VRA System Flashing Strong Buy Signals

/Good Thursday morning all.

VRA Market Update. VRA System Shows 11/12 Screens Bullish

As you’ve seen/experienced with me over the last week or so, my life can be a tortured existence. I live and breath the markets….and for those that do as well, life ain’t always easy.

The current market turmoil reminded me that it is impossible…absolutely impossible…to completely remove emotions from our investing. I compare it to acting…or speaking in front of an audience…the day that your nerves/emotions cease to exist, you’re probably in the wrong place at the wrong time. It comes with the territory. But it must also be controlled…

As I was writing up this mornings VRA Alert, with our new positions, that was the feeling I had; was it too soon to act? Is there another big leg down coming that I am missing? Are the bears actually right, this time?

But that’s also when I remind myself that this is exactly why I built the VRA System. Making money in the markets FORCES us to “buy low”. It is simply not possible to buy low when everyone is bullish. We must buy low when everyone is bearish. And man oh man, do we see that bearishness in the sentiment readings and put/call levels.

Here’s why:

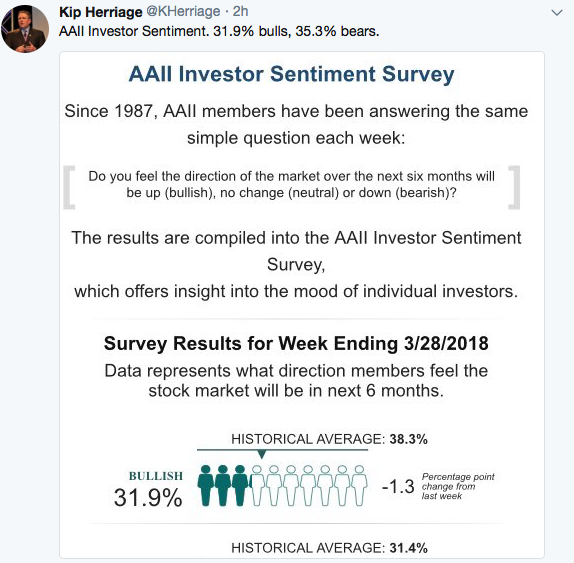

We got the following sentiment figures last night:

Only in a small handful of times in my 3 decade career has sentiment been this overwhelmingly bearish…in a major bull market, no less…where the market has then continued lower. Extreme sentiment readings like these are one for the most powerful contrarian indicators of all time. Period.

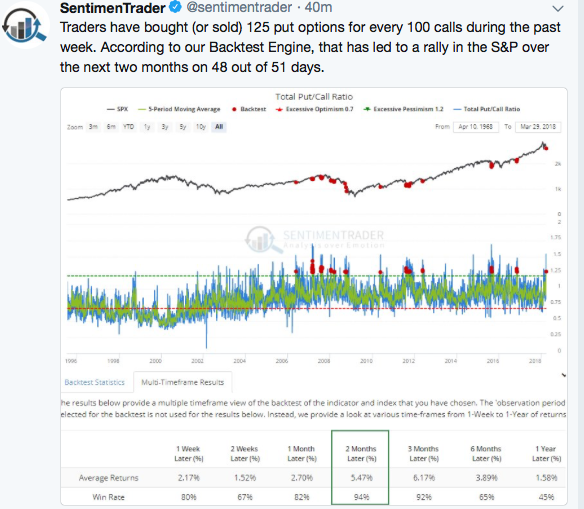

And check this out. For those on Twitter, I recommend that you follow @sentimentrader

As you can see below, when the put/call ratio has been this bearish for an entire week, the S&P 500 has then gone on to rise 48 out of 51 days. Holy put/call ratio…

And I’ll remind you of the other reasons I am bullish, as we head into Q2:

1) the economy is rocking. Period. Earnings will be sensational. Again, period.

2) Over the last 20+ years, following a negative Q1 stock market performance (and this will likely be a negative Q1 barring a 600+ point close higher in the DJ today), the second quarter has been negative only twice.

3) Share buybacks have been in SEC lockdown….zero co’s that report on a calendar year have been allowed to buy a single share back over the last 5 weeks. Certainly helps to explain the selling pressure/lack of buying. But that all begins to change next week, as co’s report Q1 and are once again allowed to start buying. Remember, estimates are that buybacks will top $850 billion this year, an all-time record x 15–20%. Removing supply from the markets, allowing demand to then send stock prices higher.

4) Congress is out for another week. Over the last 50 years, 90%+ of all stock market gains have occurred between November-May and when congress is out of session.

I could add a few more…like its pretty impressive that the broad markets have held above their 200 dma, in light of the bad news of late…but you get the picture.

Investing is about probabilities. Using all knowable information and then pulling the trigger. That’s why we acted this morning. And guess what? If I am wrong…if the markets want to continue going lower still…we will set our stops and get sold out. Then, should we actually drop beneath the 200 dma and the VRA System switch from bullish to bearish, we will as well.

But that day is not today. Instead, I believe we timed this with near perfection. Easy to say with the DJ +270 as I write…but check back with me at the end of the day 😃

The VRA Portfolio has 2400%+ net gains since 2014.

Until next time, thanks again for reading…have a great long weekend all.

Kip

To receive updates like this Daily sign up to receive two free weeks from the VRA at www.vrainsider.com/14day