Get Ready for a September Melt Up. Thank You, Mr. Treasury Secretary. Stunning Sentiment Readings.

/Roughly 3 hours after yesterdays (second) VRA Update, where we applied Occam’s razor and made our case that global bond markets are screaming at us “there’s not enough debt in the world…interest rates will keep plummeting until you issue more debt”, Treasury Secretary Steve Mnuchin announced this:

We rarely use our clout to phone the White House. Tyler and I don’t like to abuse the privilege. We were a bit surprised they acted on our advice that quickly :) (Don Jr. does follows me on twitter)

Folks, investments are driven purely by one economic law; supply and demand. When a stock goes parabolic, the ONLY reason that it does so is that there is more demand than supply. There are more buyers than sellers, meaning that there are not enough available shares and those shares must then rise in price. It is that simple.

With this economic law in mind, let's apply Occam’s razor to this crazy move lower in bond yields, in the US and globally. Aren’t the bond markets SCREAMING “there is not enough supply…we need MORE debt?”

It sounds insane…I’ll likely be laughed out of rooms for making this argument…but it doesn’t mean that I’m wrong.

When this mountain of global demand for debt starts making its way into equities, wonder what might take place in our stock markets??

VRA System Update

Each week we welcome new members to the VRA…great having you with us! The following is an excerpt from Tuesdays VRA Update. This is how we’re positioned…we believe you should be aggressively long. The best discounting mechanism on the planet is kicking in. DJ +327 as of writing this.

“September, Hugely Important. I Expect Fireworks to the Upside

Here at the VRA we’re big believers in viewing the stock market as a “leading indicator” and as “the single best discounting mechanism on the planet”. This was the mindset and training of my mentors (RIP Ted Parsons and Michael Metz), who themselves learned this investing approach from their mentors, both of whom worked on Wall Street during the Great Depression. Quite the lineage, no? Not a day goes by that I don’t hear their voices and give thanks.

As a discounting mechanism, it’s my belief that the markets will (soon) begin to move sharply higher, giving us advance notice of the events that we can expect in September (do you hear the song in your head…cause I do). Here’s what September is about to deliver:

1) The ECB has already pre-announced their “Big Bazooka”, in what will be aggressive central bank policy of interest rate cuts AND the re-start of QE, or quantitative easing. The ECB meets on 9/10. Expect fireworks…with strong language from the ECB that more is to come

2) The following week (9/17) our Fed meets. While we won’t follow the ECB with a re-start of QE, we WILL have a rate cut of 1/4 to 1/2 percent, with almost certainly a change in the Fed’s language, strongly hinting that additional rate cuts are on the way.

3) and in what could truly be a jolt to the upside for markets, China is still on for a D.C meeting next month. There is little to no excitement today about a trade deal being reached (should they make the trip), which is music to my ears. Folks, we want the surprise out of nowhere….one that sends the DJ 3000 points higher over the next month. Again, the markets will almost certainly begin to discount the possibility of “some” forward movement in US-China trade.

All of the above takes place within the next 2–4 weeks. I fully expect a ramp higher in the markets in advance. It may already be underway.

Now is not the time to be bearish. Central banks are about to re-announce to the world “get your money out of banks and savings accounts. Put your money into stocks and real estate. Do it now, because if you don’t, we will keep cutting rates until you do. Do not fight us. We are the all knowing, all seeing, all powerful, masters of the universe.”

One day, central bank madness will become a massive liability. This is not that day.”

— —

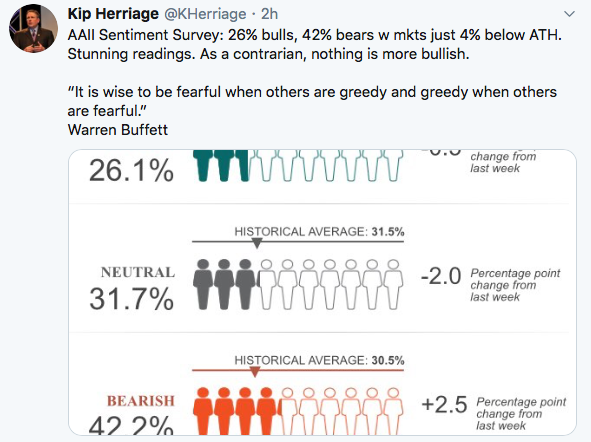

AAII Sentiment Survey

26% bulls, with the markets just 4% from ATH. Not even sure stunning is a strong enough word.

10/12 VRA Investing System Screens Bullish…back up the truck.

And how about this; as of yesterday, the yield on the S&P 500 is now greater than the yield on 30 year treasury bonds. The last time this occurred? March, 2009. The bear market lows, following the GFC (which we nailed within minutes).

— —

So you are ready for the good times to come…”September” by EW & F

https://twitter.com/KHerriage/status/1167026299455660032

Until next time, thanks again for reading….

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/16 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast