VRA Market Update, Rock Solid June Jobs Report, Trade Wars, and Technical Analysis; Buy the Rumor, Sell the News.

/Good Friday morning all. Hope everyone had a a great July 4th holiday!

Employment data for June was just released, showing the US economy and jobs market continues to grow at an expanding pace. 213,000 jobs were created, beating the estimates of 195,000. In addition, April and May were revised higher by 37,000 jobs.

But here’s what you can count on seeing in the financial MSM today; the unemployment rate ticked up from 3.8% to 4% and while wage growth was a positive 2.7%, it missed estimates by a whole .01% (2.8%). Again, look for our Trump bashing MSM to focus on these most minor of negatives from an outstanding jobs report.

Just an fyi, the reason the unemployment rate rose to 4%? Americans are re-entering the labor force…once again looking for jobs that many had given up hope of finding again, in years past. A stronger labor force participation rate can equate to (in the short term) a slightly higher unemployment rate. This is a good problem to have. Bottom line; the US economy continues to point to highly positive GDP growth. This is not the scenario where stock markets reverse course.

US equity futures have rallied on the news. DJ futures were -90 before the report and now have been flat or slightly up since the open. If you’ve heard our end of day podcasts the last two days, you know that we’ve been laser focused on the markets internals (http://www.vrainsider.com/podcast). On Tuesday, even as the Dj plummeted in the close, finishing down 130 points, the markets internals remained highly positive. This told us, based on the VRA Investing System, that we should expect a bounceback in yesterdays trading. We got exactly that, with all 4 major indices closing sharply higher. Our market leaders continue to be the Nasdaq and Russell 2000, with both closing more than 1% higher. Remember, when the Nasdaq and Russell 2000 are leading the way, the rest of the market is almost certain to follow (this is backed up by historical market statistics that we’ve been covering a great deal in the past several weeks.

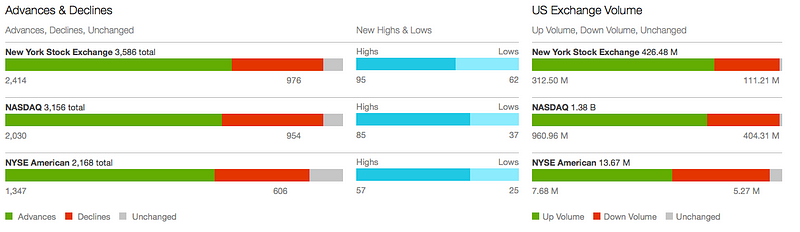

Here are yesterdays market internals. Advance/declines 2.3:1 positive. Volume 2:1 positive. New highs/lows 2:1 positive. The VRA System pays close attention to the internals, just as my mentors taught me some 30 years ago. The internals tell us the foundational strength/weakness of the broad markets and while I cannot back this statement up with hard data, I can say that from my memories, I cannot remember a significant market reversal having taken place when the internals are as rock solid as they’ve been….most certainly not with 40% of the worlds primary equity markets trading below their 200 dma. The US markets continue to be the place to be. I look for a second half rally in the Dow Jones and S&P 500, as they play catch-up to the Nasdaq and Russell 2000).

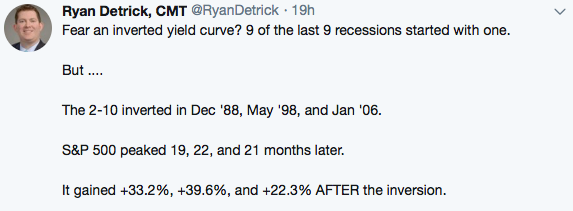

Over the last couple of months, one of the most commonly received questions to our office has been about fears of an inverted yield curve (when 2 year yields surpass 10 year yields), which has yet to occur but should it take place might lead to recession in the US. The bears…which seem to follow me in droves and look for every opportunity to tell me that the US economy is about to fall off a cliff (sorry…it’s not).

The following is from Ryan Detrick of LPL. Save this one….send it to all your “inverted yield curve” fear mongers. As can see, while the last 9 recessions started this way, take a look at what first happened; The S&P 500 rises sharply over the next 18 months or so, with an average gain of 30% + AFTER the inversion.

Trade Concerns

Trade tensions have gotten most of the blame for the stock market weakness. As we’ve covered here often, China (Shanghai) is down 40% from its highs and 40% of the worlds primary equity markets trade below their 200 day moving average (dma).

So exactly how bad are things, trade/tariff-wise? Consider this fact; today (7/6), after the first round of official US tariffs are put in place ($31billion) it will take total global tariffs to $60 billion, a whopping .03% of all global trade. Three tenths of one percent!

Worst case scenario, should all global governments actually follow through on their tariff threats (0% chance of this)…totaling close to $500 billion in threats…just 4% of all global trade would be threatened. Folks, this looks like the exact definition of “buy the rumor, sell the news”. It’s highly likely…in my view…that global markets have a “rip your face off” type of rally higher.

Technical Analysis

The VRA Investing System is made up of 12 proprietary screens….a combination of the lessons learned from my mentors and my 33 years in the business. 70% fundamentals and 30% technicals. Today, 9/12 screens are in bullish mode, meaning that the odds of a sharp market correction are slim. Very slim.

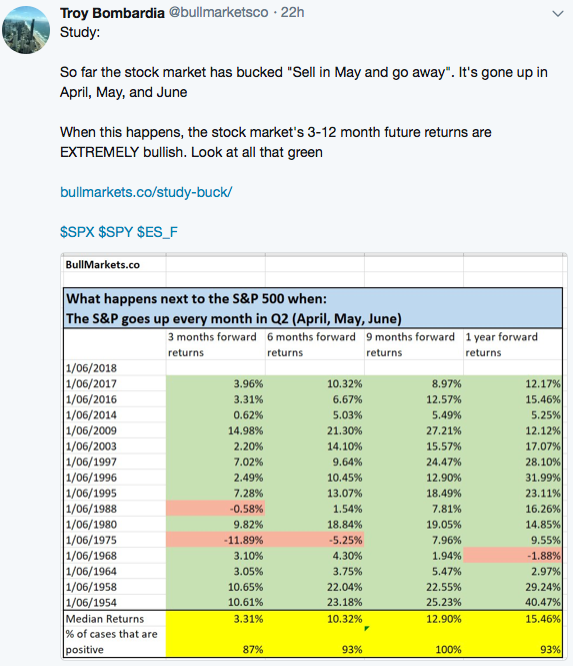

Back in the Spring of 2007, just 4/12 screens were positive…we know what happened shortly thereafter. But this is not 2007. Consider the following, from @bullmarketsco, one of my new favorite follows. When US equity markets rise each month in Q2 (April, May and June), the markets go on to rise sharply for the next 3–12 months (with a median 6 month return of 10% and 1 year return of 15%). Importantly, the markets have risen 93% of the time, going all the way back to 1954.

Now, add this most important research we’ve been discussing here for the last couple of weeks (if you have been following us, we wrote about this two weeks ago here https://medium.com/@kipherriage/statistical-analysis-tells-us-a-nasdaq-boom-predicts-a-broad-market-boom-9a82b9e17623), namely; US markets have moved higher 100% of the time (21 cases) over the last 20 years when a) the nasdaq has outperformed the DJ by 12% over a 4 month period and b) the Russell 2000 has been higher for 8 straight weeks (with median 1 year returns of 15–20%).

Add it all up folks, and if you’re as much a fan of statistical analysis and repeating patterns as I am, the signals could not be more clear; if you’re not long…you are almost certainly very, very wrong.

Until next time, thanks again for reading….have a great weekend.

Kip