VRA Update: Rally Caps Engaged. Double Bottom, 800 point DJ Surge.

/Fear and greed moves the markets, most certainly at extremes, and have we ever seen plenty of fear and greed over just the last few days. The MSM flipped from wall to wall coverage of “Russia Russia Russia” to “China China China”, and as usual, scared many investors into panic selling their positions.

For our VRA Members, as we covered yesterday, panic is not an investing strategy. Instead, and in high likelihood, the markets lows are now firmly in place.

When we can time the markets well…and while never perfect, the VRA System gets us out near the highs and back in near the lows…leveraged ETF’s on the most attractive market sectors (again, according to the VRA System) gives us the ability to beat Mr Market. I have no other goal, with the VRA Portfolio.

With a clear double bottom (and near perfect retest) now in place, this is when the smart money has a clear and distinct game plan. This is the time to be heavily invested in the broad market. With Q1 earnings, share repurchases and M&A activity directly ahead….all positives and due in majority part to Trump’s tax reform…now is the time to be long and strong.

Our exit strategy is clear; we are heavily long, expecting a surge higher, and will only take profits in 2 situations; 1) the markets reach extreme overbought levels and then begin to show internal weakness or 2) the markets instead reverse and take out their double bottom lows.

I continue to expect higher prices…we are well positioned.

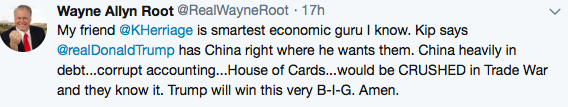

I also want to give a shout out to my very good friend Wayne Allyn Root for his tweet from yesterday.

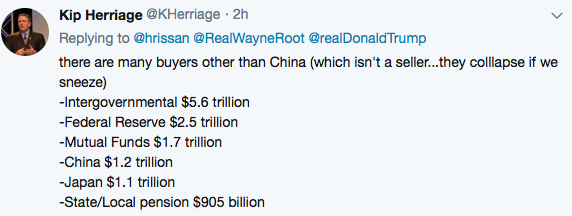

In my view, this is the reality that the markets are waking up to. We have few reasons to be fearful of China…but China has MANY reasons to be fearful of the US. Among the replies to Wayne’s tweet, the most common reply from Twitter trolls went something like this: “oh yeah? Doesn’t China own all of the US’s debt? If they stop buying, the US economy will crash!”

It’s a common misconception. First, should the US government debt market implode, China would implode right along with it. A more symbiotic relationship, there is not. And second, heres the list of the largest US debt holders. Chinas on it….but at $1.2 trillion, their total holdings make up less just 5% of all govt debt outstanding.

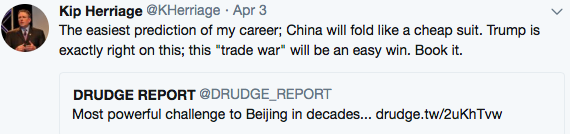

And I’ll repost this tweet as well, for our newer VRA Members. If you have not seen The China Hustle, I highly recommend giving it a gander;

Folks, this is why China has never been included in the MSCI emerging market index, despite China making up 90% of all emerging market equity capitalization. Should we get another sharp sell-off, China tariff related, think back to this VRA update and use it as a buying opportunity. We’ll crush China in any trade war…of course they know this…which is why there will not be one. Bank on it.

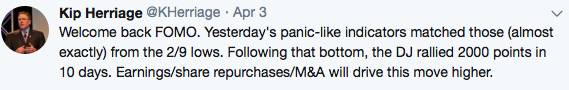

FEAR OF MISSING OUT (FOMO) is back on. From Mondays opening 700 point lows, this was my view…it remains my view…and then some:

Will we have another 2000 DJ move higher, over the next 10 days as well? If I told you I had that answer you should never listen to a word I say, ever again, but I am confident in saying “its certainly possible”. The combination of fundamental and technical positives line up very, very well.

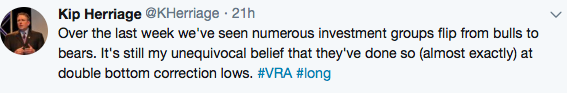

Yet, just this week we’ve seen numerous market timing gurus switch from bullish to bearish…right at the lows…remarkably, according to the VRA System. They clearly do not have access to VRA momentum screens:

With current US economic strength, we see no signs of an impending recession. Instead, we see signs that the US economy is on track for a full year 3% GDP, at minimum.

Market corrections are never a fun experience. With a bit of good fortune, we’ll survive the current one and get into the heart of Q1 earnings season next week. This is when US share repurchases can resume, a major driver for higher stock prices (matched with lower supply).

The lows are in place. It’s time to be highly bullish, once again.

Until next time, thanks again for reading…

Kip

To receive access to our full VRA Membership and daily updates(including our VRA Portfolio with buy and sell recommendations, featuring 2400% net gains since 2014), sign up to receive two free weeks from the VRA at www.vrainsider.com/14day