the 1700 area, a further decline from current prices of 40%. A similar decline in the Dow Jones would take it to 14,500.

This is the kind of painful decline we would not want to be long US/global broad market indexes. Certainly not in leveraged ETF’s. Instead, we will look to go short, in both VRA and Parabolic portfolios.

If our research proves to be wrong, that means the planet avoided the dire economic future that looks likely today. That would be great by us. We’ll still own our VRA 10 baggers and our PM/miners positions, which will soar to infinity as global currency inflation reaches levels never before seen.

As of Fridays close, each major broad market US index (S&P 500, Dow Jones and Nasdaq) has gained more than 30%, in roughly 3 weeks, from the 3/23 crash lows. Each of these indexes now sit at either heavily overbought or extreme overbought, on VRA System readings. It’s time to start taking action.

Over my career, this is what I have learned to do. We did it during the financial crisis (short and long), just as I got my clients out of the market before the dot-com crash (99), got them into PM/miners (2003), went aggressively long at the March 09 lows, then predicted the Trump win and stayed aggressively long the markets.

I completely whiffed on cv insanity. I have no interest in letting that happen again. I repeat, we will only make these moves if confirmed by VRA System readings.

We’ll walk you through each and every step we make. As always, look for VRA Alert (Parabolic Alert) in your subject lines.

Stay frosty. We expect a near term top may soon be in place. Watching VRA System readings like a hawk.

Until next time, thanks again for reading…

Kip and Tyler

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/17 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast