VRA Weekly Blog Update: Bit of VRA History. Quick Notes, VRA 10 Baggers.DJ 50,000 is Coming.

/Good Thursday morning all. With 10/12 VRA Investing System Screens bullish and with investors (of all sizes) heavy in cash and heavily bearish, we are gearing up for a major breakout to the upside.

If you’re new here, a quick recap.

First: We’ve beaten the markets in 15/16 years of the VRA. My mentors taught me well. Our VRA Investing System has served us well. We’re not perma-anything…bull or bear…but we do enjoy permanently crushing Mr Market. You can only beat the markets if you ignore the crowds. Once you read “Extraordinary Popular Delusions and the Madness of Crowds”, you’ll never look at the gurus and news media the same. Add “The Creature from Jekyll Island” to your reading list and you’ll never look at our global central bank system and/or fiat currency scam the same either.

Bottom line: we are contrarians. More than anything, this is the most likely reason that we have outperformed the markets, consistently.

Second: We pick winners. From the use of ETF’s to VRA growth stocks, our game plan is to be on the right side of big moves. I continue to expect each of our 10 baggers to give us 10 x profits. Our 10 baggers are debt free, have highly sexy products/opportunities and management teams that are committed to success.

Try our 14 day free trial at VRAinsider.com to see exactly what the VRA 10 baggers are.

Back to the broad markets and why we remain so bullish on the future.

Again, with 10/12 VRA Screens bullish, we must back up the truck and buy on pullbacks. DJ 50,000 + remains our bogey, by end of 2024.

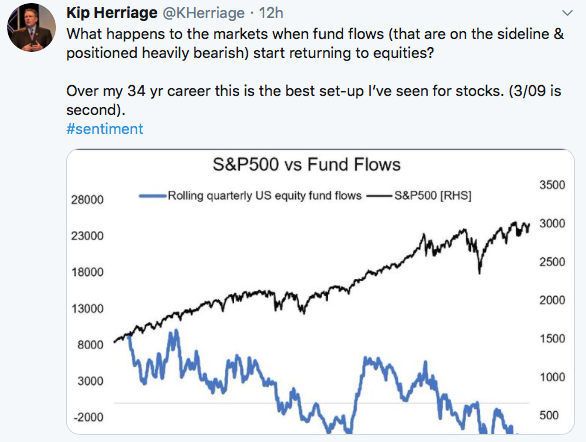

My tweet from last night might be the most significant reason for the breakout that we see as just around the corner. Again, investor sentiment is too bearish. As in WAY too bearish. Folks, bull markets do not end when fund flows are going in exactly the opposite direction of the markets. Bull markets end in a euphoric move higher, with investors “all in”, with little to no cash left to invest. Save this chart…it will look quite a bit different when the DJ hits 50k.

Remember these analytics. Since WW2 there have been 3 cases where the markets have been range-bound for 20 months or more. In all 3 cases, the markets were higher over the next 12 months, with an “average” gain of 51%. Wowser.

Investors are hyper-focused on the Q4 ’18 crash (December). Can it happen again? And if you’ve been watching much TV, you know that our MSM financial pundits are now making the case that an Elizabeth Warren presidency is possible.

We say “no” to both….but again, it helps to explain why the public and so-called “smart money” institutional investors/portfolio managers remain so bearish. WAY too much cash on hand. Cash that should serve as jet fuel for the stampede higher into year end that we expect.

Q3 EARNINGS + RANGE EXPANSION = MUCH HIGHER PRICES

Through yesterday, 78% of the 145 SPX co’s that have reported Q3 earnings have reported year of year earnings growth with 78% topping analysts estimates. Our forward P/E remains in the 16 range. We look for range expansion to continue to build. Analysts that believe a forward P/E of 16 is high have clearly forgotten the late 90’s, when a forward P/E of 25 was the norm.

Aggressively add to positions on pullbacks. Stampede higher into year end.

Until next time, thanks again for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/16 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast