VRA Update: The Lows are in Place. Mueller Raids Trumps Attorney. China Blinks in Trade War.

/By mid-afternoon yesterday, the DJ was +440. Excellent trading day, all around. 3–1 positive market internals across the board. Then the slide began…the DJ lost 400 points of those gains, finishing higher by just 50. The culprit? Special Counsel Mueller. When you raid a “sitting” US Presidents long time personal attorney, its safe to say the gloves are off. If Attorney/client privilege no longer applies to our president, you and I have no chance of protecting confidentiality.

Imagine if this had happened to Obama while he was in office. His personal attorneys office, raided by the FBI. Or even HRC, as her legal team deleted/destroyed 33,000 emails that were already under congressional subpoena. No doubt, the ACLU would stand by both their sides 1000%. Doubtful they’ll do the same for Trump.

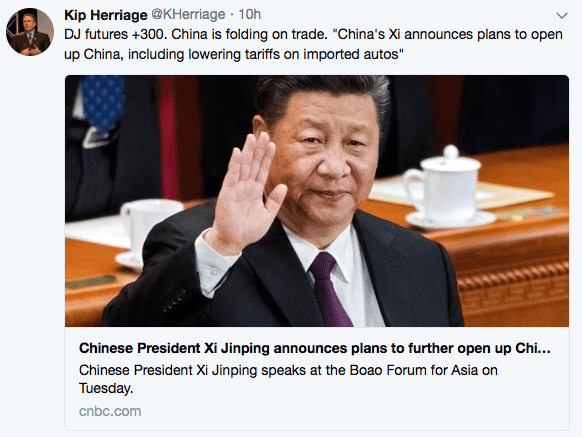

So, that’s what drove the markets from their 440 point DJ highs. But overnight, we got some interesting news out of China. President Xi blinked. As I write DJ futures are higher by 330 points. As we’ve covered here often, China will fold like a cheap suit. This will be one of Trumps easiest victories. Any negative news from China going forward is a “buy the dip” opportunity.

As you know, I am bullish on the broad market (I’m even more bullish on our VRA Portfolio). We look to have double bottom lows in place, just as Q1 earnings are about to kick in. That’s just one of many reasons I’m bullish.

Should the lows be in place, those that are bearish on Trump, and out of the markets, will be forced to begin buying back in at higher prices. Those that are short, will be forced to cover (and then go long as well). And those huge numbers of put option buyers will be forced to sell those puts and then buy calls.

We look to be set up beautifully for a rocket-ship like move higher. When all 3 components of the VRA System line up (the fundamentals, technicals and investor sentiment), we must be long. Period.

We will look back at this time frame and realize a golden opportunity was staring us right in the face.

Major VRA System Points of Interest:

1) By Wednesday of next week, more than 150 S&P 500 co’s will have reported earnings. 90% of all earning reports will be out over the next 3 weeks. Earnings will be sensational…I expect CEO comments about Q2, Q3 and Q4 earnings will be rock solid as well.

2) The forward P/E multiple on the S&P 500 is now 16.3. Just 18 months ago it was 23. 12 months ago it was 20. Do you see a trend here?

Earnings growth of 15% is driving down P/E multiples to their lowest levels in years. Value investors have no choice but to find this overwhelmingly bullish…even the Trump haters must admit that an earnings revolution is taking place. US economic strength is powering ahead…and tax reform is only now making its way through the system. If you are underestimating the power of Trumps tax reform, you will likely miss one of the quickest surges in US economic growth, in history.

3) Once earnings are announced, reporting co’s are allowed to continue their share buyback plans. According to SEC rules, there is a roughly 5 week period (before earnings are announced) that prevents co’s from repurchasing their own stock. The market has missed this demand. Remember, it’s estimated that total buybacks in ’18 will top $850 billion, an all-time record times 15–20%.

4) Look for mega sized mergers and acquisitions to be announced during the 2nd quarter. $30 billion to $80 billion + in size. Again, tax reform is the reason. Some $4 trillion is headed back to the US financial system.

5) Finally, according to the VRA System, investor sentiment continues to flash “buying opportunity”. Bearish sentiment is at extreme fear levels, while the markets remain in “confirmed bull market” status. On Friday, the TRIN closed over 2.5 for just the 3rd time in the past year. This signals “investor panic”. As contrarians, we MUST use this as a buying opportunity.

Until Next time, thanks for reading.

Kip

To receive access to our full VRA Membership and daily updates(including our VRA Portfolio with buy and sell recommendations, featuring 2400% net gains since 2014), sign up to receive two free weeks from the VRA at www.vrainsider.com/14day