VRA Weekly Update: Big June Jobs Report. CV is Over. Sentiment Flashing Buy Signals. PM and Miners.

/Good Thursday morning all. Reminder that US markets are closed tomorrow in observance of Independence Day, we hope you have a great holiday.

June employment data is out and its another big shocker. 4.8 million jobs were added in June vs the estimate of 2.9 million, taking the unemployment rate down to 11.1%. What's getting less coverage is the fact that we also had 1.4 million Americans filing for first time unemployment benefits.

I've been a broken record on this...taken a fair amount of heat for it...but I repeat; the worst of coronavirus is behind us. Has been for some time. The markets sniffed this out long ago, even as our panic porn MSM tries to gin up the mass hysteria of "record numbers of new cases", conveniently forgetting to mention that we also have record testing taking place.

Only one data set matters; death totals. Recommended follow Jordan Schachtel has done great work in this area. Death totals continue to plummet...lowest totals in 98 days. The virus is burning itself out as it mutates weaker and as herd immunity keeps doing it's thing.

Note: Dow Jones futures are +400 on the employment data. While we remain aggressive buyers of VRA Portfolio 10 Baggers and gold, silver and VRA Miners, as you'll read below from our Parabolic Options update yesterday, we would not be adding to broad market positions here.

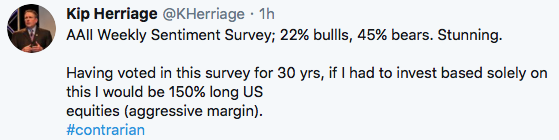

AAII Sentiment Survey

Another stunner from AAII with bulls down to 22% and bears up to 45%. As a contrarian, and as someone that's voted in this survey for more than 30 years, there's only one way to interpret this data; "bullish".

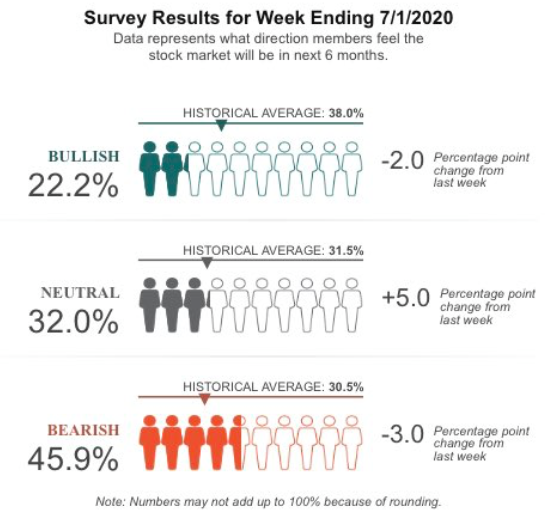

We see similar (but less bearish) readings in the Fear and Greed Index, which sits at 49 (neutral). Again, following a 40% move higher from the 3/23 lows, sentiment surveys should be much more optimistic. The fact that they aren't means the public wants little to do with this market...and that's bullish.

From the Philly Gold and Silver Index we see that the miners outperformed the S&P 500 by 64% in the second quarter. It's being reported that this is the best quarterly outperformance on record for the miners, but I have not been able to confirm. The miners also outperformed gold in Q2 by 51% and Nasdaq by 33%. A move through $1800/oz gold (on a closing basis and on volume) and the miners will begin to pick up steam.

This morning BAC's head of commodities raised their 18 month target on gold to $3000/oz. At $3000 gold Vista Gold (VGZ) is $20....TRQ is $15...NUGT is $300+

Chart perfection in gold. Were it not for major money center bank manipulation (GATA.ORG), gold would likely be $3000/oz+ today. That volume build we see below is telling us the dam is in the process of bursting. If Bitcoin can trade up to $20,000, what might gold be able to trade up to in an honest trading environment? It’s long past time that we found out.

Until next time, thanks again for reading… have a great July 4th weekend.

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/17 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast