VRA Update: Social Media Bears Out in Full Force. The Correction is Over. MAGA Bull Market.

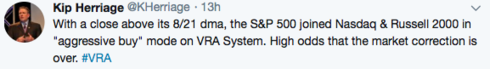

/We look to have timed this market correction well. Yesterdays 336 point move higher in the Dow has taken it out of the “trouble” zone….but, the best looking moves higher have taken place in the S&P 500, Nasdaq and Russell 2000. Each remains in short term “aggressive buy” mode, based on VRA System readings.

The VRA uses (roughly) 70% fundamental analysis and 30% technical analysis and for our most important/major moves we employ the 50/100/200 dma…for more short term trading purposes we use the 8/21 dma. It continues to look VERY much to me like the correction is behind us. The moves higher, from EXACTLY the 100 dma have been near perfection, Highly bullish. In addition, Europe is showing 1% gains across the board with Hong Kong up a big 2% and Japan surging 1.8% higher. In my view, based on VRA System readings and my 3 decades of instincts, we must continue to be positioned for the next advance to new all-time highs.

Fundamentally speaking, the US economy is in great shape…for the all of the reasons we cover here often…plus new signs of economic power that we see daily:

If you’re on social media (and I’m a twitter guy), you see it all. The crazies, the dummies, the Mensa level geniuses, the socialists, the capitalists and of course the Trump haters and the Trump lovers. Well, the bears are out again, trolling me on Twitter like we’re about to have a stock market crash (no…we are not). I’ll come back to the markets in a moment.

Years ago I made the decision to keep politics out of the VRA…as much as possible, that is…but its no secret that I am a major Trump supporter. I predicted he would win in late 2015 and unlike essentially every politician I’ve voted for, he has not let me down. I’m an independent that has voted for both D’s and R’s…I have always strived to be objective with my vote…and were it not for President Trump I honestly would fear for the future of our great country. In my view, we were one wrong choice for President away from a systemic/planned economic collapse. I am certain of this. I also covered this most important topic in my book “CrashProof Prosperity, Becoming Wealthy in the Age of Trump.” Planned economic crashes, like the Great Depression, give enormous power, to a much larger government. When people are desperate, they’ll take the help from wherever they can get it. Saul Alinksy explains it all in “Rules for Radicals”…just don’t read it right before you go to bed.

I only mention politics and Trump this morning because this ties in directly to the direction of both the stock market and the economy. From the night of the election, as the DJ futures lost 1000 points on the reaction to Trumps win…to the 39% spike higher that ensured since…Trumps economic policies are once again giving Americans from all backgrounds a fighting chance. This is MAGA time.

I also remind bears of the following…the reasons that I have been bullish since Trump was elected:

1) Earnings are growing at a 15% clip….best corp earnings in a decade.

2) The untold benefits of tax reform are just now kicking in. Trumps tax reform will prove more powerful than Reagans…in my view…and Reagans tax cuts paved the way for a DJ that more than doubled during his final 6 years in office.

3) Red tape over-regulation is quickly dissolving…this is a massively under reported story.

4) $4 trillion in offshore funds being repatriated into the US (hugely positive)

5) Infrastructure deal is coming…$1.5 to $3 trillion in size (jobs, jobs, jobs)

6) Consumer confidence at an 18 year high

7) And one of my personal favorites…both US and global markets have entered “range expansion”. Range expansion marks new all-time highs in markets/sectors. Range expansion bull markets are the most powerful kind…and they mark the birth of a new bull market…a bull market that can power higher for years and years.

8) Finally, due to the stronger economy, higher earnings and tax reform, US co’s are buying back shares and using M&A at a rate not seen in decades, if ever. This has the effect of reducing the number of public co’s and the number of available outstanding shares to be bought. Its simply supply and demand, really. In just the last 9 years, the number of US public co’s has shrunk by some 60%. Highly, highly bullish for both the ST and LT nature of this bull market.

For those that want to beat the markets…and I’ve yet to meet an investor that does not…we must use corrections like the 10% one we’ve just seen to ensure we are positioned for the gains to come.

Since 2014, the VRA Portfolio has a total net gain on all positions of 2413%

Lastly, at the beginning of the year I recorded the following video…it provides additional perspective on how my background (small town East Texas nobody to Wall Street slayer), VRA long term success/game plan and how we position ourselves, in good markets or bad (and there really is no bad market…not as long as we are on the right side of it).

Here’s the YouTube link: https://www.youtube.com/watch?v=8-8y21NvwCw

Until Next Time, thanks again for reading.

Kip Herriage

Founder/ Publisher Vertical Research Advisory (2003)