VRA Update: Trump Bull Market, Phase 2. Q1 Earnings, Buybacks, M&A Take Center Stage

/Good Friday (the 13th) all. Other than avoiding black cats, I have no superstitions for today. Instead, following yesterdays sharp move higher, DJ futures are ramping higher again this am, following dynamite earnings from JP Morgan and Citi, kicking off what should be the best quarter for US earnings in more than a decade. Possibly two.

I’ll repeat; if you’re not long, you are almost certainly wrong.

I continue to be stunned by feedback from the bears. They see things in the charts (and stars even) that simply do not make sense to me. We have what looks to be a MAJOR double bottom low in place…and a highly bullish technical backdrop…that tells us that we MUST be in this market.

I’ll draw your attention once again to my late night update from Tuesday:

“If my theory is correct…if we are in fact living through a mirror image of the Obama bull market…then we likely know which segment of the country is OUT of the stock market. We also know which segment of the country is short the market/buying puts on the market.

Half the country is bearish. I believe that half is on exactly the wrong side of this bull market. A bull market that could take the DJ to 40,000 by the end of 2020.

Fear…and lots of it…is everywhere. As contrarians, we know what to do.

I’m a Trump fan. I am hyper bullish on the US economy and the future for US stock markets. I believe we should use the mirror image of the previous bull market to stay very long and very strong. The VRA System is highly bullish…right now. We must be greedy when others are fearful…especially when what they are most fearful of is President Trump.”

I well remember the pain that I felt being on the wrong side of the bull market during the second year of Obamas first term (because we nailed the 3/09 final bear market lows within 5 minutes). But in that second year, and following the flash crash lows, it was very hard for me to even consider being bullish. I believed that Obama might crash the US economy. But I was wrong…the markets kept rising…ultimately forcing me to become bullish as well.

Importantly, this is exactly where the Trump bears reside today. They believe that Trump will send us back into the stone ages. That Trump is the worst thing since the Bubonic plague. They cannot imagine being bullish on either the US economy or on stock prices.

Trump bears are heavily short. They own a sh*tload of puts. That’s what makes a market, of course, but thats also what will be a major driver for higher stock prices going forward, as they are ultimately forced to cover their shorts and then go long as well. Just as I was forced to do back in 2010/2011.

Now, its time for share buybacks (in massive quantities), plus record setting levels of M&A…all driven by Trumps historic tax reform…to push US markets to new all time highs, yet again.

Since the election, the S&P 500 is up 25%…the DJ is up 33%…and Nasdaq is up 37%. We’ve now had our 10% correction…that is behind us…the train is now leaving the station. FOMO is about to return, in a big, big way.

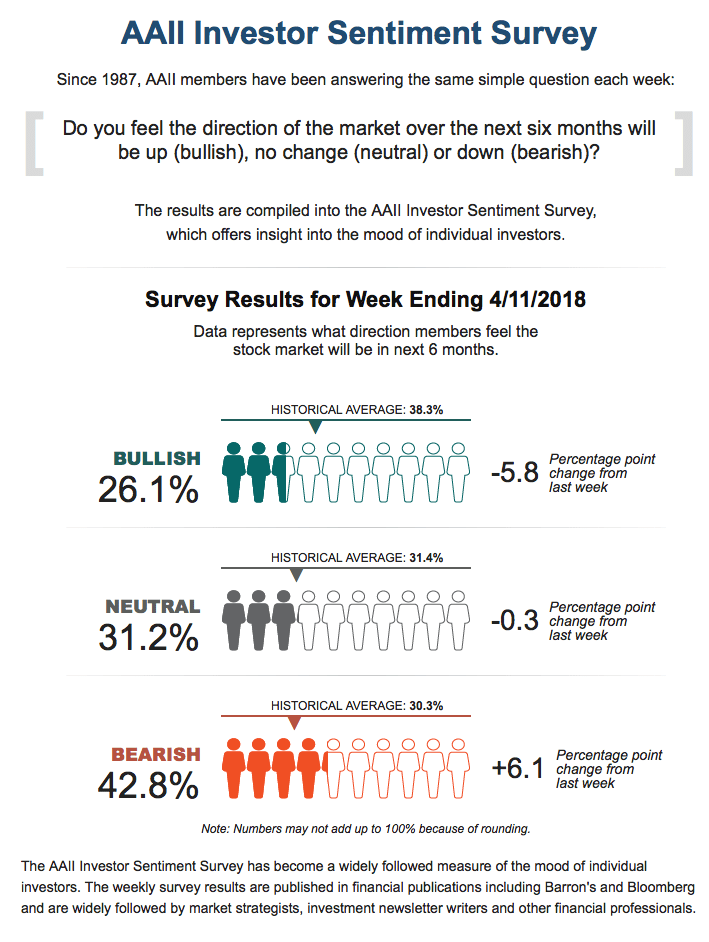

Now, are you prepared to be stunned? Check out the latest sentiment readings from AAII. 26% bulls and a BIG 42% bears! As contrarians, we know what this means….BUY BUY BUY.

Combined, based on everything that I see and readings from the VRA System, my year end target for the DJ remains 30,000 (23% higher from here).

Until next time, thanks again for reading…have a great weekend.

Kip

To receive access to our full VRA Membership and daily updates(including our VRA Portfolio with buy and sell recommendations, featuring 2400% net gains since 2014), sign up to receive two free weeks from the VRA at www.vrainsider.com/14day