VRA Market and System Update: US Markets Hitting Oversold Levels, China at its Most Oversold Levels in 5 Years, Crazy Investor Sentiment Readings

/Good Friday morning all. Just a week ago we began warning about the VRA Investing System’s extreme overbought levels in our market leaders, the Nasdaq and Russell 2000. What followed was an almost immediate overbought sell-off that (as of yesterday) took the Nasdaq back to its 50 day moving average (dma) and to a now heavily oversold level. We see an almost identical picture in the R2K.

As of this morning, most of that overbought selling pressure has evaporated. Doesn’t mean our market leaders cannot go lower, but here’s what it does mean; buying opportunities are here, once again.

In the Dow Jones, the VRA Investing System sees an even bigger opportunity. With yesterdays advance, the DJ is now back above its 200 dma and remains at extreme oversold levels. In the interest of time, we won’t repeat ourselves this morning (too much), but with blow-out Q2 earnings approaching, I remain HIGHLY skeptical of a sharp sell-off from current levels. And here’s an interesting trading note; July is the best performing month of the 3rd quarter. With today being the final day of Q2, look for major fund flows (from rebalancing and retirement/pension accounts) to support the markets until the blackout period on share buybacks is lifted (for co’s that report in the next 1–3 weeks).

Folks, I see almost NO chance that the current trade related fear mongering will match what we saw in Q1. Once again, the financial media has Trump Derangement Syndrome.

This morning we saw blow-out earnings from industry leader KB Homes, which is trading up 8% in pre-market trading. It’s time for the financials and housing stocks to start trading better. Both have pulled back to major support levels and are trading at extreme oversold levels. Buying opportunities, plain and simple.

8/12 VRA System screens remain positive. The biggest concern? The action in global markets, where 40% of all primary equity indexes are now below their 200 dma. Headed into today, each major US equity index is either hitting heavily oversold levels or in the case of the DJ, at extreme oversold levels.

What’s happening here appears clear to me. As Trump reverses decades of unfair trade policy, impacting US GDP annually by as much as 2%, revenue and growth that had been exported to other countries is now returning to the US. Yes, its a form of short term chaos for global markets, but its exactly what Trump ran and won on. Frankly, no one should be surprised.

Bottom line: highly positive for the US economy…short, medium and long term. But also not without its hiccups. Most especially for global markets.

In China, there’s growing talks of financial panic, as evidenced in this leaked news to Bloomberg.

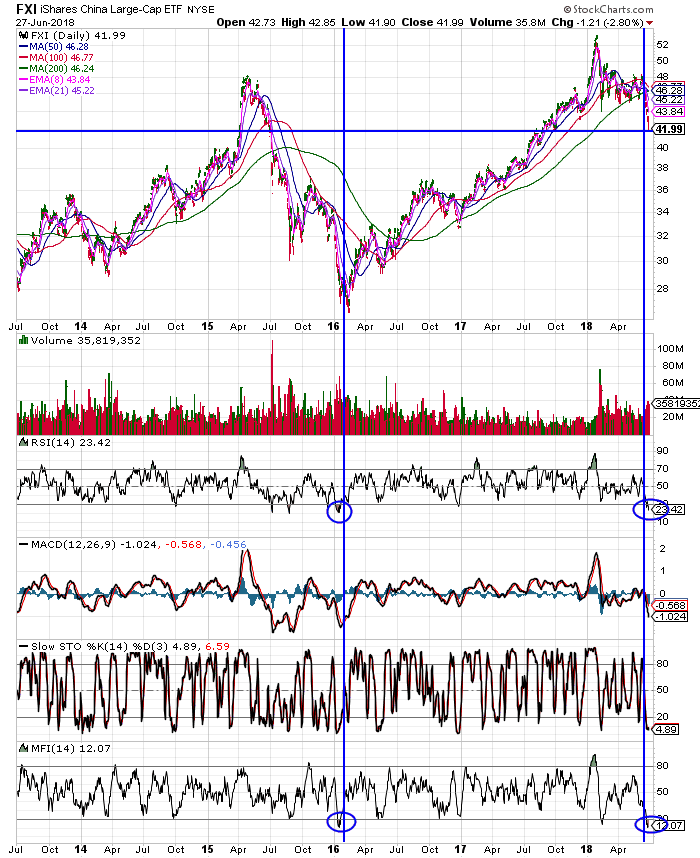

Most typically, when it comes to China, articles like this that are “leaked” are the sign of near term panic lows, resulting in higher stock prices in Chinese markets. Take a look at this 5 year chart of FXI:

Current oversold levels in FXI (on RSI and MFI) have only been seen one other time, over the last 5 years. The last time China was this oversold, within 5 trading sessions the bottom was in place and over the next 20 months FXI would soar 100%, doubling in price.

As if right on cue, China (Hong Kong and Mainland shares) were both up big overnight (1.6% and 2%). Only time will tell if the worst is over in China…I expect that it is…which is (90% of the time) the case when investors reach “panic selling” levels of fear. As contrarians, we embrace the fear. we buy when there is blood in the streets. With China’s Shanghai down 40% from its highs, I’d say that qualifies…

For our newer VRA Members, an important reminder; using the VRA Investing System and my 33 years of doing this, day after day, we use leveraged ETF’s and my favorite growth stocks/story stocks to crush Mr. Market. With this approach we’ve outperformed the S&P 500 14/15 years and since 2014 our VRA Portfolio has net gains of more than 2400%.

Not every day is roses…but we must trust the process. Remember, its hard to “buy low” when everyone is bullish.

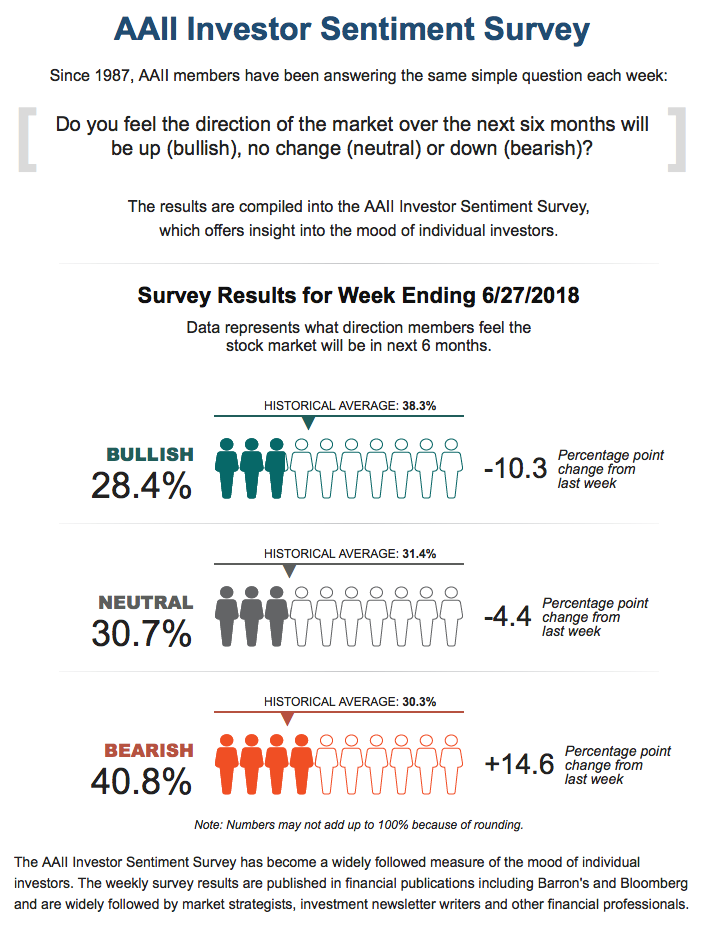

Finally for this morning, check out what I can only refer to as RIDICULOUS readings from this weeks AAII Investor Sentiment Survey. Bulls sit at just 28.4% (down a huge 10%), with bears surging to 40.8% (up an even bigger 14%).

Folks, this is not how bull markets end. It’s just not. When investors reach this level of fear…in a roaring bull market, no less….as contrarians, we must be buyers. The public is rarely (if ever) on the right side of Mr. Market. Nothing says “short term bottom” more than readings just like this.

Until next time, thanks again for reading…have a great weekend.

Kip