VRA Update: VRA Performance. Still Crushing our Benchmarks. VRA Market Update. Welcome to March and April, HIGHLY BULLISH.

/Before we get to this weeks sell-off, and the panic level sentiment that has come flooding back into stocks, here are our performance numbers for 2018:

The VRA Portfolio has a net gain for 2018 (on all trades and current holdings) of +4.6%. Annualized, this gain equate to +27.6% for the full year.

How are we stacking up versus the broad markets? Both the Dow and S&P 500 were down (slightly) for the first two months of the year, but our nearest benchmark, the Russell 2000 Index, was is down 1.9% to start the year.

Bottom line; in Wall Street parlance, the VRA Portfolio is outperforming our nearest benchmark (R2K) by a very big 39% (annualized basis). Since 2014, we have a total net gain on all positions of 2413%

Over the weekend we will update the VRA Portfolio in your VRA Members Site, as we do at the end of each week.

VRA Market Update

With yesterdays 400+ point drop in the DJ, we’re reaching important support levels that could determine whether or not we have a retest of the February 9th lows (23,264). Based on VRA System readings, we want to see the DJ hold the 24,400 level on a closing basis. For the S&P 500, this number is roughly 2650. With futures off 1% this morning, both of these support levels may be broken…but its not how we open that matters…its how we close.

The reason being given for the sharp drop yesterday was Trump’s position on imposing tariffs, on both steel and aluminum, to countries flooding US markets with cheap product. Why anyone is shocked, I have no clue. This is exactly what Trump ran on…and its a big part of the reason that he won. This is what MAGA is all about folks….restoring power to US manufacturing through “fair trade”…not the easy manipulated “free trade” that US president after US president has endorsed.

Trump continues to baffle those that still don’t get him. How interesting has this week been…he’a managed to tick off gun owners and staunch 2A advocates (winning over some on the left) while also ticking off traditional conservative economists on free trade, and again, getting high praise from those on the left (unions, chief among them).

This is what makes Trump, Trump. Its my studied belief that we’re witnessing 4D chess level political triangulation…right here, right now…on a number of important issues.

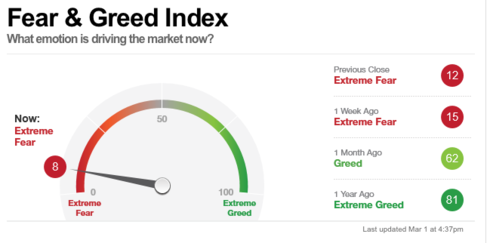

Back to the markets…fear induced panic levels are shooting up, once again. Take a look at the CNN/Money weekly survey…its all the way back to 8…extreme fear. As contrarians, we know that these readings mark far more bottoms than tops and we should look to invest accordingly.

We also learned this week that the AAII Investor Sentiment Survey saw bulls drop to 38%. Remember, just over 1 month ago, this level stood at 60%.

Yesterdays selling pressure also saw the put/call ratio close at 1.29 (extreme bearishness) with the VIX (fear index) rising some 22%. Again, all of the signs of extreme bearishness…market crashes RARELY happen when everyone expects them to.

Still, because of the level of aggressiveness in the VRA…its how we crush the markets year after year…we will not take dumb risks. Again, should we need to enter stop losses, we will do so…and we will do so without flinching. But no…I do not believe this will be necessary.

March and April, Highly Bullish.

Welcome to the month of March, historically one of the most seasonally bullish months on record (April is right there with it). Remember, 90% + of all stock market gains (going back 70 years) come between the months of November — May. I’ve know this fact for a long while…yet each time I say it/write it, it still surprises me.

Below is research from LPL…March and April, since 1950…hugely positive. And when March is positive, it tends to be VERY positive, with an average gain of 4.1% over the last 20 years. (h/t to @ryandetrick, one of my favorite Twitter follows).

February was also the first down month since Trump was elected. Hey, it had to happen at some point.

Bottom line; the Dow rallied some 2400 points in less than 2 weeks…its now been followed by -1000 points of losses in the DJ. This is normal backing and filling. Again, “normal”…and represents an opportunity to buy our favorite investments while they are on sale.

It looks VERY much to me…again, based on the VRA System and my 33 years of doing this daily…that the bears will be proven wrong. Tens of billions of inflows into equity funds are on the way…combined with a rapidly recovering US economy, I see few reasons to be concerned. But as always, should the VRA System give us a warning shot across the bow, we will take action by placing stops in our most exposed broad market positions.

Until next time, thanks again for reading….have a great weekend

Kip Herriage

Founder/ Publisher Vertical Research Advisory (2003)