VRA Update: China Trade War — Bring it On! VRA Market, VRA System Update

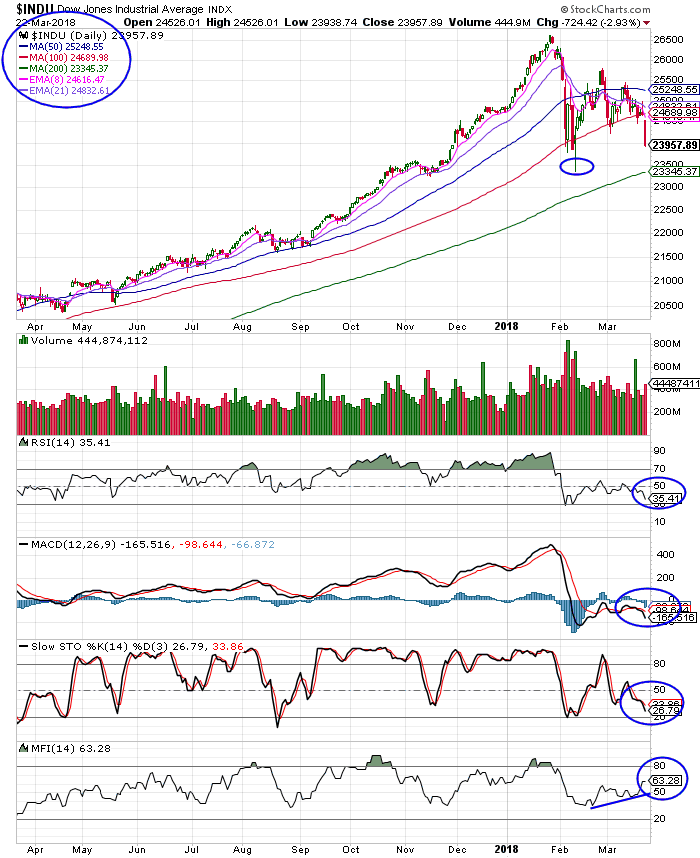

/Good Friday morning all. Yesterdays 700+ point drop in the Dow Jones (-2.9%) and 2.5% decline in the S&P 500 caused both the Dow and S&P 500 to break through the “higher lows” that we have been discussing in our daily updates…a bullish technical pattern that has now been violated. Futures are up modestly this morning, so we’ll see what the day brings.

If you were able to join us on Waynes show last night, you heard me say that I could not be more positive on the US economy and US equity markets….medium to long term…absolutely nothing has changed here. However, especially in the use of leveraged ETF’s, I do not take chances. When the ST technicals break down, I have zero interest in being caught up in the downdraft. My goal, as a trend following investor, is to be on the right side of the market, literally as much of the time as possible. This is how we beat the markets as they rise and how we avoid portfolio killing mistakes in times of correction.

Here’s the link to last nights interview. We got into a number of topics, from my market view, China trade war, Federal Reserve fiat currency money printing inflation and the continuing reality of a Trump economy that will right the US ship for many years to come.

http://usaradio.com/2018/03/22/wayne-interviews-kip-herriage-ceo-of-vertical-research-advisory/

CHINA TRADE WAR: BRING IT ON

In the interest of time, here are my tweets from last night, on the possibility of a trade war with China.

Please hear me on this…I know what I speak of, on this most important subject. China may have 1.3 billion people and presumed to be the next global economic powerhouse, but much of this is merely an illusion. Back in the 80’s, the fad was to have your kids learn Japanese. They were buying up the world, including a ton of US companies and US real estate. Japan was all the rage. For years we were forced to read cover stories in every major US publication that said Japan had passed us by.

At one point, the land surrounding the Imperial Palace (a mere few blocks) was valued at more than all California real estate combined.

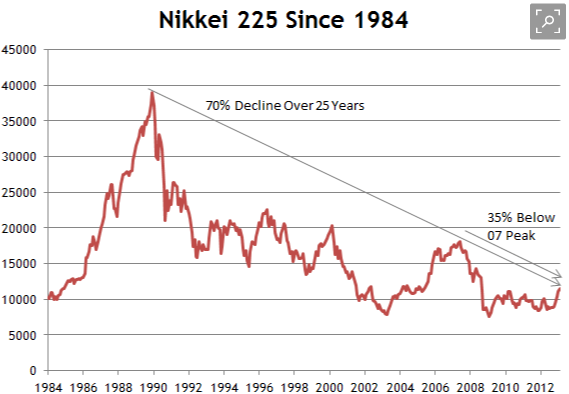

But then, Japan ran into a buzzsaw. They ran into the very focused will and might of the US. For 19 years Japanese real estate prices fell. Beyond brutal. And the Nikkei (their Dow Jones) fell some 70% over the same time frame. #Don’tMessWithTheUnitedStates

Now consider these two points about China today.

One: They are BURIED in debt. Over just the last couple of years their government debt has soared to near Japan levels, with a current debt to GDP ratio of 250%.

Two: Their accounting is crap…its highly fraudulent and untrusted, on the Chinese mainland. It’s been so corrupt, and for so long, that until just late last year mainland China equities were not even allowed to be included in the MSCI Emerging Markets Index, the global benchmark for institutional investing. Think about this for a moment; China is THE powerhouse in emerging markets but even when finally included in the MSCI (later this year) Chinese stocks will only be allowed to make up less than 1% of the entire index. Stunning really.

Of course, Trump and his economic team know all of this. China knows it as well. China has so much more to lose in a trade war with the US that should they be dumb enough to enter into one, we will crush their economy just as we crushed Japan. And remember, China is still a totalitarian state. Their leaders rule with an iron fist…which might be ok when the Chinese economy is rolling…but should economic conditions reverse, the level of popular unrest in China could easily grow into a civil war. This may seem like hyperbole…but it is not. Again, Trump and team know these facts well.

Bottom line; we will almost certainly NOT have a trade war with China.

The one major question that I don’t have the answer to today is this; exactly why are US stocks going in the wrong direction? I have my theories…I’m working on that VRA Update now. I will likely do a podcast over the weekend and share those thoughts with you. I’ll also cover each of our story stock growth stocks in the VRA Portfolio. And, the VRA Portfolio has been updated as of this morning. Make sure and login regularly to ensure you are positioned correctly.

VRA Sentiment Update

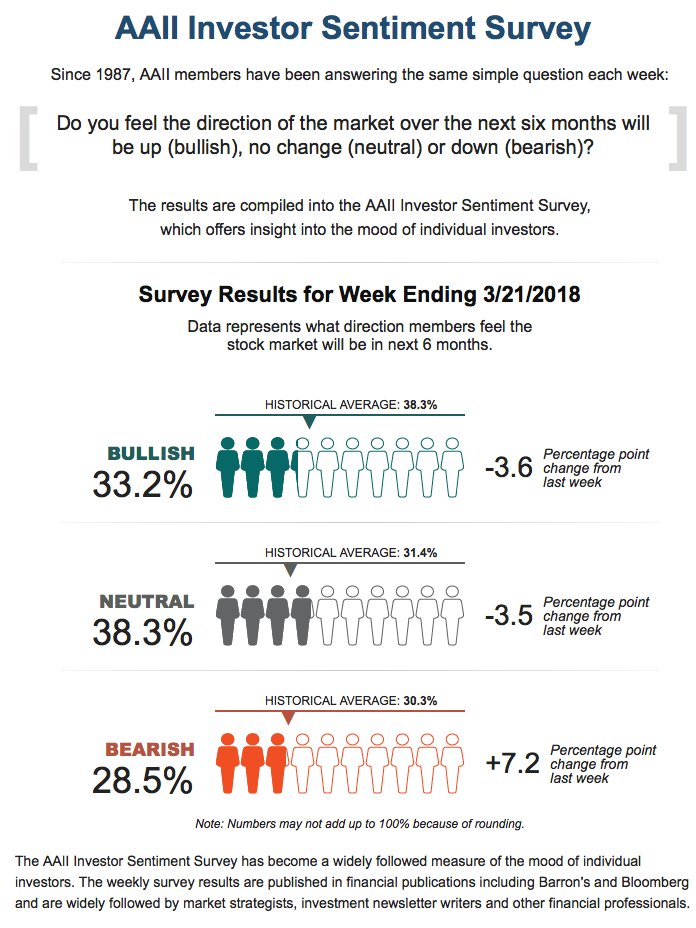

You know my thoughts. The technicals are mixed but the fundamentals remain incredibly solid. But man oh man, is everyone getting bearish. Not just my Twitter stream (where its hard to find a bull), but we’re really seeing it in sentiment.

Take a look at this weeks AAII Investor Sentiment Survey, released Wednesday night:

33.2% bulls, 38.3% neutral and 28.5% bearish. Investors are swinging bearish…quickly…not the readings we see at historic market tops (remember, the majority is rarely right).

Finally, lets consider one chart this morning…the Dow Jones:

Yesterdays decline broke the “higher low” of 3/2. The bears next target is now the 2/9 lows, which happen to coincide exactly with the 200 day moving average, at 23,345. Should we reach that level all eyes will be whether or not we’ll then have a double bottom, followed by another sharp move higher.

Interestingly, should this occur, it would also take VRA momentum oscillators to “extreme oversold” levels. This is what we’ll be watching. And btw, both the Nasdaq and Russell 2000 are holding well above their 3/2 “higher lows”.

Until next time, thanks again for reading….

Kip

To receive updates like this Daily sign up to receive two free weeks from the VRA at www.vrainsider.com/14day